Are you looking for an essay on ‘E-Banking’? Find paragraphs, long and short essays on ‘E-Banking’ especially written for school and college students.

Essay on E-Banking

Essay Contents:

- Essay on Automated Teller Machine (ATM)

- Essay on How to Avail ATM Service?

- Essay on the Process of Use of ATM

- Essay on the Functions of ATM Cards

- Essay on ATM Cum Debit Card/Debit Card

- Essay on Credit Card

- Essay on Real Time Gross Settlements (RTGS)

- Essay on Banking Working Process

Essay # 1. Automated Teller Machine (ATM):

These days, customer services have been greatly expanded by banks. Earlier banks used to provide their customers services so far they could be ‘Satisfied Customer’ but now they want to provide them services to give the feeling of ‘Pleased Customer.’ In this process, the electronic banking’ facilities have been started. Following things are included in it.

Automated Teller Machine is such a computerised device that provides the customers of the bank the facility of safe financial transactions at a public place. There is no need of any direct service through a bank employee for this facility.

Automated Teller Machine is known by different names in different countries. For example—it is called Automated Banking Machine in England, Money Machine and Bank Machine in Canada, Cash Machine in the U.K. and Hole-in- the-Wall or Cash Point in New Zealand.

By using an ATM a person can withdraw cash from his account, can know the balance of his account, and can get a mini statement about some latest transactions. These days ATM also receives deposits through Cash and Cheques.

Essay # 2. How to Avail ATM Service?

When somebody wants to get the ATM Service, he needs am ATM card. To get this card, one has to get an account opened in a bank. This account may be a savings account or a current account. If one already has an account, one just needs to apply for ATM, in a prescribed form.

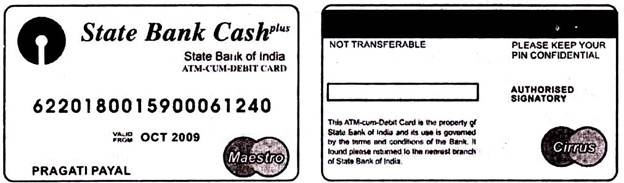

However, these days all commercial banks have made it mandatory to get an ATM Card for every account that is opened. For example, if somebody gets an account opened with State Bank of India, he/she will receive a special Card made of plastic. This card will have the name of the bank, its logo and some other particulars.

Some of these particulars are:

(i) On the front of the Card there would be the name of the bank, logo and name of the account holder as well as the time from when it is legal.

(ii) On the other side of the card there is a black strip which is called Magnetic Strip. This black strip retains secret information about the concerned customer.

(iii) There is a white strip below this black strip. The customer has to sign on this white strip with the view to safety.

(iv) There is some other information below this white strip.

(v) There is a 19 digit number on the front face of the card. It indicates many things.

Essay # 3. The Process of Use of ATM:

An ATM is mainly used to withdraw cash.

The processes involved in withdrawing cash are as follows:

Step-1:

An ATM is fixed in a air-conditioned room of special shape. This special room may be within the bank office or other important places. Entering this room, one has to insert his ATM Card in the special slot made in the entrance door. After doing this, the green light is on and it means that the door can be opened. But before entering, the card should be withdrawn from the slot.

Step-2:

To operate the ATM, the card should be inserted in the specified place in the machine in the condition of Dip card; the card must be withdrawn at once. ATM gets operated after doing this.

Step-3:

Once the ATM gets operated, the name of the cardholder will come on the screen. At the same time there would also appear the options for selecting the language. Hindi or English may be opted as the operational language. If the machine is screen touch, the place of the desired language has just to be touched; otherwise the button on the side has to be pressed.

Step-4:

Now the ATM would direct to type the PIN (Personal Identification Number). PIN is a secret number of 4 digits. For example: 2493 or any other number. Now the ATM would process the PIN. If the pin is found to be correct, the process would continue further, otherwise the PIN would have to be typed again. If wrong PIN is typed three times, the card will be rejected for the whole day.

Step-5:

Many options appear on the screen in this step.

Some examples are:

i. Fast Cash,

ii. Withdrawal,

iii. PIN-Change,

iv. Mini-Statement etc.

On selecting the desired option, the further process will continue.

Step-6:

While getting the cash, a paper containing details of the transaction is given out through another slot in the side. This should also be obtained. This way the process of cash withdrawal gets completed. Before leaving the ATM room it should be ensured that the cash, ATM slip, and ATM Card have been duly collected.

Essay # 4. Functions of ATM Cards:

Different functions of ATM cards are:

(i) Money can be deposited and withdrawn using it. However, most of ATMs provide the facility of withdrawing only at present.

(ii) Non-cash functions can also be performed with it. Some examples are: Balance enquiry, fund transfer from one account to the other etc.

(iii) A mini-statement can be obtained using it. It contains the details of last five transactions, however some banks provide the details of last ten transactions.

(iv) Due to increasing popularity of the ATM Card, now the facilities of paying the electricity bill and telephone bill are also provided with it.

Essay # 4. ATM Cum Debit Card/Debit Card:

ATM cum debit card is the most popular card these days. Most of commercial banks provide these cards to their customers. In other words, these days ATM cards are used as Debit Cards. So these are called ATM cum debit card. Goods can be purchased using this card, however only the authorised business establishments provide this facility.

For purchasing goods from business establishment following steps have to be passed through while using a Debit card:

Step-1:

First it should be ensured whether the ATM cum Debit Card or the Debit Card holds the logo of Maestro or Visa. Next it should be ensured whether the business establishment displays that logo or not. If it matches, the process may take place.

Step-2:

After the purchase of goods, the shopkeeper receives the card from the customer and presses the O button of POS (Point of Sale). Again he puts the card in the terminal and types the amount of purchase.

Step-3:

Now the shopkeeper gives the PIN-pad to the customer. The customer selects the options like Savings Bank Account or Current Account and also types the secret PIN.

Step-4:

The terminal completes the process and prints a receipt for the amount of purchase.

Step-5:

After checking the receipt, the customer sign on it and the process of purchasing with the help of debit card gets completed. Before leaving the establishment, the customer must occupy his goods along with the Debit Card and a copy of receipt.

Essay # 5. Credit Card:

Credit Cards are also called Plastic Money. This card is also issued by banks, but it is not necessary that the cardholder should have an account in the bank. It is a form of credit money. Commercial banks limit the maximum amount of credit according to the financial position of the cardholder. It means that the card can’t be used for the amount exceeding that amount.

Generally three kinds of cards are issued by banks:

(i) Gold Credit Card.

(ii) Silver Credit Card.

(iii) Bronze Credit Card.

The value of Gold Credit Card is up to 1 Lakh rupees, while the values of Silver Credit Card and Bronze Credit Card are up to Fifty thousand rupees and twenty five thousand rupees respectively. Using this card, the cardholder can withdraw the cash up to the limit from the authorised banks or can purchase goods and services; the cardholder has to repay the withdrawn money with 30 to 45 days. Banks charge high interest for this service.

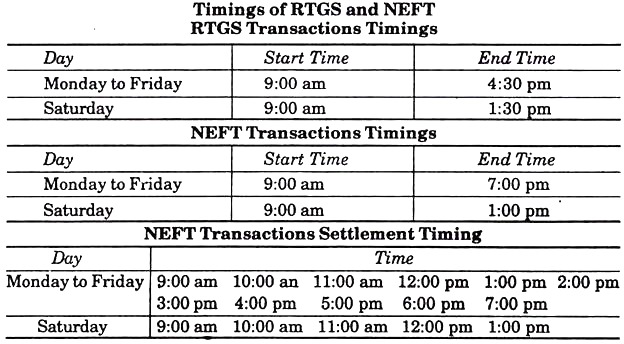

Essay # 6. Real Time Gross Settlements (RTGS):

Real Time Gross Settlement (RTGS) is a modern mechanism of fast money transfer through banking medium. Money is sent on the basis of ‘Real Time’ and ‘Gross’ through RTGS. Here ‘Real Time’ means sending money instantly without any delay. Similarly ‘Gross’ mean completing transactions one by one. It means that this amount is sent without waiting for other transactions.

The customer sending money through RTGS has to provide the banks following information:

(i) Amount to be remitted.

(ii) Account Number which is to be debited.

(iii) Name of the Beneficiary Bank.

(iv) Name of the Beneficiary Customer.

(v) Account Number of the Beneficiary Customer.

(vi) India Financial System Code—IFSC of the receiving branch.

It is worth mentioning here that IFSC number is a number comprising of 11 digits and letters. It helps in recognising the branch code. It can be obtained from one’s branch; however it is written on the cheques of most banks.

Essay # 7. National Electronic Funds Transfer (NEFT):

NEFT is also an electronic way of sending money from one place to the other through the banking medium, but it can’t be sent instantly. The main reason for it is a certain point of time in this transaction. In this system also all the details similar to RTGS have to be given to banks.

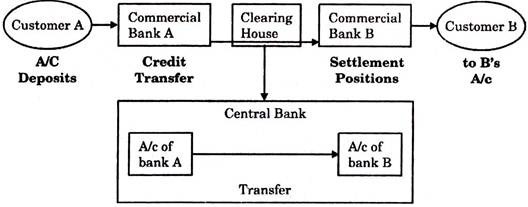

Essay # 8. Banking Working Process:

Banking working process can be understood with the help of following table:

In this way, in the inter-banking process following steps are included in the Electronic Fund Transfer (EFT) of the Reserve Bank of India:

Step-1:

Filling up EFT application.

Step-2:

Preparing schedule and sending the service providing bank’s branch.

Step-3:

Preparing, the EFT data file of the local branch of the Reserve Bank of India.

Step-4:

The Reserve Bank of India receives the files of the commercial banks, sorts them out accordingly to cities and takes important step after preparing vouchers.

Step-5:

Next, the Reserve Bank of India sorts these files according to Commercial banks and takes necessary steps.

Step-6:

On the same day or the next day the commercial bank credits the amount in the account of the beneficiary.

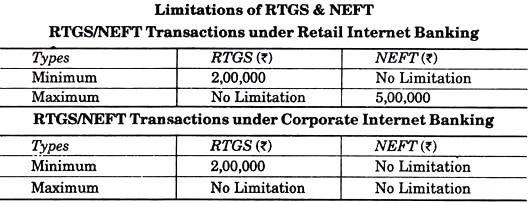

The above table clarifies that in any condition an amount less than one lakh rupees can’t be sent in RTGS, while there is no such restriction in NEFT. So far as the question of the maxim vim amount is concerned in the retail banking it is limited up to five lakhs rupees. But there is no such limitation for corporations.