Are you looking for an essay on the ‘Banking Reforms in India’? Find paragraphs, long and short essays on the ‘Banking Reforms in India’ especially written for school and banking students.

Essay # 1. Banking System Reforms:

Many defects grew in the banking system with the development of the banking sector. There have been many attempts from time to time to eliminate the faults/defects in the working of banking system.

Some of these are:

First Recommendation of Narasimham Committee on Banking Sector Reforms (1991):

A committee was set up by the Government of India in August, 1991 in the chairmanship of Shri. M. Narasimham to look into every aspect of banking and financial system. This committee presented its report in December, 1991.

The main recommendations of this committee for the reform in the banking sector were as follows:

(i) Statutory Liquidity Ratio (SLR) had to reduce gradually to 25 percent. A period of 5 years was recommended for it.

(ii) Similarly, the current rate of Cash Reserve Ratio (CRR) was also supposed to be the highest and a gradual reduction in it was recommended.

(iii) Bringing transparency in the balance sheet of banks.

(iv) Allowing regional rural banks to perform all kinds of banking functions.

(v) Liberalising the current policy of allowing the foreign banks to open their offices and/or branches.

(vi) The direct loan activities of Industrial Development Bank of India (IDBI) should be handed over to another institution and the refinance functions should be left with IDBI.

(vii) Making laws on the basis of international standards for the formation and management of Mutual Funds.

(viii) Making such laws regarding the interest rates that may be appropriate according to the circumstances.

(ix) Achieving 4 percent of Cash Reserve Ratio (CRR) with respect to risk weighted assets by March, 1993 and 8 percent by March, 1896.

(x) Setting up special tribunal for pacing up the process of loan repayment.

(xi) Making proper arrangements for the resolution of complaints of the customers regarding the faults in banking services.

(xii) Setting up proper standards for financial and non-financial institutions.

(xiii) Making the Reserve Bank of India the primary agency so that the double control over the banking system may be ended.

(xiv) Determining rational principles for the management functions of banks and financial institutions.

(xv) Reducing the number of banks by the rearrangement of banking systems. In such a system there should be 3 or 4 banks of international level, 8 to 10 national banks, the branches of which should perform the international level of banking business all over the country. The regional banks should be authorised to operate in specified regions only and the rural banks should operate only in rural areas etc.

Reforms after Recommendations:

The reforms made after the submission of the first report of Narasimham Committee in 1991 are described here:

(i) Statutory Liquidity Ratio was gradually reduced from 38.5 percent in 1992 to 25 percent, which is now 21.25 percent.

(ii) The current Cash Reserve Ratio was reduced in 1999 from 10 percent to 9 percent, which is now 4 percent.

(iii) Bank rate was activated to enable it to tackle the market circumstances.

(iv) To bring transparency in the balance sheet of banks it has been made mandatory from 31st March, 1992 to make profit and loss account, balance sheet in a new format. New format has been given in vertical form in which all information has been written with the help of schedules.

(v) Strong standards were determined for financial institutions and non- banking financial companies.

(vi) To improve the customer oriented services the system of Electronic Fund Transfer was started and acknowledging the importance of computers these were brought into use on proper scale.

(vii) The nationalised banks were authorised to accumulate funds from the capital market by the process of Capital issue but it was confined to a certain limit. According to this limit, the share of the government’s ownership was not allowed to be less than 51 percent.

(viii) Six Special Recovery Tribunals were set up to facilitate the process of loan repayment by banks and financial institution. These tribunals are at Kolkata, Jaipur, New Delhi, Chennai, Ahmedabad, and Bengaluru. Besides, there is also an Appellate Tribunal at Mumbai.

(ix) The banks of the private sector were also allowed that they can raise capital up to 20 percent from foreign institutional investors and 40 percent from non-resident Indians.

(x) Banking Ombudsman Scheme was announced in 1995 for speedy solution of lacking in the banking services as complained by customers.

Second Recommendation of Narasimham Committee on Banking Sector Reforms, 1998:

For the observation of the reforms made in the banking sector according to the first report of Narasimham Committee, 1991, the Finance Ministry of the Government of India set up another committee on 26th December, 1997 under the chairmanship of Shri M. Narasimham and named it Banking Sector Reform Committee. This committee submitted its report to the Finance Ministry on 22nd April, 1998.

The main recommendations of this committee are:

(1) Need of Strengthening the Banking System:

The committee has given many guidelines and directions for strengthening the banking system.

Some examples are:

(i) For capital to risk asset ratio should be increased from 8 percent to 9 percent by 2000 and to 10 percent by 2002 for risky assets.

(ii) The net non-performing assets should be bought below 5 percent by 2000 and below 3 percent by 2002.

(iii) The system of income determination and clarification of assets should be implemented on advances guaranteed by the government in the same way as on the other advances.

(iv) Such advances guaranteed by the government which have been blocked should be marked as non-performing assets.

(v) The committee also suggested that there should be carefulness in merging together of strong and weak banks. There should not be any negative impact on the assets of strong banks due to the effect of merging.

(vi) Two or three Indian banks should be of international standards.

(2) Narrow Banking:

The committee has defined the working those banks as Narrow Banking, which invest their money in risk involving assets and the balance of its demand deposits is in safe liquid assets. The committee has recommended those banks to adopt the concept of narrow banking whose non-performing assets have increased greatly, so that they can re-establish themselves.

(3) Capital Holding:

According to the recommendations of the committee the share of the Reserve Bank of India in shareholding of the nationalised banks and State Bank of India should be brought down to 33 percent.

(4) Reforms in Banking System:

With the objective of reforming the banking system, the committee recommended that:

(i) Maintaining of accounting should be developed by computers.

(ii) There should be an independent ‘Loan Monitoring System’ to recognise big credit accounts and non-performing assets.

(iii) There should be an extra full time Director for the period of 3 years in the nationalised banks.

(5) Capital Adequacy Ratio (CAR):

The committee has suggested the government to provide the banks chances to strengthen themselves to bear the risks. For this the government should consider to enhance the predetermined Capital Adequacy Ratio.

(6) Evaluation of Bank Acts:

The Committee has recommended amending the Reserve Bank of India Act, Banking Regulation Act, State Bank of India Act etc. after their re-evaluation according to the needs of the present times.

Reforms after Recommendation:

After the Second report of the Narasimham Committee following reforms were made in the banking sector:

(1) Minimum Capital Risk Assets Ratio (CRAR) was increased to 9 percent.

(2) Banks have been allowed to enter capital market and 12 banks have started this work.

(3) Banks have been advised that their assets would be classified as ‘Doubtful Assets’ which have been in the sub-standard form up to 18 months. Earlier this period was up to 24 months.

(4) Banks have been guide-lined that they should take proper step regarding Non-Performing Assets (NPA) and they should give Risk Management System a proper place.

(5) Banks have been authorised that they can issue bonds to raise their TIER-II Capital. There won’t be need of any guarantee from the government for s such bonds.

(6) The Public Sector banks have been allowed to adopt Open Market Campus Recruitment System to recruit capable persons for the Information Technology Risk Management, Treasury Operation etc.

(7) Banks have been suggested that they should make a fresh observation of training in the areas of credit management, treasury management, risk management etc.

(8) The capital was classified into TIER-I, TIER-II and TIER-III to improve Capital Adequacy Ratio (CAR).

(9) The Ombudsman Bill, which had been recommended in the first report itself, was implemented.

(10) Basel-II was implemented according to the Basel Committee Agreement.

Essay # 2. Committees on Banking Reforms:

1. Banking Ombudsman Scheme:

‘Banking Ombudsman Scheme’ has been formed for the quick redressal of Customers’ complaints. The Reserve Bank of India implemented this scheme for the whole country on 14th June, 1995, to give the benefit of this facility to the whole country 15 Ombudsman have been appointed in different regions viz., New Delhi, Kolkata, Mumbai, Chennai, Patna, Chandigarh, Hyderabad, Jaipur, Kanpur, Guwahati, Bhubaneswar, Ahmedabad, Bengaluru, Bhopal and Trivandrum.

In this scheme there is an arrangement that if a customer feels that proper action on his complaint has not been taken by the bank management within 2 months, he can lodge his complaints with the Banking Ombudsman within 1 year.

A customer can make following complaints with a ‘Banking Ombudsman’:

(i) Unnecessary delay in the payment of cheques, drafts and bills.

(ii) Not accepting small currencies without giving a proper reason.

(iii) Not issuing bank drafts.

(iv) Complaints regarding the operations of bank accounts etc.

A ‘Banking Ombudsman’ first takes an initiative to bring the customer and bank to a point of agreement, but if it is not possible he can declare the award for the customer which can be equal to the loss caused to the customer. This award can be up to 10 lakh rupees. If this award is not paid by the bank, the Banking Ombudsman can make its complaint to the RBI.

All Scheduled Commercial Banks, Regional Rural Banks and Scheduled Primary Co-operative Banks are covered under banking ombudsman scheme. Now the area of complaints to the Ombudsman has been increased. Now the complaints regarding Credit Cards, not accepting coins demanding commission for any work have been brought under its jurisdiction. This scheme has been effective in the whole country since 1st January, 2006.

2. Basel Committee for Banks:

Basel committee is an organisation formed by the central banks of Group 10 countries. It works in the direction of improving the observation system of Central banks. It was founded in 1974. Banking policies are formed for the member countries as well as those countries which are not its members.

Before this, bank for International Settlement—BIS was started in 1930. It is called the Central Bank for Central Banks. It is not a bank that provides financial assistance, but it is the first international financial organisation of the world that formulates international financial policies and acts to bring co-operation among the central banks of various countries. Its, headquarter is in Switzerland.

What does Basel Accord Mean? Basel agreement refers to the group of those agreements among members of Basel Committee that suggests ways to keep away risks. First Basel agreements are known by name of Basel-I.

Basel-I:

Basel-I is an agreement for the minimum capital need of banks as per the discussion of Central banks. It was announced and published in 1988. It is also called the ‘Basel Accord I’, 1988. It was also implemented legally by ‘G-10′ countries in 1992. The need of classification of the banks’ assets for the credit risks has been mainly emphasised in this agreement. Besides this it would be essential for banks to keep at least 8 percent of Risk Weighted Assets as Tier-I and Tier-II assets. For example if the Risk Weighted Assets of a bank is 100 dollar, it will have to maintain at least 8 dollar capital.

Tier-I Capital:

Tier-I Capital is also called the core capital. This capital is in form of just available help against maximum fixed and unexpected loss. The equity share capital and declared reserve are included in it.

Tier-II Capital:

It includes undeclared reserve, general loss-resource, and secondary loan. In the matter of Capital Adequacy Standard determination, in any condition the Capital of Tier-II should not be more than 100 percent of Tier-I and the sub-ordinate loans should not be more than 50 percent of the capital of Tier-II.

It is also worth mentioning here that Capital Adequacy Ratio means such capital which should be kept up to a certain level for the creation of commercial assets.

Capital Adequacy Ratio—CAR can be obtained with the help of following formula:

CAR = Tier-I Capital + Tier-II Capital

Basel-II:

The second agreement of Basel Committee is known by the name Basel-II. Its final document was prepared in 2004 and a time period up to 2015 has been given to completely bring it is into action.

It is mainly centralised on three areas which are called the three pillars:

(A) Pillar-I:

It is for the minimum capital requirements.

This determines the following:

(i) Credit Risk.

(ii) Operational Risk.

(iii) Market Risk.

(B) Pillar-II:

It is for the supervisory review. Following four main principles come under it:

(i) Banks should adopt such process so that a complete capital adequacy can be maintained in the condition of risk.

(ii) The Supervisors should evaluate the internal capital adequacy of banks. If the banks shows negligence in this respect and the observatory is not satisfied, he should take proper steps.

(iii) It should be expected by the supervisors from the bank that they are maintaining their capital above the minimum Regulatory Capital Ratio.

(iv) The Supervisor should interfere if the bank is in its capital limitation below the minimum level at the initial level.

(C) Pillar-III:

It is for the market discipline. Following things are included in it:

(i) Scope of Application of Funds.

(ii) Capital Structure.

(iii) Capital Adequacy.

(iv) Credit Risk Exposure.

(v) Credit Risk Mitigation.

(vi) Operational Risk Exposure.

(vii) Exposure to Interest Rate risk.

3. Recommendation of Goiporia Committee:

To bring an improvement in the customer services of banks, the Reserve Bank of India set up a committee in the chairmanship of Shri M.N. Goiporia, the then Chairman of State Bank of India, in September, 1990. The Committee presented its report on 5th December, 1991.

The main recommendations of the committee are as follows:

(i) The banking hours should be expanded for all other banking services excluding the cash payment.

(ii) There should be proper arrangement that the bank counter should open on proper time and customers needn’t wait unnecessarily.

(iii) Increase in the interest rates on savings accounts.

(iv) Complete utilisation of the rational (considerate) power given to bank staffs.

(v) The outside cheques up to Rs. 5,000 should be immediately deposited in the bank account.

4. Verma Committee on Weak Banks:

The committee was constituted on 8th February, 1999 for suggesting of weak banks. The committee submitted report on 3rd October, 1999.

The major recommendations are as under:

(i) Cut staff strength by 25 percent through VRS.

(ii) If VRS scheme fails cut wages across the board.

(iii) Reconstruct Bank Boards.

(iv) Debts recovery tribuna’s to work on war footing.

(v) RBI to setup a special wing to supervise weak banks.

(vi) Nodal body to monitor progress of weak banks.

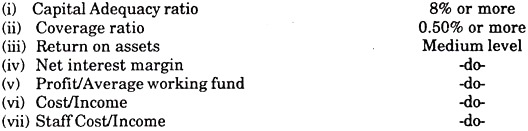

The committee had used 7 parameters for identification of banks strength/weakness:

5. Sarkar Committee on Anti-Money Laundering:

Indian banking association, set-up a study group under the chairmanship of P.K Sarkar to study the anti-money laundering practices and know your customer guidelines being followed in other countries.

The major recommendations of the group are as under:

(i) Urgent need to adopt anti-money laundering policy.

(ii) Each bank must have its own anti-money laundering policy.

(iii) A time-bound action plan to implement the bank’s anti-money laundering policy.

(iv) Adoption of ‘know your customer’ guidelines by banks.

(v) The bank account forms should contain information about the financial status of the customer, his source of income etc.

(vi) Banks should report suspicious transactions to the RBI.

(vii) Banks should have structured training modules to impart full knowledge of anti-money laundering guidelines.

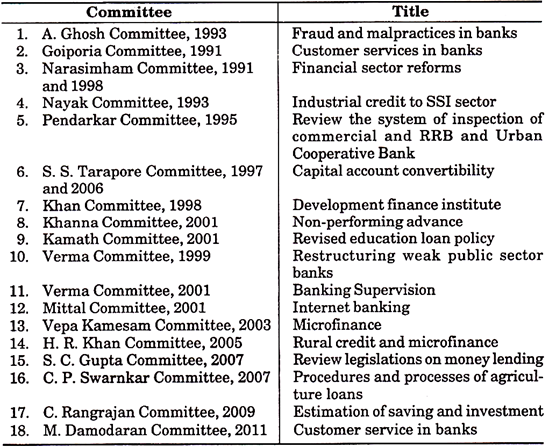

Committees on Banking reforms at a Glance:

Some important committees on banking reforms are as follows: