Are you looking for an essay on ‘Banks’? Find paragraphs, long and short essays on ‘Banks’ especially written for school and banking students.

Essay on Banks

Essay Contents:

- Essay on the Meaning of Banks

- Essay on the History of Banks

- Essay on the Types of Banks

- Essay on the Categories of Indian Banking System

- Essay on the Nationalisation of Commercial Banks

- Essay on the Objectives of Nationalisation of Banks

- Essay on the Arguments against Nationalisation of Banks

- Essay on the Defects of Indian Banking System

Essay # 1. Meaning of Banks:

Bank is a financial institution that provides banking and other financial services to their customers. It is generally understood as an institution which provides fundamental banking services such as accepting deposits and providing loans. A banking system referred as a system provided by the bank which offers cash management services for customers, reporting the transactions of their accounts and portfolios, throughout the day.

The banking system in India should not only be hassle free but it should be able to meet the new challenges posed by the technology and any other external and internal factors. Before the establishment of banks, the financial activities were handled by money lenders and individuals. At that time the interest rates were very high. Again there were no security of public savings and no uniformity regarding loans.

The bulk of all money transactions today involve the transfer of bank deposits. When a depositor writes a check against his account, his bank must surrender that amount in reserves to the payee’s bank for the check to clear. Reserves are constantly moving from one bank to another as checks are written and cleared. At the end of the day, some banks will be short of reserves and others long. The supply of reserves changes whenever base money enters or leaves the banking system.

Those who are new to banking or who have lived in other countries where the banking system can’t be trusted might be wondering why they would want to use a bank at all.

It’s certainly possible to operate on a cash-only system, but that isn’t the best idea for several reasons:

(a) Security;

(b) Convenience; and

(c) Saving and investing.

Essay # 2. History of Banks:

The first regular institution resembling what we call a Bank was established at Venice, nearly seven hundred years ago. The Republic being engaged in war, and falling short of funds, had recourse to a forced loan. The contributors to that loan were allowed an annual interest of four per cent on the sums they had been obliged to lend; certain branches of the public revenue were assigned for the payment of that interest.

The Bank of Venice long remained without a rival; but about the beginning of the fifteenth century, similar institutions were established at Genoa and Barcelona, cities, at that time the pride of Europe, and second only to Venice in extent of trade.

The Bank of England, first chartered in 1694, is the prototype and grand exemplar of all our modern banks; its history, will deserve the more particular attention. The original capital of bank was 1,200-0001 sterling. The original capital of this bank was 1,200,000 sterling. This capital did not consist in money, but in government stock.

The subscribers to the bank had lent the government, the above sum of 1,200,000 at an interest of eight per cent, besides an additional annuity of 4,000 and the privilege of acting as a banking company for the term of twelve years. These hard terms are a pretty clear proof how low was the credit of King William s government in the first years of its establishment.

With the increase of wealth and commerce in Europe, private bankers established themselves in all the principal cities and towns. They received money on deposit; they managed the money affairs of states and individuals; they lent money to such borrowers as could give the necessary security; and they bought and sold bills of exchange, bullion, and coin.

Two banks were established in Scotland by charter from the king; one the Bank of Scotland, in 1695; the other, the Royal Bank of Scotland, in 1727. These two banks have branches in most of the principal towns of Scotland; but as they never obtained any exclusive privileges, a multitude of private banks sprung up to dispute the business with them, and to divide its profits.

Essay # 3. Types of Banks:

Bank can be classified in various ways on the basis of their functions, ownerships etc.

Some of them are:

1. Central Bank:

Central bank is the apex institution that controls, regulates and supervises the monetary and credit system of the nation. In India Reserve Bank of Indi is the central bank. Guiding principles of the RBI are to operate its most instruments in a way that serves the objectives of economic policy laid down by the Government and Planning Commission. The central bank has the monopoly of issuing notes or paper currency to the public.

Another important function is to act as the banker to the government. The central bank is the lender of the last resort for other banks in difficult times because there is no hope of getting help from any competing institution. The chief function of central bank is to maintain price and economic stability. Another important function is to maintain the exchange rate of the national currency.

2. Commercial Bank:

It is such bank that performs all types of banking activities and finance for industry and business. They collect savings from people and give loans when needs. They give loans for short term, medium term and long term. Majority of commercial banks in India are in the bank of the public.

Commercial banks are the single most important source of institutional credit in India. Modern commercial banking begins with the setting up of the first Presidency bank, The Bank of Bengal in 1806 in Calcutta. Two other Presidency banks were set up in Bombay and Madras in 1840 and 1894 respectively. They were amalgamated in Imperial bank in 1921.

3. Exchange Bank:

Such bank deals with the foreign exchange and international trade. They involve international payments through the sale and purchase of bills of exchange and helps for promoting the foreign trade.

4. Saving Bank:

Such bank plays vital role for improving the savings habits among people. People can easily save money and also get interest and other benefits.

5. Agricultural Bank:

Agricultural bank specially set-up for agriculture development. In India, co-operative institutions and land development banks are more important among those. Farmers needs more credit from scheduled banks so that they not depends on moneylender and others people who exposits them by higher rate of interest.

Essay # 4. Categories of Indian Banking System:

The present form of Indian Banking System is much attractive and convenient, but it has a history of intense struggle.

The history of its development can be classified into following categories:

1. First Stage (Till A.D. 1806):

There was Muslim rule in India before the reign of Britain. The banking task was mostly performed by the money lenders and traders during the Muslim rule. The British rule was established in India in the seventeenth Century A.D. British Banking System came into operation during this rule. This gave a big blow to moneylenders and merchants. The main factor responsible for this condition was that money lenders and merchants had no knowledge of English language.

Moreover, their banking systems were different. Money lenders and merchants were not aware of the British Banking System; hence they were not able to modify themselves accordingly. The East India Company established some Agency Houses in Mumbai and Kolkata in the 18th century A. D. These were financially nourished by the East India Company. The banking functions were carried out by these agency houses.

The main functions they performed were as follows:

(i) Accepting deposits from public,

(ii) Issuing paper notes,

(iii) Advancing loans for agricultural productions, and

(iv) Lending money to meet the army requirement of the East India Company.

‘Bank of Hindustan’ the first Bank in India on the trend of the British Banking System, was founded by Alexander and Company at Kolkata in 1770. But this bank could not be very successful. Hence, there was no bank in India till May 1806.

2. Second Stage (From A.D, 1806 to A.D. 1860):

The East India Company lost its commercial rights in 1813. Hence the agency houses established by them also began to decline. After this, the private shareholders started setting up banks in India. Bank of Calcutta was established on 2nd June, 1806 and it was renamed as Bank of Bengal on 2nd January, 1809.

Again Bank of Bombay was established on 15th April, 1840 and Bank of Madras on 1st July, 1843. Though all these three banks were set up by private shareholders, the government had some shares in them. Thus, these three had the authority of government bankers. But the government of India withdrew their right of issuing notes after 1862. Due to the increasing nature of the government functions, the Imperial Bank of India was established in 1921, incorporating these three banks.

3. Third Stage (From A.D. 1860 to A.D. 1913):

Joint Stock Company Act was passed in India in 1860. According to it, bank could be founded on the basis of the concept of limited responsibility. This legislation paved the way for the foundation of Indian Banks. Consequently many banks started getting established with the help of joint capital, viz. Allahabad Bank in 1865, Alliance Bank of Shimla and Awadh Commercial Bank in 1881, Punjab National Bank in 1894, and Peoples Bank of India in 1901. Out of these Punjab National Bank is the bank that was fully operated by Indians.

These banks did not show much progress. The speed of banking progress was much slow in India up to 1900. It started showing some progress after this. The rapid proliferation of banks started taking place in India after A.D. 1906. Swadeshi Movement had taken birth in the country by that time.

Indians started boycotting foreign banks and Indian banks run by Indian entrepreneurs started spreading their business. This gave a new life to Indian banks. Many small and big banks were established in this period, of these, Bank of India in 1906, Bank of Baroda in 1908, Central Bank of India in 1911, and Bank of Mysore in 1913 were prominent.

4. Fourth Stage (A.D. 1913 to A.D. 1939):

This stage of Indian Banking system is called the worse period of banking history. Reforms in banking area had just started when the developments of Indian banks was blocked during the First World War (1914-1918). Many banks were established in India due to Swadesi movement but many of these Banks were weak and were not following the banking principles properly. Consequently, the customers lost their confidence in these banks. Gradually, many banks collapsed.

Moreover, there was a lack of direct control over banks due to the absence of the Central Bank. Many banks showed their paid up capital more than what was real figure and thus misled their customers. The capital market was not well developed in the country by that time, and consequently there was no proper co-ordination among banks. These banks couldn’t gain any help from anywhere at the time of economic crisis.

But this condition did not last long. Some banks were able to win the confidence of the people through their work. Gradually, the banking atmosphere speeded up. Tata Industrial Bank was founded in 1917 with the objective of granting financial assistance to industries. Again, Imperial Bank of India was established in 1921 by incorporating the three Presidency Banks (Bank of Bengal, Bank of Bombay and Bank of Madras). It was nationalised in 1955 and renamed as State Bank of India.

There was some improvement in the banking work after the establishment of Imperial Bank of India, but there was the need of more reforms. The government of India formed “Hilton Young Commission” in 1925 to give recommendations for the establishment of a separate Central Bank.

The commission suggested the establishment of Reserve Bank of India as the Central Bank of the country. The government accepted this recommendation and presented ‘Gold Standard and Reserve Bank of Indian Bill’ in the legislature in January 1927, But this Bill could not pass due to some dissensions.

Again in 1929, Central Investigation Committee strongly recommended the establishment of the Reserve Bank of India. Accordingly, one more bill was presented in the Indian Legislature on 8th September, 1933 which was passed on 22nd December, 1933. Again, it was passed by ‘Council of States’ on 16th February, 1934. The Reserve Bank of India Act, 1934 got passed on 16th March, 1934 after getting the approval of the Governor General and it started its function formally on 1st April, 1935.

5. Fifth Stage (A.D. 1939 to A.D. 1946):

This was the golden period for the Indian banks in the field of banking development. A good banking environment had developed in the country by that time. Banks had started proliferating in the country. People had surplus money due to the situation of inflation and consequently deposits with banks started increasing.

The demand of loans had also started soaring up due to the development of industrial atmosphere. There was a balance in the banking system due to the rise of both deposits and credits. Many new banks proliferated their branches and at the same time many new banks were also founded in this period.

However, this was the period of the World War II. The World War II had some impacts on the banks in the initial phase. People started withdrawing their deposits from banks, but the condition improved gradually. It was this shortcoming that resulted into an imbalance in the development of banks. Banks were mostly set up in cities. Moreover, banks were founded in those areas which already had it.

As a result an unnecessary competition developed. There also took some basic changes in the investment policies of banks. Before the war, banks used to invest 54 per cent of their investable money in government securities but it was raised to 61 percent during the war. Similarly they used to keep 1 percent of their deposits as a cash reserve before the war, but raise to 25 percent during the war.

6. Sixth Stage (From 1947 to Present):

The position of the country after the independence had bad consequences on Indian banks. Particularly in Punjab and Bengal even banks had to take shelter in India as refugee due to the partition of these states.

Consequently, many banks collapsed. As the Reserve Bank of India had been established as the Central Bank of India, it had the responsibility of protecting banks. The Reserve Bank of India launched a new scheme to come up to its responsibility.

According to this scheme, the scheduled banks were granted the facility of taking loans from RBI on the basis of accepted securities; and arrangements for the rehabilitation of refugee banks were also made. The government of India nationalised the Reserve Bank of India on 1st January, 1949 to strengthen it. The Banking Company Act was also passed in this year.

Imperial Bank of India was nationalised in 1955 and it was renamed as the State Bank of India which started working formally from 1st July, 1955. By then, the condition of many banks had well-improved, but many banks had failed too.

Only during a period of five years the period from 1947 to 1951,242 banks had collapsed. Banking Company Act, 1949, was amended in 1962 and renamed as ‘Banking Regulation Act’. According to this Act many rules and sub-rules were added to banks working norms.

Before this, according to State Bank of India (Associates) Act, 1959, the term ‘State’ was added in the beginning of the names of eight banks and these were made the associate banks of the State Bank of India.

Again, on 1st January, 1963, two of these—State Bank of Bikaner and State Bank of Jaipur were merged to form State Bank of Bikaner and Jaipur. After this, there remained seven (7) associates’ banks of State Bank of India. But now State Bank of Saurashtra and State Bank of Indore have been merged with State Bank of India. So the number of associates’ banks of State Bank of India has remained just 5.

Essay # 5. Nationalisation of Commercial Banks:

14 such commercial banks which had more than 50 crores of rupees as deposits were nationalised on 19th July, 1969 under an ordinance.

These banks included:

(1) Central Bank of India,

(2) Bank of India,

(3) Punjab National Bank,

(4) Canara Bank,

(5) United Commercial Bank,

(6) Syndicate Bank,

(7) Bank of Baroda,

(8) United Bank of India,

(9) Union Bank of India,

(10) Dena Bank,

(11) Allahabad Bank,

(12) Indian Bank,

(13) Indian Overseas Bank, and

(14) Bank of Maharashtra.

Again 6 such banks which had deposits of more than Rs. 200 crores were nationalised on 15th April, 1980.

These banks included:

(1) Andhra Bank,

(2) Punjab and Sindh Bank,

(3) New Bank of India,

(4) Vijaya Bank,

(5) Corporation Bank, and

(6) Oriental Bank of Commerce.

Thus, in 1980, excluding State Bank of India, its associates, there were 20 nationalised banks in the country. But the government merged New Banks of India with Punjab National Banks on 4th September, 1993. This reduced the number of nationalised banks from 20 to 19. It again reached to 20 after the inclusion of I.D.B.I. Bank in the list of the Public Sector Banks.

Essay # 6. Objectives of Nationalisation of Banks:

Following are objectives behind the nationalisation of commercial bank in India:

(1) Collecting increased savings from public by developing faith in them and using it for the national development on the basis of priorities.

(2) Proliferating branches of banks in every part of the country and connecting more and more people with banking services.

(3) Controlling the use of bank loans for speculation and non-productive objectives.

(4) Providing proper training to bank officials to render services on proper conditions.

(5) To fulfill the legal requirement for granting sanction of loans to business and industry sector.

(6) Ending ownerships of a few persons on the banking sector.

(7) Promoting the rate of economic development and growth.

(8) Arranging credit for agriculture, cottage industries and exports.

(9) Bringing transparency in the banking sector.

(10) Eliminating the distance between the society and banks.

Essay # 7. Arguments against Nationalisation of Banks:

The nationalisation of 14 major banks in the first stage by the government of India is considered to be a good step. But a big section of population opposed this move.

The main arguments against the nationalisation of banks are as follows:

(1) Hasty Decision:

The critics held it that 14 major banks were nationalised in haste in 1969. The bill which was presented in the Lok Sabha in this regard was not prepared with seriousness; that is why a new Bill had to be passed after the interference of the high court.

(2) Political Decision:

It is said that the Congress Party which was in power at the time of nationalisation had been divided in two parts. Thus, it is supposed that it was a political decision instead of an economic decision.

(3) Influence of Politicians:

It was supposed that the influence of politicians would increase on banks after their nationalisation. Its consequence would be visible as the policies of banks would keep changing according to the policies of ruling parties. It would have impacts on the economy of the country.

(4) Encouragement to Inflation:

It was also blamed that the nationalisation would give boost to inflation. The running expenditure of banks would increase after the nationalisation, and to meet it, they would provide costly loans. This will give rise to inflation.

(5) Decrease in Efficiency:

It was expected that the feeling of competitiveness would come to an end and bureaucracy would increase. This would lower down the level of customer service.

Conclusion:

Whatsoever arguments have been given against the nationalisation of banks, it is an established fact that the banks have been nationalised.

Essay # 8. Defects of Indian Banking System:

Many policy-related decisions were taken to establish a proper banking system in the country after independence. ‘Banking Companies Act’ was passed in 1949 to do away with the defects of Indian Banking System. According to the amendment made on 1st March, 1966, it was renamed as Banking Regulation Act, 1949. Actually, the Indian Banking System has been reformed a lot due to this act. But owing to people’s dependence on banks, we still find that there are many faults in Indian Banking System.

The main defects of Indian Banking System are:

(1) Inadequacy of Banking Facilities:

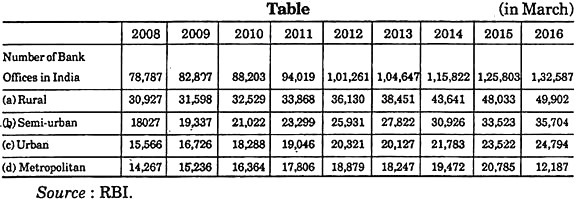

It is true that the offices of banks have increased over the last few years, but it is not satisfactory. The number of offices of Scheduled Commercial Banks in 2008 was 78,787 which increased to become 1,32,587 in 2016. The total numbers of branches in rural areas in March 2008 were 30,927 which got increased to become 49,902 in March 2016.

The decreasing banking facilities despite increasing branches can be understood with the help of following table:

(2) Misbehaviour with Customers:

It is a general complaint these days that banks do not treat their customers properly. We know that banks are service providing commercial institutions. Still they lack the serving attitude. Considering the banks, Mahatma Gandhi, the Father of Nation had said, “We are not benevolent to serve them (customers), but they are benevolent as they provide us chances to serve.” “He is not an outsider in our business, but he is a part of our business.” “He is not an obstruction in our work, but we have work due to him.” “He doesn’t depend on us but we depend on him.”

(3) Ineffective Credit Control Policy:

In India the Reserve Bank of India retains the job of Credit Control. RBI becomes successful in controlling the credit policies of bank in organised sector, but it has no control over the banks of unorganised sector. That is why the credit control policy of RBI often remains unsuccessful.

(4) Lack of Bill Market:

For the proper development of money market in the country it is essential that the bill market should also be well developed. But despite many attempts the bill market has not fully developed in India. Consequently, traders are away from many facilities.

(5) Lack of Proper Training:

Though banks manage to train their employees, it is limited to clerical jobs, advancing loans and getting loans repaid. There is no training as to how to satisfy customers, even though, it is very essential.

(6) Lack of Credit Deposit Ratio:

The Credit Deposit Ratios of Commercial banks have not been satisfactory in India. However there has been some improvement in it in recent years. This ratio was only 78.7 percent in 2013 which decreased to 78 percent and 77.4 percent in 2014 and 2015 respectively. On 31st March, 2016 it was 77.9 percent.

(7) Investment Deposit Ratio:

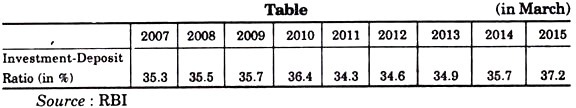

There has been lack of stability in the investment-deposit ratio of Indian banks.

The fluctuation in this ratio can be understood with the help of following table:

(7) Increase in Non-Performing Assets:

Non-performing assets are such loans distributed by banks the principal and interest of which are not repaid in time or not repaid totally. The profitability of banks has declined over the last few years. The increase in non-performing assets is a major factor responsible for it. The Gross NPA of the Scheduled Commercial banks in the end of March 2013 was 1,64,462 crores. The Gross NPA was 3.61 percent of Gross Loans and Advances given by the Scheduled Commercial banks in March 2013.

(8) Increase in Operating Expenses:

Increase in operating expenses is also a cause of decreasing profitability of banks. The employee’s federations have much pressure over Indian banks due to which they are able to get the decisions in their own favour. As a consequence, the operating expenses of banks increase. Besides it, the expenditure to run non-profitable branches has also to be met by the bank.

(9) Defective Loan Policy:

Granting loans and advances is another primary function^ banks, but there has not been any substantial improvement in the loan policy of banks. Most of the loans are granted on the basis of the collateral the fixed assets. Besides, in the matters of big loans approach and not the eligibility is the prime consideration, these days the more emphasis is laid on granting loans based on governmental scheme, but there is lack of proper policy for repayment. These loans are mostly based on subsidy.

(10) Presentation of False Balance Sheet:

Many banks in India present wrong particulars to the Reserve Bank of India. This way they hide their weakness, and the Reserve Bank of India faces difficulty in making proper decisions. These false particulars are prepared so wisely that it becomes difficult to find out the fault in them.