Are you looking for an essay on the ‘Commercial Banks in India’? Find paragraphs, long and short essays on the ‘Commercial Banks in India’ especially written for school and college students.

Essay on the Commercial Banks in India

Essay Contents:

- Essay on the Organisation of Commercial Banks

- Essay on the Functions of Commercial Banks

- Essay on the Sources of Funds of Commercial Banks

- Essay on the Types of Banking Investment by Commercial Banks

- Essay on the Utility and Significance of Commercial Banks

Essay # 1. Organisation of Commercial Banks:

Different countries of the world have witnessed the rise of banking in different phases of time. So, there is a lack of uniformity in the organisation of banks across the globe.

But most of the countries have either of the following two banking organisations:

(A) Branch Banking System:

Branch Banking System refers to the system of banking in which banks perform their work through branches. In this system, banks have their head offices in big cities and branches in different parts of the country. India also has the branch banking system. Some banks having this system establish their branches outside the country also. Though, the branch banking system is present in England, France, Australia, Germany, Canada, India etc. England is supposed to be the pioneer in this regard.

Merits of Branch Banking System:

The main merits of branch banking system are as follows:

(1) Large Scale Business and Division of Labour:

Banks adopting the branch banking system are undoubtedly having a big organisation. It has vast economic human power. Due to strong and consolidated economic strength, their business increase and due to strong human force, the work gets performed quickly accordingly to the speciality and vision of labour. The job is offered according to the speciality of a person. This way the banks get the benefit of division of labour and achieve excellence.

(2) Facility in Transferring Money:

In the Branch Banking System, a bank has its branches all over the country or in a large part of it. So the transferring of money from one place to another is made possible in the least time and at a minimum expense.

(3) Geographical Division of Risk:

Like other businesses, banking also involves risk. Bank invests the deposits in different areas. It is possible that the investment of a branch may incur some loss. In this condition this risk attains the geographical levels because banks have their branches in different regions. Gain at one place and loss at some other, reduces the risk.

(4) Expansion of Banking Services:

When the banks feel encouraged due to their success, they have a raised level of confidence. As a result, the branches of banks are opened in non-banking areas also. This leads to the expansion of banking services.

(5) Proper Utilisation of Capital:

Banking System is much better with the view of proper utilisation of capital. If a branch of bank has some surplus money and there is no better alternative of investment, it sends that surplus money to such a branch which has better options of investments.

(6) Similarity in the Rates of Interest:

It is possible that the demand of money increases at a time. In such a condition, the rate of interest also goes up. It is also a merit of Branch Banking System that if the demand of money increases at a place, it is fulfilled by transferring it there from some other branch. This way there is similarity in the interest rates all branches throughout the country.

(7) Training of the Staff:

The works of banks get expanded through Branch Banking System. As a result the staff is trained to do different kinds of jobs.

(8) Economy of Cash Reserves:

It is another merit of Branch Banking System that banks keep a small portion of deposits with them and invest the remaining amount. As banks have their brandies at other places also, so cash can be obtained from other branches in case the need arises.

(9) Knowledge about the Economic Position of the Country:

Banks have their branches all over the country, so Branch Banking System helps in gaining the knowledge of economic status of the country. This helps banks in deciding about their investment options.

(10) Facility for the Government:

The Government finds it easy to control and regulate banks through Branch Banking System.

Demerits of Branch Banking System:

Branch banking system has some demerits too.

Some of these are as follows:

(1) Difficulties of Management:

Banks have large number of branches in Branch Banking System. This poses difficulties in control, management and supervision of every branch. Due to being under the control of head office, branches have to remain dependent on it even for simple matters.

(2) Expensive System:

Banks have many branches in Branch Banking System. There is a need to establish coordination among various branches. This leads to high expenditure. Besides, many branches are very small. Even in this case, minimum expenditure has to be met. This way this system becomes highly expensive.

(3) Encouragement of Monopoly:

Though banks have branches spread over a large area, these are controlled by the head office. The whole economic system is ruled by a few people at the head office. This gives rise to monopoly. Such a monopoly is obstructive to the social progress.

(4) Lack of Initiative:

In this system, the work is performed at branch level but the orders are issued by the head office. Branches may face some difficulties on special occasion and circumstances, but they are not free to take decision. They have to depend on the decision of the head office. This leads to lack of initiative among employees.

(5) Unnecessary Competition among Banks:

It is a major fault of Branch Banking System that many branches are opened at the same place. This gives rise to unnecessary competition. Such a competition disturbs the process of healthy competitive development.

(6) Protection to Weak Branches:

There is no uniformity in functions of all branches. Some branches are weak and unprofitable. These get protection from branches running in profit. It means, the weak branches survive with the support of profit-earning branches.

(7) Difficulties in Foreign Countries:

There are differences in the banking laws, monetary policies and credit system of different countries. If a bank wants to open a branch in a foreign country, it has to face many problems.

(8) Neglect of Small Businessmen:

Banks feel that big businessmen provide them the strength of managing and earning profit. So, they neglect small businessmen. Granting loans to big businessmen are supposed to be safe investment.

(B) Unit Banking System:

Unit Banking System is a system in which a bank has only one office. Except under some special circumstances, the bank can’t open a branch. A bank usually performs its functions only in limited areas.

According to Prof. Sayers, “In this system the bank’s operations are confined in general to a single office, though a few banks are allowed to have branches within a strictly limited area.” This system is much popular in the USA. Thousands of banks operate in the USA under this system. Such banks are established by local people.

Merits of Unit Banking System:

The main merits of unit banking system are as follows:

(1) Facilitates in Management:

The size of banks in the unit banking system is small, so their management is easy. At the same time the cost of management is also small.

(2) Liquidation of Weaker Banks:

The weak and non-profitable banks get eliminated naturally in this system and they get liquidated. Thus banks try very hard to evade liquidation.

(3) No Formation of Monopolies:

There is no centralisation of the economic strength as the offices of banks are at different places. Thus there is no formation of monopoly.

(4) Increase in Efficiency:

Every bank is complete in itself in this system. There is no need to wait for orders from the head office to perform a task. Every big and small job has to be solved at its own level. So, the jobs are performed at the earliest and there is an increase in the work-efficiency of workers.

(5) Full Knowledge of Local Condition:

The banks established in an area under the unit banking system have the full knowledge of the economic and social conditions of that area. In this condition, banks plan and perform their task according to the local needs.

(6) Free Enterprise:

The atmosphere of free enterprise starts in banking. With the freedom in work there is an increased progress and satisfaction.

(7) Quick Disposal of Banking Works:

No decision is kept pending in this banking system. All banking works are performed quickly. This brings customer satisfaction.

Demerits of Unit Banking System:

The main demerits of unit banking system are as follows:

(1) No Possibility of Geographical Distribution:

There is localisation of a bank at one place in unit banking system. If there is an apprehension of economic depression, there is no chance of the geographical distribution of risk and there is a threat of the closure of the bank.

(2) Difficulty in Facing Economic Crisis:

As the banks are small in this system, they have very little economic strength. Consequently banks can’t face crisis. A big evidence of this is the economic depression of 1929. Hundreds of American banks collapsed in this worldwide depression.

(3) Inconvenience in Remittance of Money:

Banks have no branches in the unit banking system, so there is difficulty in remittance of money. There is more expenditure in remittance of money.

(4) Difference between Rates of Interest:

There is no easy and economical system of remittance of money, so different areas have different rates of interest. The developed regions have low interest rates but undeveloped and developing regions have high interest rates.

(5) Lack of Division of Labour and Specialisation:

Due to small size and area there is very little division of labour and specialisation. Particularly, because of the lack of specialisation, there is a reduced profit.

(6) Lack of Resources:

Due to limited economic and human strength there is a limitation of resources. As a result there is no proper development.

(7) Difficulty in Extension of Branches:

Even a successful bank is not allowed to open its branch in the unit banking system. A bank is established in a big place initially, but later on if it tries to open branches in smaller areas; it is not allowed to do due to the banking laws.

Essay # 2. Functions of Commercial Banks:

Following are the important functions of commercial banks:

1. Receiving Deposits:

The main function of a commercial bank is to attract deposits from the public. Persons having surplus cash would like to keep it in a safe place. They go to a bank and deposit their savings with it. The bank not only protects their savings but also provides the depositers with a convenient method for transferring funds through the use of cheques.

Deposits are of various types:

(a) Demand Deposits:

Demand deposits are also known as current deposits and are those which can be withdrawn by the depositors at any time. The bank does not pay interest on demand deposits. Cheques are generally used only against these deposits. These deposits are kept by businessmen and industrialists who receive and make large payments through banks.

(b) Saving Deposits:

Saving deposits are made by those whose main objective is to save. The bank pays interest to the depositor against his saving deposits. But it places certain restrictions on the depositor in withdrawing his deposit. For instance, a bank may allow its saving depositors only five cheques a month. One form of saving deposit is known as cumulative deposit. A person deposits a given amount every month for a period of 25 months or more and the amount accumulates along with interest. It is a good and profitable form of saving.

(c) Fixed Deposits:

Fixed deposits are those deposits which can be withdrawn only after a specified period. They carry higher rate of interest. Fixed deposits are preferred to depositors both for their safety and for their interest income.

Thus, the first main function of a commercial bank is to attract the savings of the public by means of deposits. In the absence of banks, these savings would have been lying idle. But now they are kept with banks which lend them out to businessmen and industrialists for productive purposes. Keeping the money in a bank as a deposit is good for the depositors also. For one thing, money is safe; secondly, it earns interest; and thirdly, it is used to make payments. Bank deposits are money proper, and are known as bank money.

2. Advancing Loans:

In this respect, the banker has to shoulder many responsibilities. The bank makes profit by advancing loans. But the bank deals in other people’s money. It has, therefore, to keep ready cash to meet the depositors’ demands. Hence, great care has to be exercised in the matter of lending and keeping reserves. The bank must strike a fine balance between liquidity and profitability. If it keeps its assets in too liquid a form, it loses profit, and, if it tries to make too much profit, it may not be able to meet the depositors’ demands. It must arise at both liquidity and profitability.

It should be noted that the bank does not merely lend funds actually deposited with it by its clients. The bank can itself create deposits and thus make advances considerably in excess of the sums deposited with it. After satisfying itself that the purpose for which the loan is required is economically sound and after taking precautions as regards security, the bank gives its clients the right to draw cheques.

The loan thus becomes a deposit to the credit of the customers concerned. If the customer, by a cheque or a series of cheques, withdraws this amount, the payment is made to somebody. These cheques, in their turn, come back either to the same bank or to other banks of the country or locality. They appear as deposits in the credit of various people to whom the payments were made. Thus, it is that “loans create deposits”. That is why it is said that in modern times, deposits of cash have changed into deposits of credit.

3. Other Services:

Apart from these two major functions, commercial banks perform a number of other useful functions for the community. For instance, banks have developed the cheque system. The depositors are given the right to withdraw from their deposits any amount, at their convenience by means of cheques.

The cheque is used to settle debts, to pay for purchases made and to transfer funds from one person to another. The bank draft is also used to transfer funds from one place to another. Both the cheque and bank draft are very convenient, cheap and safe methods of payment.

The commercial banks also provide safety vaults or lockers in which the customers can keep their jewellery and other valuables in safe custody. It acts as an agent to its customers in making payment to the government or others or in receiving payment. It buys or sells gold, silver and securities on behalf of the customers.

The commercial bank thus is very useful institution. A good and efficient banking system is necessary for the development of an economy.

Essay # 3. Sources of Funds of Commercial Banks:

Like other commercial institutions, banks too are profit earning establishments. It is the work culture of banks that they receive money from people and other sources and invest in profit giving fields. That is why Gizbert has described ‘a bank as a trader of money’. Earning maximum profit in a legal way is the responsibility of a banking enterprise. But at the same time it is also a duty of the bank to meet the social obligations.

For this banks invest the accepted deposits in different fields in such a way that there should be maximum profits, protection of money and maintenance of liquidity. In other words, the commercial banks work on the principle “Don’t put all the eggs in one basket” at the times of investment of money. Before clarifying the investment policy of bank it is essential to know as to which are the main sources of funds of commercial banks.

Commercial banks in India get funds from internal as well as external sources. Among the internal sources, we include share capital, reserve funds, undistributed profit etc. On the other hand in the external sources, we include accepted deposits, loans from other commercial banks and loans from the Reserve Bank of India etc.

The source of funds of banks can be clarified through the following points:

(1) Share Capital:

The banking organisation in the present time is operated in India on the basis of Joint Stock Company. So capital is obtained by banks by selling shares. The board of director of the bank decides it in the Memorandum of Association that what should be the capital of the bank.

This capital is also called Registered Capital or the Nominal Capital. Some part of the Authorised Capital is issued in the market for sale, which is called Issued Capital. Among the Issued Shares, as many shares are applied by the people for purchasing are called Subscribed Capital.

The part of the Subscribed Capital which is really paid by the people is called Paid-up Capital. According to Section 12 of Banking Regulation Act, the Subscribed Capital of the bank should not be less than the half of its Authorised Capital in India. Similarly, the paid-up capital should not be less than half of the Subscribed Capital.

(2) Reserve Fund:

Due to being a company as Joint Stock Company, banks have to distribute their profits as dividends among the shareholders; but banks can’t distribute their total profit among shareholders. According to the Section 17 of Banking Regulation Act, 1949 for every banking company incorporated in India it is essential that it must keep at least 20 percent of its net profit in Reserve Fund. More funds in the Reserve Fund is the indication of more faith of public in the bank.

(3) Undistributed Profit:

The remaining amount of the profit and loss account which remains undistributed is called undistributed profit; the economic condition of the bank gets strengthened with it. It also raises the working capital of the bank.

(4) Deposits:

Accepting deposits from people through various accounts is the primary function of the bank. Deposits from people are a big part of the bank’s capital. People deposit their small savings through various accounts on definite terms. They further hope that their money should be safe and they should get interest on their deposits. Banks accept deposits from people through Fixed Deposit Accounts, Current Accounts, Savings Bank Accounts, Recurring Deposits Accounts etc.

(5) Borrowing and Loans:

Banks meet their needs in a general way by accepting share capital and deposits, but in special cases banks accept loan from commercial banks and the Reserve Bank of India. When a large number of customers come to withdraw their deposits at the same time and the bank is not able to fulfill such a sudden demand with the help of its general sources, it retains the faith of the people by taking loan form the Central bank of the country or from other commercial banks.

(6) Credit Creation:

The system of granting loans and advances by the bank is such that bank doesn’t provide the entire sum of the sanctioned loan at one time but the entire amount is credited in the account of the borrower. The borrower withdraws money according to his/her needs. On the other hand the depositors also don’t withdraw all their deposits at the same time, but withdraw amount according to their needs. In this process, banks create credit and raise their funds.

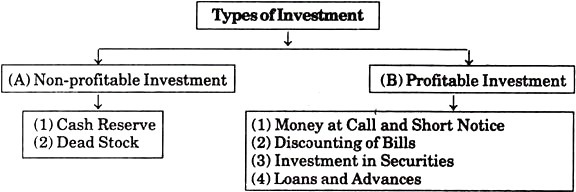

Essay # 4. Types of Banking Investment by Commercial Banks:

Every commercial bank invests its funds in two ways—Non-profitable Investment and Profitable Investment. There is no fixed rule regarding the ratio between these two kinds of investments. So the banks must be rational in making a balance between the two while investing their funds.

(A) Non-Profitable Investments:

Banks do not get any direct profit from the non-profitable investment, but with the objective of fulfilling the cash demands of the customers and ensuring security it becomes essential that banks should invest a part of their money in non-profitable field.

There are two non-profitable investments of banks:

(1) Cash Reserve:

Banks have to keep a part of their deposits as liquid money to fulfill the cash demands of their customers. The more the amount of cash with the bank, the sooner they would be able to fulfill the demands of cash by the customers. But banks can’t keep their total deposits with them because it won’t earn any income.

So, banks keep only a certain portion of their deposits as liquid money. Now the question arises as to what percent of the total deposits should be kept by the banks as liquid money. There is no fixed rule or law regarding this, but certain points are kept under consideration by banks while deciding the amount of cash reserves.

Those points are:

(i) Legal Requirements:

According to Section 42 of the Reserve Bank of India Act, 1934 every commercial bank has to keep a certain part of its deposits with Reserve Bank of India. Initially this ratio was 5 percent of demand deposits and 2 percent of the fixed deposits. After two amendments in 1962 the Reserve Bank got the right of a Joint Ratio in place of two different ratios.

The Cash Reserve Ratio was fixed to be 5 percent in June, 1973 and 7 percent in September, 1973. Later it was frequently raised. It was fixed at 8.5 percent in August 1983, 10 percent in October, 1987 and 15 percent in April, 1991. But it was greatly reduced in the onset of 21st Century.

The Cash Reserve Ratio was fixed at 4.5 percent on 31st March, 2004 which was again made 4.75 percent on 18th September, 2004. It was slightly changed to be 5 percent on 2nd October, 2004. Again on 23rd December, 2006 it was re-changed to be 5.25 percent. According to the declaration made on 8th July, 2016 it has been fixed at 4 percent.

(ii) Nature of Investment:

The amount of Cash Reserve also depends to the maximum part on their investment in good securities, bill of exchange and other liquid sources; they need to keep less amount of Cash Reserve. On the contrary, if banks invest their money in non-liquid assets, there is a need of keeping a bigger amount of Cash Reserve.

(iii) Banking Habit among People:

Banking habit develops among people according to the Cash Reserve of banks. They start making their monetary transactions by cheques. In this condition there is a need of keeping less Cash Reserve. Opposite to it, if people make all their transactions in cash, banks have to keep a bigger amount of Cash Reserve.

(iv) Facilities of Clearing House:

The more an area has the facility of Clearing House, the less is the need of keeping Cash Reserve by banks. The reason behind this condition is that they make the most of their transactions by cheques only. So, banks have to keep less amount of Cash Reserve. But if there is not much facility of Clearing houses, banks have to do most of their transactions in Cash and hence they need to keep a higher amount of Cash Reserve.

(v) Size of Deposits:

What amount of Cash Reserve should be kept by banks is largely determined by the number of their customers and the size of deposits. If the number of customers is less and the size of deposit is big, there would be the need of keeping a lesser amount of Cash Reserve. On the contrary, if the number of customers is more and the size of deposits is small, the banks would need to keep a higher Cash Reserve.

(vi) Nature of Accounts:

Customers of banks deposit their money with banks through various kinds of accounts. If the banks have more and more current accounts they would need to keep a higher Cash Reserve. The reason is that the holders of current accounts demand cash frequently. But if banks have more number of Fixed Deposit Accounts and Recurring Deposit Accounts, banks can maintain themselves with lesser Cash Reserve.

(vii) Business Conditions:

Booms and depressions are common in the economy. When there is a boom, there is abundance of cash in the trading world. In such a condition people deposit/invest their money instead of withdrawing money from banks. But in the times of depressions, there is an economic crisis.

In such conditions, people tend to withdraw their deposit from banks. So, the demand of cash increases. Thus when there is a tendency of rise in trade and economy, banks need to keep less amounts as Cash Reserve and when there is a tendency of fall, they have to keep a higher Cash Reserve.

(viii) Cash Reserve Policy of other Banks:

The Cash Reserve Policy of one bank influences the Cash Reserve Policy of other banks also. While deciding its Cash Reserve Policy a bank observes the Cash Reserve Policy of its supportive as well as competitive banks.

(2) Dead Stock:

To run their business banks have to invest a part of their money in such assets which don’t earn them any direct income. For example, we can take investments in construction of office buildings, decoration of buildings, furniture’s, lockers, fans, almiras, generators etc. There is no direct income from these investments, so these are called dead stock. Such investments are needed for security of investment and running of banking enterprise.

(B) Profitable Investment:

Due to being profit earning enterprises, banks invest most of their money in profit-earning areas.

The profitable investments of banks are:

(1) Money at Call and Short Notice:

The nature of this loan given by the bank is short-term. Generally its period is from 1 to 15 days. Banks can get such loans repaid at short notice or without any prior notice. Banks earn some interest on such loans.

For being short-term loans, these have the features of liquidity. After the Cash Reserve it is the second most liquid fund of banks such loans are in maximum use in bill market but there is scarcity of organised bill market in India, so its use in India is giving loans by one bank to other.

(2) Discounting of Bills:

Banks invest their money by discounting of bills too. This is also a short-term investment of banks. This is generally for a period of three months. If the holders of such bills need money before the maturity, they get it by discounting of bills by commercial banks. The discounts that banks get on such bills are the income of banks.

On the maturity of bills the banks get the total amount of the bills from the drawee of the bills. If the commercial banks need cash money before the maturity of bills, they can get it by their rediscounting by Reserve Bank of India. These way commercial banks meet the need of Cash money.

(3) Investment in Securities:

Every commercial bank of the country invests a part of its money in the securities of the Central and State government. Such investments help the governments on one hand and on the other hand investment is safe. Similarly banks invest money in the shares and bonds of Blue chip companies as well. Investments in the securities of such companies are suitable with the view of safety and liquidity.

(4) Loans and Advances:

Loans and advances comprise the important areas of the investment of their money by commercial banks. Banks grant loans and advances to persons, firms, industries etc. on the guarantee of various kinds of collaterals. There is a lack of liquidity in such investments.

So, banks get a higher interest on these. Banks should work very cautiously in such investments from the view point of safety. Banks in India invest the maximum part of their resources in this field. So banks get maximum income from this area. Loans and advances are granted by banks in different ways.

Some examples are:

(I) General Loans and advances

(II) Cash Credit and

(III) Overdrafts.

In this way it is clear that banks should not invest just in one field. Instead, they should invest in various areas to get the benefit of liquidity, safety, profitability, marketability etc.

Essay # 5. Utility and Significance of Commercial Banks:

Bankers are the custodians and distributors of the liquid capital, which is the life blood of our commercial and industrial activities; and upon the prudence of their administration depends on the economic well-being of the nation.

More concretely we may summarise the uses of banks as follows:

1. The banks encourage the habit of saving among the people and enable small savings which otherwise would have been scattered ineffectively, to be accumulated into large funds and thus made available for investments of various kinds. In this way they promote economic development through capital formation.

2. They make money more mobile as they bring lenders and borrowers together, and by helping funds to move from place to place and from person to person in a convenient and inexpensive manner, through the use of cheques, bill and drafts. In this way, they help trade and industry.

3. By encouraging savings and investment, the banks increase the productivity of the resources of the country and thus contribute to general property and welfare by promoting economic development.

4. The bank’s agency functions are very useful to the customers of the bank. They undertake to make petty payments of various kinds on behalf of their customers and also make several types of collections on their behalf.

5. The banks create purchasing power in the form of bank notes (e.g., reserve bank currency notes), cheques, bills and drafts and thus economise the use of metallic money which is very expensive.

6. Thus, the banks are useful not only to the community in general but also to the individual customers.