Are you looking for an essay on ‘Co-Operative Banks’? Find paragraphs, long and short essays on ‘Co-Operative Banks’ especially written for school and college students.

Essay # 1. Introduction to Co-Operative Banks:

The main principle of co-operation is: “One for all, all for one”. An organisation framed on the principle of co-operation is called a co-operative. A co-operative is a voluntary organisation of people who come together with the objective of mutual co-operation.

The nature of this organisation is socioeconomic. The world’s famous philosopher Plato has said, “One’s own betterment is included in the betterment of others.” Similarly Stligman has said, “Leaving all kinds of competitions and removing all mediators in the distribution and production is co-operation.”

In this way the members of co-operative bank help one another by consolidating savings and investments as basis. Mostly its members are from weak and middle economic classes. A bank formed by the contribution (shares) of these members is called a co-operative bank.

The concept co-operative bank was born in Germany. Its beginning in India took place in 1904 through Co-operative Credit Committee Act. A need to take interest in it was felt due to its popularity. Consequently, a broad act was passed in 1912. In this act, it was arranged that besides credit, there should be other kinds of committees.

In India, though Co-operative banks also perform the basic functions of banking, they are different from commercial banks.

Essay # 2. Structure of Co-Operative Banks in India:

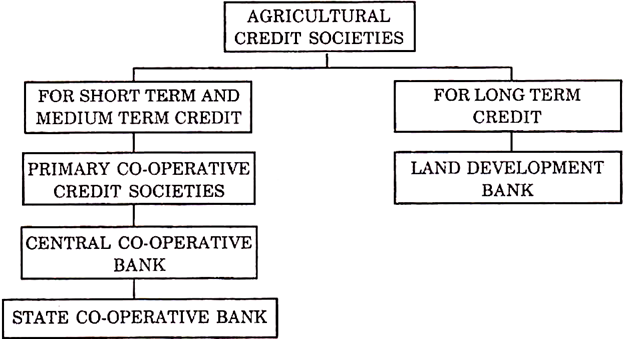

The Co-operative movement was started in India with the objective of rescuing the farmers from the exploitation of moneylenders and providing them sufficient capital at the minimum interest rate. The credit committees have been classified as follows for the formation of co-operative banks.

(A) Short Term and Medium Term Credit Co-Operative Societies:

There are three categories of institution granting loans for short and medium term.

These are:

Primary Co-operative Credit Societies at village level, Central or District Co-operative Bank at the district level and state co-Operative Bank at the state level.

1. Primary Co-Operative Credit Societies:

A primary Co-operative credit society is formed by at least ten persons from a village or a specific region. It is founded primarily for fulfilling the short term needs of the agricultural sector. Loans for the period of 1 to 3 years are granted by it.

Objectives:

The main objective of Primary Co-operative Credit societies are as follows:

(i) Encouraging the saving tendency.

(ii) Providing short and medium term loans.

(iii) Developing the sense of co-operation among its members.

(iv) Eliminating the importance of money lenders.

(v) Reducing the regional inequalities.

Characteristics or Features:

The main characteristics of a Primary Cooperative Credit society can be clarified under the following titles:

(i) Voluntary Organisation:

It is a voluntary organisation of people. Anybody can become its member. If somebody likes to quit it, he can do it by giving proper information. In this condition, he has the full right of getting his invested capital back. But no member can transfer his share to others.

(ii) Democratic Management:

Its management is based on democratic concepts. It is the principle of one person, one vote; no matter what is the number of shares held by a person. Its chairperson and secretary are elected by the majority of members. The secretary is a salaried person while the chairperson is non-salaried.

(iii) Division of Profit:

The profit of a co-operative society is divided as bonus among its members. The basis of distribution of bonus is the contribution by members in the organisation through shares.

(iv) Sources of Capital:

Its sources of capital include share capital, membership fee and reserve fund. Besides this deposits from its members and other people and deposits from central co-operative banks are also its assets. They also receive grants.

(v) Loans:

Members are given short-term loans by the primary co-operative credit society on personal security or on the security of crops or land. In some special circumstances, medium-term loans are also given.

Progress:

The progress of primary co-operative societies is not satisfactory. Its number in 1970-71 was 1 lakh 61 thousand which got reduced to only 1 lakh on 31st March, 2001. But the loans granted by these societies have increased. On 31st March, 2001, its deposits and advances were Rs. 13,481 crores and 34,522 crores respectively.

Drawbacks:

It is true that primary co-operative credit societies have expanded themselves on the national level and they have made proper progress in advancing loans. Still there are some serious drawbacks.

These are as follows:

(i) The committees have not been much successful in collecting deposits.

(ii) The recovery of granted loans is not satisfactory.

(iii) The farmers have to go through long tiring processes to get loans from these committees.

(iv) These committees don’t have proper financial resources.

(v) They are deficient in trained employees. Many committees don’t have even a full-time secretary.

(vi) The share capital of most of primary co-operative credit committees is very little.

Measures to Remove Drawbacks:

The Agricultural Loan Observation Committee of RBI has given many recommendations to remove the drawbacks of primary co-operative credit committees so that they are able to perform their task effectively.

Some important recommendations are as follows:

(i) There should be consideration of bringing a Unique Deposit Scheme to increase the amount of deposits.

(ii) There should be improvement in the process of granting loans to farmers.

(iii) There should be some scheme of reward so that the recovery of loans may be made on time.

(iv) To improve the quality of management there should be the appointment of a full time trained secretary.

(v) Proper steps should be taken to increase the share capital.

2. Central Co-Operative Bank:

A Central Co-operative Bank is in every district, so it is called District Co-operative Bank. Its working area is limited to a specific district.

Central Co-Operative Banks can be classified into two parts:

(i) Co-operative Banking Organisation, and

(ii) Mixed Central Co-operative Bank.

Only co-operative committees can have the membership of Co-operative Banking Organisation while both Co-operative Committees and individuals can be members of Mixed Co-operative Banks. In all Indian states there are mostly Central Co-operative Banks having mixed membership.

Functions:

The main functions of Central Co-operative Banks are as follows:

(i) Granting loans to primary Co-operative Committees without collaterals.

(ii) Accepting deposits from people and giving a handsome interest on it.

(iii) Helping in the solutions of the problems of primary Co-operative credit committees.

(iv) Observing the functions of Primary Co-operative Credit Committees and supervising them.

(v) Helping in the development of Co-operative movement.

Progress:

Due to lacking of proper advertisement and promotional activities, these banks could not develop at a greater speed. The number of these banks was 509 in 1950-51 which got reduced to 364 in 1997-98. But at the end of March, 2001 there were 367 Central Co-operative banks in operation. Out of these 245 were in profit and the remaining 122 were running in loss.

Management:

The managerial arrangement of Central Co-operative Banks is done by the Board of Directors and these Directors are elected on the basis of ‘one member, one vote’. Boards of Directors appoint managers, accountants and other trained staffs for the successful operation of banking management.

Sources of Capital:

The main sources of the working capital of Central Co-Operative Banks are as follows:

(i) Share Capital, which these banks obtain by selling shares to their members.

(ii) Deposits from members and non-members.

(iii) Loans from state Co-operative banks and commercial banks.

(iv) Reserve fund.

Loans:

Central Co-operative banks provide short and medium term loans to meet the financial needs of primary co-operative committees.

Drawbacks:

Following are its drawbacks:

(i) The rate of interest on loans granted by Central Co-operative banks is generally high.

(ii) There is lack of a proper co-ordination between the Central Co-operative Banks and Primary Co-operative Credit Committees.

(iii) There is unnecessary political interference in the process of granting loans by these banks.

(iv) The process of granting loan is lengthy.

(v) Central Co-operative banks hesitate in giving medium term loans due to lack of proper provision.

(vi) They don’t have the right of granting loans to individuals and non- cooperative institutions. So, they are not in the condition of earning much money in the form of interest.

Suggestions:

Following suggestions can be given to remove the shortcomings of Central Co-Operative Banks:

(i) Central Co-operative Banks should attempt to collect more deposits from individuals and non-cooperative institutions.

(ii) They should expand branches in their respective districts.

(iii) They should provide more banking facilities to people.

(iv) They should establish good relationship with primary co-operative committees.

The attitude to render proper service should be developed in bank employees.

3. State Co-Operative Banks:

State Co-operative Banks are the Apex of Central Co-operative Banks. These are the Apex Banks in the Co-operative structure of India. There is only one State Co-operative bank in every district which supervises and regulates the Central Bank. 30 state Co-operative Banks were in operation in the country by the end of March 2001. 23 out these were in profit and the remaining was in loss.

Management:

A State Co-operative Bank is managed by a General Committee but it is controlled by Board of Directors. The number of Directors in the Board of Directors is between 10 to 30. The General Committee comprises of individuals and representatives of primary Co-operative Credit Committees and Central Co-operative Banks. The Registrar is the officer of the managing committee of this bank. He appoints some managers.

Functions:

The main functions of Co-Operative Banks are as follows:

(i) The State Co-operative Bank performs the task of establishing Coordination between Primary Co-operative Credit Committees and Central Cooperative banks.

(ii) The activities of Central Co-operative banks are regulated through it.

(iii) They attempt to generate the feelings of Co-operation.

(iv) They work as a link between Co-operative institutions and NABARD.

(v) They also function as commercial banks.

Sources of Capital:

The working capitals of these banks include money received from selling shares, deposits from people and loans from NABARD and other banks.

Loans:

State Co-operative Banks grant loans to Central Co-operative Banks to meet the financial requirements of Primary Co-operative Credit Committees. Their loans are on the basis of promissory note. It does not grant direct loans to primary Co-operative Credit Committees excepting the cases where there is no Central Co-operative Bank.

Drawbacks:

The functioning of state Co-Operative Banks has the following shortcomings:

(i) Most of state Co-operative Banks has started functioning like Commercial banks. So, the objectives of co-operation are not achieved.

(ii) There is no scheme with state Co-operation which is not achieved.

(iii) Experience has not been made basis of its membership.

(iv) They often have shortage of fund.

(v) In the process of granting loans they are mostly influenced by political ideologies instead of the real needs of the beneficiaries.

(vi) The management by Board of Directors is not proper.

(vii) There is non-availability of trained employees.

Suggestions:

For the improvement in the working system of state Co-Operative Banks, following suggestions may be given:

(i) The membership of State Co-operative Banks should be limited to Primary Agricultural Co-operative Credit Committees and Central Co-operative banks only.

(ii) They should raise their funds by increasing share capital by selling shares.

(iii) Instead of working as commercial banks they should work on the basis of co-operation to provide maximum benefits to the farmers.

(iv) With the objective of improving work efficiency of employees, the selection process should be similar to commercial banks.

(v) There should be positive initiative in the direction of obtaining maximum deposits from people.

B. Long Term Credit: Land Development Bank:

Land Development Bank has been established to meet the long and medium term financial needs of farmers. Its old name is Land Mortgage Bank. Its structure in different parts of the country is different. Its structure in some states it works in the form of a federal arrangement. In the situation of a unitary structure is Land Development Bank works through its branches.

Land Development Bank in India started as Land Mortgage Bank in Chennai. This state founded Central land Mortgage Bank in 1929 by merging the primary banks of the state. After this such banks were established in other states too.

Functions:

The main function of Land Development Bank is to provide medium and long term loans to farmers. This bank provides loans for a period of 5 to 20 years to purchase land, agricultural implements and repay old loans. Land Development Bank keeps the permanent property of farmers as mortgage and provides loans equal to the 50 per cent of the value of the mortgaged assets.

Management:

The management of the Land Development Bank is done by a Board of Directors. This Board of Directors comprises of 15 to 20 members elected properly by Primary Land Development Bank, members nominated by the state government and the registrars of Co-operative Committees. The registration of Land Development Bank is under Co-operative Committee Act, 1912.

Sources of Capital:

The sources of working Capital of Land Development Bank include-money obtained through share capital, money obtained by issuing debentures, public deposits, reserve funds and loans.

Out of these, debentures are the most important source. Reserve Bank of India, Commercial banks, Cooperative banks, Life Insurance Corporation of India and the Central and State governments invest in the debentures of these banks. These debentures are issued for a long term.

Drawbacks:

The functioning of Land Development Bank is satisfactory as compared to other banks. But, there are still some drawbacks which need to be paid due attention.

Some important drawbacks are as follows:

(i) The limitation of granting loans equivalent to 50 per cent value of the mortgaged property is not right.

(ii) The system of loan recovery is impractical.

(iii) Common people don’t show interest in purchasing their debentures.

(iv) A lot of delay is made in providing loans by the Land Development Bank.

(v) They grant most of the loans not for productive work, but for repaying old loans.

(vi) These banks provide more benefits to rich farmers.

(vii) Their management is not proper.

(viii) There is no clear policy regarding the recruitment, promotion and training of employees.

Suggestions:

Following suggestions can be given to improve the working of Land Development bank:

(i) They should adopt flexible but effective policy for the recovery of loans.

(ii) Political interference should be avoided while granting loans.

(iii) The system of selecting employees, their recruitment, promotion and training should be like those of commercial banks.

(iv) There should not be unnecessary delay in granting loans.

(v) Loans upto 75 per cent of the value of the mortgaged assets should be granted.

(vi) There should be arrangement of providing information to the people about the speciality of the bank.

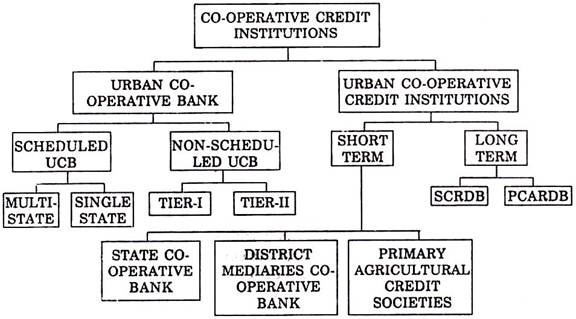

Essay # 3. Revised Structure of Co-Operative Credit Institutions:

Co-operative Committees have been contributing in the financial system of India since ancient time. But uptil now it is a weak link of the Indian banking system. To improve its condition and give it proper directions there have been attempts from time to time.

The structure of Co-Operative Credit Organisations at present is as follows:

The above chart clarifies that the nature of Co-operative Credit Institutions in India is non-similar. Co-operative banks in urban areas are divided into scheduled and non-scheduled banks. Both kinds of urban Co-operative banks sire of two categories namely multi-state and single state while non-scheduled urban Cooperative banks have been classified into TIER-I and TIER-II.

Tier-I includes those banks out of urban Co-operative banks which have deposits of less than 100 crores and which have branches in a single district. If they have branches in more than one district, then these branches should be in close by districts and deposits and advances of the branches in one district should be at least 95 percent of the total deposits and advances. With it those banks fulfilling the above conditions also come in Tier-I category which had branches originally in one district but it got converted into multi-district nature due to the re-organisation of districts.

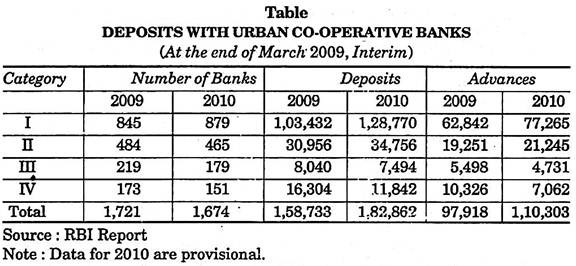

Urban Co-operative banks have been classified into four categories on the basis of their financial activities. Grade I and Grade II include those banks which have strong financial positions while Grade III and Grade IV include financially weak banks.

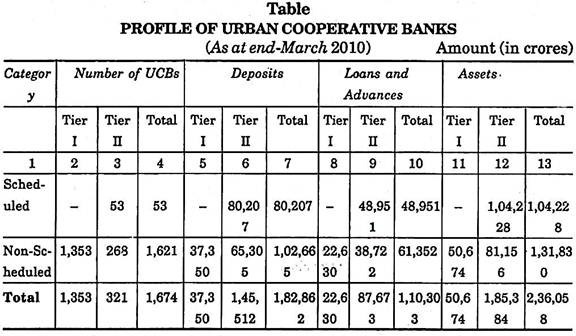

In the above table, 1,721 banks have been classified into four categories and their deposits and advances have also been shown. Out of these 1,721 banks 53 are scheduled and 1,668 are non-scheduled urban co-operative banks. Their deposits are Rs. 67,929 crores and Rs. 90,804 crores. Similarly their loans and advances are Rs. 42,234 crores and Rs. 55,684 crores respectively.