Are you looking for an essay on the ‘Regional Rural Banks’? Find paragraphs, long and short essays on the ‘Regional Rural Banks’ especially written for school and college students.

Essay on the Regional Rural Banks (RRB)

Essay Contents:

- Essay on the Organisational Structure of RRB

- Essay on the Capital of RRB

- Essay on the Progress of RRB

- Essay on the Objectives or Functions of Regional Rural Banks

- Essay on the Problems of Regional Rural Banks

- Essay on the Suggestion to Improve Working of RRBs

- Essay on the Steps taken for the Progress RRBs

- Essay on the Amalgamation of RRBs

Essay # 1. Organisational Structure of RRB:

There are 9 directors in the Board of Directors of a RRB. Out of these 6 are appointed by the Central government, 1 by state government and the remaining 2 by the sponsor bank. It is worth mentioning here that every RRB has a commercial bank as its sponsor. RRBs are included in the second schedule of the Reserve Bank of India Act, 1934. So, the Board of Directors has to be ruled by the government and the Reserve Bank of India. But on 12th July, 1982 the control of these banks was given to the newly founded National Bank for Agricultural and Rural Development-NABARD.

Srimati Indira Gandhi presented a 20-Point Programme in the interest of the nation on 1st July, 1975 after the declearance of emergency in the country. Besides other things the programme also included the idea of granting loans on easy terms to rural farmers and labourers to bring an improvement in their living condition.

To embody this announcement, the government of India decided to set up Regional Rural Banks on the national level and an ordinance in this regard was passed on 26th September, 1975. Consequently five Regional Rural Banks were set up on 2nd October, 1975 in the first phase. These were situated at Moradabad and Gorakhpur in Uttar Pradesh, Bhivani in Haryana, Jaipur in Rajasthan and Malda in West Bengal.

Essay # 2. Capital of RRB:

According to an ordinance passed on 26th December, 1975 the Authorised Capital of every RRB was Rs. 1 crore and its paid up capital was Rs. 25 lakhs. Its capital formation is distributed among the government of India, the concerned state government and the sponsor bank in the ratio 50:15:35.

Essay # 3. Progress of RRB:

Only 5 RRBs were set up in the first phase on 2nd October, 1975 but, it was aimed that 50 banks would be established by March, 1976. This target was raised to 60 in January, 1976.100 RRBs had been set up in 163 districts of the country by the end of March, 1981. Considering this success it was decided that one RRB would be set up in every district of the country in the coming time.

The number went upto 183 in April, 1985. The number further went upto 196 on 30th June, 1998. The number of branches of 196 RRBs in 518 districts in 2004 was 14,507. Out of these the maximum numbers of branches were in Uttar Pradesh followed by Bihar and Madhya Pradesh. 85 percent branches of RRBs were set up in rural areas. The RRBs have been declared as the scheduled banks.

The number of branches of Regional Rural Banks increased from 16,909 as on March, 2012 to 17,861 as on March, 2013 taking the network of RRBs to 635 districts. During the year 2013-14,438 new branches have been opened by RRBs up to December, 2013 taking the total number of RRB branches to 18,299 as on December, 2013. By March 2014, 57 RRBs operated with a network of 19,081 branches. Now all branches of RRBs are on CBS Platform.

RRBs have shown a good progress in advancing short-term agricultural loans to rural farmers. Kisan Credit Card scheme was launched by NABARD in August 1988. Under this scheme, the commercial banks, RRBs and Co-operative banks were instructed to provide loans to farmers for seasonal agricultural work at the proper time through single window system. RRBs have shown annual progress in following this instruction also.

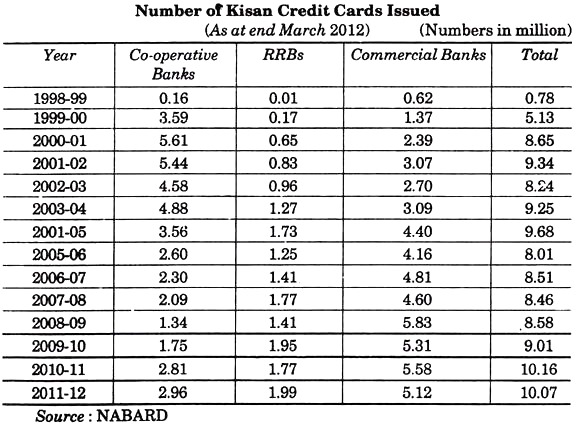

The following table shows number of Kisan cards issued by various agencies:

The above table shows clearly that RRBs have shown good progress in the distribution of Kisan Credit Cards every year except in 2008-09. But there is the need of showing greater interest in it.

So far as the question of Credit flow on the ground level is concerned, the credit of Rs. 12,404 crores was distributed by RRBs in the year 2004-05 which reached up to Rs. 26,724 in 2008-09.

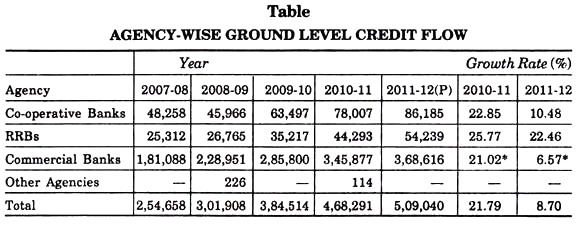

The role and place of RRBs in the credit flow through different agencies can be farther illustrated through the following table:

Note: P: Provisional, NA: Not Available, Growth Rate: Percentage change over Previous year, Source: NABARD* including other agency.

Thus RRBs have shown good progress in the credit flow from 2007-08. Thus, the bank management needs to maintain it.

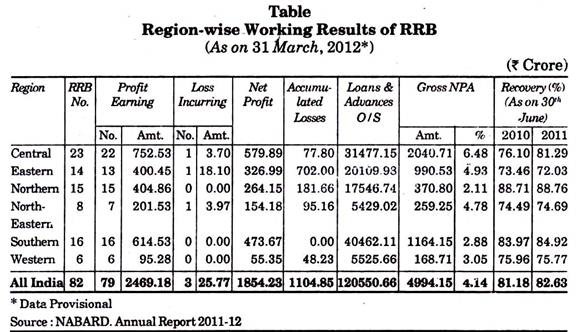

RRBs have shown profit in the specific fields and loss in the others. The region-wise profit and loss of these banks can be shown with the help of this table.

Essay # 4. Objectives or Functions of Regional Rural Banks:

The main objectives of RRBs are as follows:

(1) Opening Branches of banks in non-banking areas particularly in rural areas.

(2) Providing loans for the progress of agricultural sector to small and marginal farmers, agricultural laborers and small businessmen.

(3) Creating employment opportunities in rural areas.

(4) Developing saving tendency among the rural people, accepting deposits from them and using it for productive activities.

(5) Reducing the cost of making loan availability in rural areas.

(6) Protecting people from the exploitation by money lenders.

Essay # 5. Problems of Regional Rural Banks:

It is true that RRBs have played their role well in their short life period and they have made good contribution in the economic development of the country. But there are many problems before these banks. Dantwala Committee, Kelkar Committee and Khusro Committee have also recognised these problems.

The main problems of RRBs are as follows:

(1) Wrong Expansion of Branches:

The branch expansion of RRBs was done like a campaign. The business and profit have not increased in the ratio of expansion of these branches. The expenses of banks have increased due to this unbalanced expansion of branches.

(2) Defective Recruitment Policy:

An important objective of RRBs has been increasing rural employment, but due attention was not paid on regionally in the recruitment in these banks. According to the recruitment policies candidates from outside the region of a RRB were also eligible for recruitment. This raise the competition and regional people were deprived of recruitment.

(3) Lack of Staff:

There has not been recruitment of staffs in these banks for a long period of time. The posts are vacant due to retirement of staffs lying. As a result employees are under workload and it becomes difficult for them to dispose of the work on time. This increases disappointment amongst the customers.

(4) Weak Capital Base:

The Capital Base of RRBs is very weak. In this phase of development, every class of people wants to progress taking help from banks. In this way, the demands of loans have increased, but these banks don’t have the ability to grant loans.

(5) Difficulty in Receiving Deposits:

Most of the branches of these banks are in rural areas. The income and saving of rural people is less. Consequently, RRBs have less deposit with them. Besides, the big businesspersons need big loans which can’t be provided by these banks. So they keep their relationship with the commercial banks for both loans and deposits.

(6) Reduction in Profitability:

The profitability of RRBs have reduced due to increasing bank branches and reduced business. These banks primarily give loan to the people from extremely poor section society at low interest. Banks have to make much expense in getting these loans repaid. This badly affects their profits. Many RRBs are running in loss even at present.

(7) Difficulty in Recovery of Loans:

RRBs mainly give loans to people of weaker section of society and for the government sponsored programmes. The most of beneficiaries are less educated people who don’t give much importance to its return. Consequently, banks face great difficulty in the recovery of loans. Banks have to organise camps from time to time for the repayment of loans. All these increase the cost of operation.

(8) High Cost of Loans:

The salaries of employees of commercial bank and RRBs have become equal. Banks have to adjust these expenses somewhere. Consequently, cost of loans has gone high.

Essay # 6. Suggestion to Improve Working of RRBs:

Many suggestions have been given from time to time for the improvement in working of the RRBs.

Some of the important suggestions are as follows:

(1) Khusro Committee had suggested that RRBs should be merged with commercial banks.

(2) Narsimham Committee had recommended that to enable these banks to function smoothly they should be given the permission for doing all kinds of jobs, however their main work should be providing facilities to the targeted groups.

(3) The sponsor banks should provide refinance to RRBs at comparatively low interest rates.

(4) To increase their profits, the RRBs should grant loans to non-targeted groups also.

(5) The State Government should instruct government and semi-government institutions to keep their assets with RRBs.

(6) The sponsor banks should invest a part of the money of RRBs in long term government bonds.

Essay # 7. Steps taken for the Progress RRBs:

In the light of the above suggestions many steps were taken for the progress of RRBs.

Some of these are as follows:

(1) From 22nd March, 1997 onwards, these banks were allowed to grant loans to the people even outside of the targeted groups.

(2) The RBI has granted these banks the permission for marketing of the units of their Mutual Funds with the objective of expanding their business.

(3) The RBI has guideline these banks that in selling the units of their Mutual Funds the RRBs should follow instructions related to ‘Know your Customer’ and Avoid money Laundering’.

(4) Considering the unsatisfactory condition of the loan recovery of RRBs, they are being monitored quarterly by NABARD.

(5) Separate provisions are being made for these banks in the Union Budget by the Central government.

Despite these steps, there are many shortcomings in the RRBs which need to be mended.

Essay # 8. Amalgamation of RRBs:

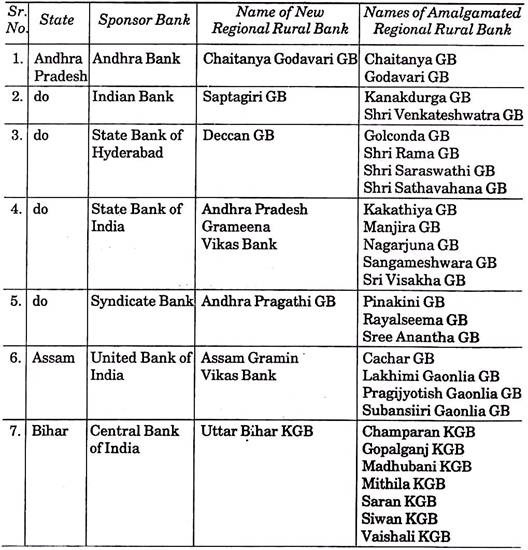

With the objective of strengthening these banks, the government of India has started the process of stepwise amalgamation of these banks. 42 new banks were formed by merging 134 out of 196 banks by 31st August, 2006. 57 new banks were set up by integrating 171 banks by March, 2012.

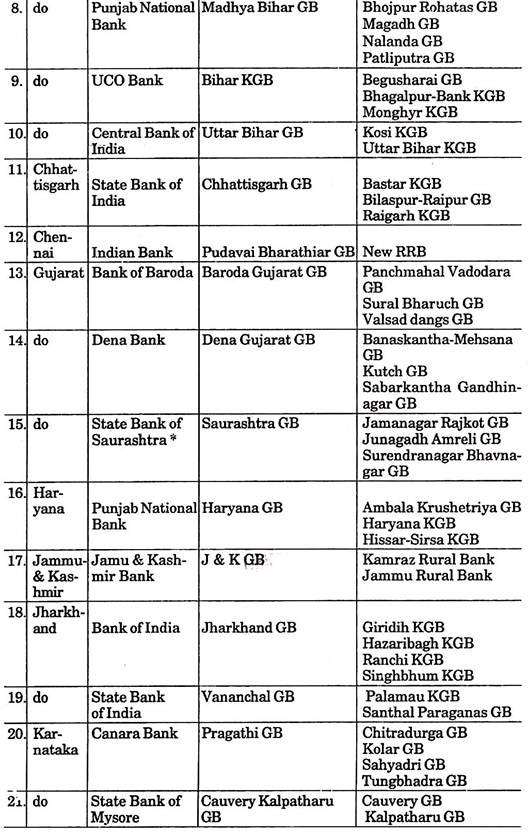

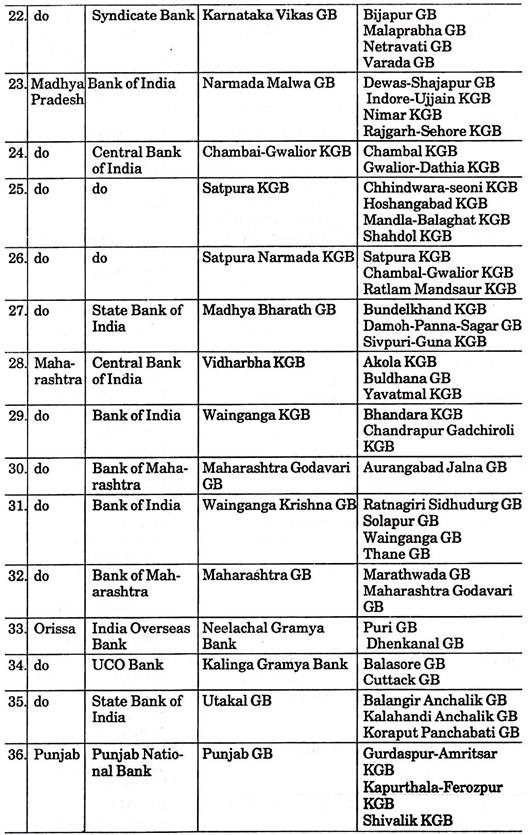

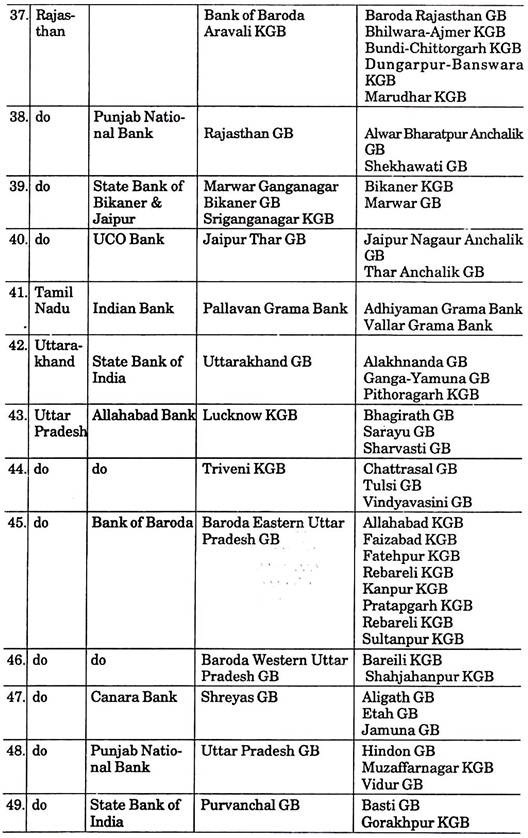

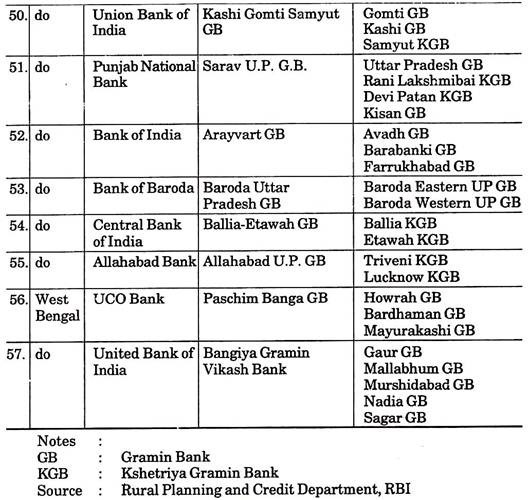

The Amalgamated Banks and their sponsor banks are shown in the following list:

List of Amalgamated Regional Rural Banks as on March 31, 2012: