Here is an essay on the ‘Co-Operative Movement in India’ for class 8, 9, 10, 11 and 12. Find paragraphs, long and short essays on the ‘Co-Operative Movement in India’ especially written for school and college students.

Essay on the Co-Operative Movement in India

Essay # 1. Introduction to Co-Operative in India:

Cooperation is an instrument of economic development of the disadvantaged particularly of the rural areas. The non-exploitative character of cooperatives voluntary nature of their membership, the principle of one man vote, decentralised decision-making and self-imposed curbs on profit eminently qualified them as an instrument of development combining the advantages of private ownership with public good. It is process of mutual help on the democratic principle. Cooperation has been known and practised in this country since time immemorial. So cooperation is not, in any way, new to India.

In ancient India it took four principal forms- kula, grama, shreni arid Jati. Historically speaking, Kula was the first form of co-operative activity that emerged in Indian society. It was both a political and socio-economic organisation in which kinsmen, friends and relatives worked co-operatively to promote their economic, social and political interests. With the expansion and stabilization of society, the aspects of economic and social co-operations gradually narrowed to the limits of joint family which has survived to the present day.

Under this system the land is owned and cultivated in common, while all adult members have to share the duties of the family engaged in the occupations other than agriculture. Members of the family live in a common house and the household expenses are met from the income of the joint property. This institutions is based on a feeling of brotherhood and mutual help.

“Co-operation at the level of grama emerged after Kula became a stabilised unit. The Gram sabha was a co-operative organisation which undertook works for the economic and social progress of the village and looked after the improvement and maintenance of village lands, pastures, roads, highways, paths, common gardens and grasslands. Artisans and cultivators often combined for purposes of co-operative working in their respective fields. The members jointly undertook buying or selling or obtaining equipment, tools, seeds and other items of production.”

“The shreni is a later development which emerged in the post-vedic era. It was a co-operative and economic organization of artisans, industrial and handicraft workers, merchants, traders, bankers, agriculturists, house- builders, workers, in construction job and building contractors.”

“Co-operation at the level of jati was mostly for social purposes as education, charity, and relief work, but when a particular occupation, craft or trade became associated with a particular caste, the system evolved a pattern in which co-operation became an important aspect of the economic activities of the community.”

But now it has been considerably shattered by a weakening of the caste system, introduction of land reforms and programmes of economic development, rise of individualistic system of living and working, the spread of modern democratic ideas and above all by rapid enlargement of economic considerations in the life of the people.

An old system of raising money in South India is known as chit funds and nidhis, the bunda system in Vidarbha, the phad system in Kolhapur and gonchi system in Andhra are other systems of organised effort at mutual-help and co-operation.

Under chit funds, a number of people in villages, having mutual knowledge of one another, join together and subscribe for a specific period, small sums of money at regular intervals under the guidance of a promoter. When collections are made, lots are drawn and the winning lot gets the total amount collected. The winner subscribes as usual like other members, for next month but drops out from the draw of the lots.

A variant of this system is that, in order to equalise the benefit, the winner gets the amount less a deduction for interest and the amount so deducted is then divided among the other contributors or subscribers who have not won the pool. This is known as the ‘discount system’.

Under the phad system, a group of villagers come together for securing irrigation facilities and also for mutual assistance in agricultural operations. The phad leader is either the best cultivator of the locality or a person who is well known to the local commission agent. This practice is known to be over a thousand years old and is still continuing in Kolhapur district.

Under the gonchi system, a gonchi is a contiguous area which is divided into plots convenient for various agricultural operations. The joint cultivation is supervised by a person known as “gonchi kadu” of the village. The total produce is pooled and divided among the members, according to the labour put in and bullock power used.

Essay # 2. Growth of the Co-Operative Movement:

The co-operative movement in India has been a growth of over 85 years and is largely dependent for its origin as well as development on the Government. Even before 1904 (when the movement was first officially set up), the Government was not unaware of the difficulties which the peasants and farmers were facing in borrowing funds and was anxious to ease the situation.

As early as 1882 Sir William Wedderburn and Justice Ranade prepared a scheme for establishing the Agricultural Banks to provide loans to farmers. Their scheme was not accepted in the form in which it was presented- but its essential features were embodied into the Land Improvement and Agricultural Loans Act (XIX of 1883 and XII of 1884 respectively), under which the agriculturists could borrow from the Government for productive purposes at the rate of 6 per cent, per annum.

Under the Land Improvement Loans Act of 1883, long-term taccavi loans on the security of mortgage of land were available for the following purposes:

(a) Construction of wells, tanks and other works of storage, supply or distribution of water for purposes of agriculture, or for the use of men and cattle employed in agriculture;

(b) Preparation of land for agriculture;

(c) Drainage, reclamation from rivers or other waters or protection from floods or from soil erosion or other damages by water or land used for agricultural purpose; or waste land which is culturable;

(d) Reclamation, clearance, enclosure or permanent improvement of land for agricultural purposes;

(e) Renewal or reconstruction of any of the foregoing works or alteration thereon or addition thereto; and

(f) Such other works which the Government may so declare.

In the meantime, H. Dupernex had submitted another scheme under the title of “People’s Bank for Northern India”. The Committee appointed by the Government of India to consider these schemes came to the conclusion that the best way of providing loans to farmers was to start co-operative societies on the lines of Reiffeisen societies.

The Famine Commission of 1901 strongly recommended that in order to prevent further famines, it was essential that credit should be made available to the farmers to improve agriculture and that Mutual Credit Association should be started. This point was referred to a Committee in Shimla, which in 1901 drafted a Bill for the establishment of Co-operative Societies under the Presidentship of Sir Edward Machagan Law. After much discussion this new Bill took the form of Co-operative Societies Act of 1904.

As the Maclagan Committee pointed out, “the cardinal object of the Act was, by the simplicity and elasticity of its provisions, to permit a genuine Indian movement to spring up based on those general principles which must necessarily underlie any organisation claiming to be called co-operative. Experiments were freely allowed and more particularly for the furtherance of agricultural rather than industrial credit…. the intention was to make matters comparatively easy for the illiterate and ignorant agriculturist.”

The passage of this Act formally inaugurated the co-operative movement in India. This measure was hailed by Henry Wolff as “a turning point in economic and social history” and by Daniel Hamilton as “the way from poverty to plenty.”

Essay # 3. History of the Co-Operative Movement

:

The history of the co-operative movement may be studied under the following heads:

1. Early Stage of Development (1904-1912).

2. Period of Hurried Expansion (1912-18).

3. Period of Unplanned Expansion (1918-1929).

4. Period of Consolidation and Reorganisation (1929-1939).

5. Period of Recovery (1939-1948).

6. Period of Planned Development (1951-to-date).

1. Early Stage of Development (1904-1912):

The idea of cooperative enterprise took concrete shape for the first time in India in 1904. Cooperation was considered as a measure to solve the problem of rural indebtedness. Accordingly, the Cooperative Credit Societies Act was passed on 25th March 1904. The Act provided the conditions for formation of Credit Societies only.

The essential features of the Act of 1904 are given below:

(1) A society could be formed by any ten persons living in the same village or town or belonging to the same class or tribe for the encouragement of thrift and self-help among the members and cooperation among agricultural, artisans and persons of limited means.

(2) The societies were given a legal personality and were authorised to raise funds and carry on their business in a corporate capacity.

(3) The organisation and control of co-operative credit societies in each province were put under the charge of the Registrar of cooperative credit societies.

(4) The accounts of every society were to be audited by the Registrar or by a member of his staff free of charge.

(5) Cooperative societies were classed as rural and urban. Rural Societies were to have four-fifths of their members agriculturists while Urban Societies were to have four-fifths of non-agriculturists.

(6) The liability of the members of a rural society was to be unlimited except with special sanction by the local Government. Liability of the urban society members might be either limited or unlimited.

(7) No dividends were to be paid from the profits of a rural society but the profits were to be carried to the reserve fund. In urban societies one-fourth of the profits was to be credited to the Reserve Fund, although when this fund had grown beyond certain limits fixed under the bye-laws, a bonus might be distributed to the members.

(8) The interest of any one member in the society’s share capital was strictly restricted. No member could hold shares for more than Rs. 1000/-

(9) Societies formed under the Act were exempt from fees payable under the stamp registration and income-tax. In the words of Sir Denziel Ibbetson the chief object of these societies was “to give encouragement to the individual thrift, and of mutual co-operation among the members, with a view to utilisation of their combined credit, by the aid of their intimate knowledge of one another’s needs and capacities and of the pressure of local public opinion.” In other words, the object was to encourage thrift, self-help and co-operation among agriculturists, artisans and persons of limited means.

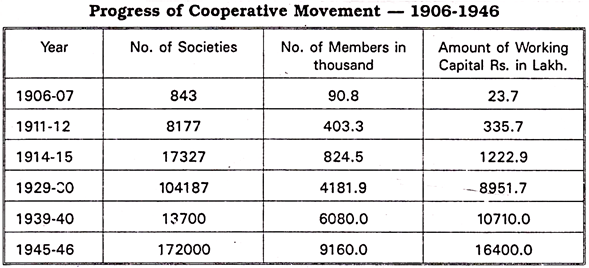

The Maclagan Committee said, “The movement did not take long to outgrow the dreams of its founders.” It made significant progress during the initial years. The number of societies and members increased from 843 and 90.844 in 1906-7 to 8177 and 403,318 respectively in 1911-12. During this period, the amount of working capital increased from Rs. 23-72 lakhs to Rs. 335-74 lakhs.

2. Period of Hurried Expansion (1912-1918):

The Act of 1904 provided for the registration of the primary credit societies only.

It was found insufficient to meet the growing needs of the market because:

(i) It made no provision for purposes other than credit, i.e., for the establishment of central agencies such as Central Banks or Unions, necessary for the proper financing of primary credit societies.

(ii) The classification of societies into rural and urban was found to be extremely unscientific and inconvenient.

(iii) The total prohibition of distribution of profits (as in Madras and the Punjab) in rural societies with unlimited liability was found to cause some hardship to rural members.

The Government realised these deficiencies and passed a comprehensive Co-operative Societies Act in 1912.

The distinctive features of the Act were:

(1) Any society may be registered “which has for its objects the promotion of economic interest of its members in accordance with co-operative principles, or a society established with the “object of facilitating the operation of such society.”

(2) Unless otherwise directed by the local Government- (a) the liability of the co-operative societies shall be limited, (b) the liability of the rural societies shall be unlimited.

(3) The requirements of an annual credit is retained as are numerous other provisions of the Act of 1904.

(4) Any registered society may with the Registrar’s sanction, after carrying 1/4 of the annual net profits to a reserve fund, the society can contribute upto 10 per cent of the remaining net profits to a wide range charitable purposes.

(5) A society has a charge upon the shares, deposits, etc., of a member with the society, in respect of any debt due from such a member.

(6) The societies are granted exemption from compulsory registration and the State Government may grant exemption from the payment of income-tax, stamp duties and registration fees.

(7) “Co-operation” may not be used as part of the title of any business concern not registered under the Act, unless it was already doing business under this name before the Act came into effect.

(8) Shares or interest in co-operative societies are exempt from attachment.

(9) The society has a prior claim to enforce the recovery of dues against a member like milk, manure and yarn.

(10) Local Governments were given considerable discretion in connection with the making of rules for the working of societies under the Act, including conditions of membership, methods of operation, procedure at general meetings and provisions for arbitration between members and the committee or officers of the society, such rules to have the same force in the respective provinces as the Act itself.

The defects of the Act of 1904 were remedied by this new Act, which gave a great stimulus to the co-operative movement. It legalised many co-operative societies which had hitherto no legal recognition. Societies were now classified as limited and unlimited.

After 1912, there was a rapid growth not only in the number of co-operative credit societies but also in non-agricultural credit societies and in their membership. However, the development was not uniform in all provinces. The number of central institutions was also growing rapidly. In 1914, when the Government of India appointed a Committee under Sir Edward Maclagan to “examine whether the movement especially in its higher stages and financial aspects was progressing on sound lines and to suggest measures for improvement which seemed to be required.”

The Report appeared in 1915. The Committee sounded a note of warning on the hurried expansion of the movement and made many recommendations that utmost care was to be exercised in the formation of a cooperative society with a view to make it truly co-operative.

These were the following:

(1) Knowledge of co-operative principles and proper selection of members.

(2) Honesty is the chief basis of credit.

(3) Dealings to take place with members only.

(4) Loans were not to be granted for speculative purposes.

(5) Exercise of careful scrutiny before advancing loans and proper vigilance afterwards.

(6) Ultimate authority to be in the hands of members and not in those of office-bearers.

(7) Encouragement of thrift and the constitution of an adequate reserve fund.

(8) Only one vote for one member and maximum publicity within the society.

(9) Capital to be raised as far as possible from savings among the members and neighbours, and

(10) Punctual repayment of loans.

The Committee found a number of glaring defects in the working of the movement, such as:

(i) Illiteracy and ignorance of the members about management and supervision of the societies;

(ii) Negligence of duty and mismanagement of funds and acts of fraud (like taking bulk of loans by means of benami loans) on the part of the management;

(iii) Non-punctually in repayment of loans and grant of loans to near relations and friends of the member of committee or management;

(iv) Misuse of loans by the members;

(v) Deserving and poors were excluded from the societies;

(vi) Societies were not properly audited and inspected; and

(vii) Much delay occurred in granting loans to the needy cultivators which drove them to the moneylenders.

(viii) Banks were regarded as the “Sarkars Bank” from which loans were taken with the intention of keeping the amount.

The Committee, therefore, made important recommendations, such as:

(i) The area of operation of the primary society should be restricted to a village;

(ii) The size of the society should not be large;

(iii) The society should have unlimited liability;

(iv) Emphasis should be laid on the deposits;

(v) Repayment of loans should be strictly enforced according to the instalments fixed;

(vi) Non-credit societies should be encouraged, though central banks may finance them;

(vii) Societies should be properly audited and regularly supervised for “without them a good society may soon degenerate and a bad society may soon come to reign.”

(viii) Unions should serve the purpose of supervision and assessment of credit of individual societies and they should form a link between primary societies and central banks;

(ix) All co-operative societies should build up a reserve fund; and

(x) Greater control should be exercised by the Government over the finances of the co-operatives.

Alas, “These very sound and valuable recommendations were dishonoured often in neglect than in their execution.” The period between 1904 and the publication of the Maclagan Committee Report in 1915 has been regarded as “the period of initial effort and planning.”

3. The Period of Unplanned Expansion (1919-29):

On the passing of the Government of India Act of 1919, cooperation became a provincial subject and was administered by provincial Governments. Some Governments passed their own Acts to undertake many-sided developments. Bombay gave the lead by passing the Cooperative Societies Act of 1925. This was followed by Madras in 1932 and Bihar and Orissa in 1935, Coorg in 1937 and Bengal in 1941. Other States adopted the Central Act of 1912.

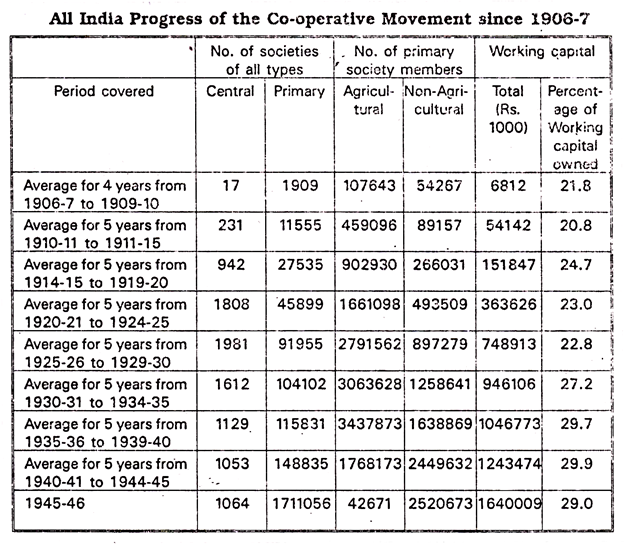

The Act of 1919 gave great stimulus to the movement. Its success was measured more by its quantity than by its quality. The number and membership of agricultural credit societies increased three times while their working capital increased four times between 1918-19 to 1928-29. The number of non-credit societies increased five-fold, and the membership by four and half times. The working capital of credit and non-credit societies increased by four times and six times respectively.

But with this expansion, over-dues were steadily increasing. These led to the institution by various provinces of Co-operative Committees of Enquiry to enquire into the working of the movement. The Central Provinces led the way with such an enquiry in 1922 and Bihar and Orissa in 1923. The Okden Committee in U.P., the Townsend Committee in Madras, and the Calvert Committee in Burma made similar enquiries. The rapid growth of movement between 1919 and 1930 is characterised by Mr. Ramdas Pantulu as the period of “unplanned expansion.”

During this period co-operation received sufficient encouragement under the popular ministries.

The great depression gave a tremendous set-back to cooperative activity. Not only did it stall the progress of the movement, but created great difficulties for the existing institutions. The catastrophic fall in the prices of agricultural goods and of land threatened the very existence of some societies and violently disturbed the economic stability of others. Recovery of loans became extremely difficult. There were very heavy accumulations of overdues and freezing of society’s assets.

Normal working of these bodies was in many cases almost completely paralysed and in several others most adversely affected. There was a serious contraction of cooperative credit. The Royal Commission on Agriculture (1927) and the Central and Provincial Banking Enquiry Committees (1929) indirectly made recommendations for their improvement. The Royal Commission stated that “the main cause of failure of the cooperative movement was the lack of site education and of adequate supervision and guidance.”

It further remarked that, “If Cooperation fails there will fail the best hopes of rural India.” The movement came to grief first in Burma and then suffered seriously in prestige in Bihar, Bengal and many other provinces. Since then efforts were directed more to the rehabilitation, reconstruction and reorganisation of existing societies than to further rapid expansion. The co-operative movement in India was passing through the phase of rectification and consolidation cautious expansion and experiment.

During this period the chief aim of the cooperative departments was to rectify and rehabilitate the societies rather than to expand them. Attention was paid to the consolidation of the existing societies by developing their resources and making them more cooperative.

Registration of lifeless and dead societies was cancelled. Because of these measures, the number of societies showed a declining trend, recording a fall of about 13 percent between 1930-31 to 1933-34. Secondly, a close supervision and strict scrutiny of the percentage of over-dues of loans outstanding of fell from 47 to 43 percent during the same period.

The depression in early thirties of this century and the collapse of the movement in some provinces as a result of it, led to the appointment of special Experts and Enquiry Committees in different provinces to examine the position of the co-operative movement and the fundamentals of co-operative structure with a view to reconstruction and in some cases permanent reorganisation.

Mention may be made of the Raghavacharya Committee in Madras (1940), Devdhar, Enquiry Committee on Cooperation in Travancore(1935); K.S.Iyer Committee in Mysore (1935); Kala Committee in Gwalior (1937), Mehta and Bhansali Committee in Bombay (1937), Deivasikhmani Committee in Orissa (1938), Wace Committee in Punjab (1939), and Ramdas Pantulu Committee for Cooperative Rehabilitation in 1939.

4. Period of Recovery (1939-1946):

The abnormal conditions created by World War II led to some far- reaching development in the co-operative movement. Between 1938- 39 and 1945-46 the increase in the number of societies, the number of members and the working capital have been respectively 41 percent, 70 percent and 54 percent. Also the movement touched 6 percent of the population and a society touched 5.4% villages in 1938-39 but 10 percent population and a society touched 3.8% villages in 1945-46.

The war stimulated the growth of consumer stores and marketing societies. Many new types of producers’ societies like weavers’ societies, milk supply unions, motor transport sections, fruit growers’ and cane growers’ associations, etc., were formed during the war period. Loan repayments were accelerated, turnover was brisk and working capital registered a substantial increase.

“The war period broadened the functional range of the co-operative movement and it brought about a shift in the lop-sided emphasis from credit aspect to the productive and distributive functions or to its multipurpose potentialities, a long felt need for imparting that richness and balance which in necessary for the proper development of the movement.”

Table given below shows the progress of cooperative movement in India:

From the above analysis the following characteristic features may be noted:

Firstly, the co-operative movement in India did not spring up from the people. It was initiated by Government resolution with a view to solve the problem of rural indebtedness. In the words of Mr. V. L. Mehta, “Government are so out of touch with public feeling and sentiment that despite their control of the machinery of administration they fail in their effort to seek an expansion of the movement.”

In fact it was not a spontaneous growth but a Government policy. The distinction between co-operation imposed by the Government and necessarily supervised, regulated, restricted and controlled on the one hand, and co-operation promoted by voluntary initiative and sustained by the cooperative spirit, which ensures the loyalty of the members, on the other hand cannot be overemphasised.

Secondly, started originally to provide the farmer with cheap credit it continued to be a predominantly credit movement so that the progress of non-credit co-operation was slow and agricultural credit societies dominated the picture.

Thirdly, though there were inter-provincial differences, the structure of the co-operative organisation was uniform in almost all the provinces e.g., in each province at the head of the movement there were three authorities, viz., the Registrar of the co-operative societies in charge of control and direction of the movement, Provincial or Apex Bank in charge of finance, and the Provincial Cooperative Institute or Union in charge of education and propaganda.

The Reserve Bank of India Review, 1939-40, noted- “Apart from this general expansion, the working of the movement in recent years has been characterised by greater diversity of functions, co-operation has permeated several walks of life, some of which were perhaps no more than touched before. It has played an important part in the attempts to solve two big problems, viz., the rehabilitation of displaced persons and the augmentation of the food production. The rehabilitation of displaced persons through the formation of co-operatives received a great fillip, owing mainly to the aid extended by the Government, in the shape of loans, grants-in-aid, cheap building materials and similar other concessions. Housing, industrial and forming societies were generally encouraged so that the displaced persons could be settled in colonies and provided with gainful occupations. In the field of food production co-operatives were entrusted with the distribution of manures, chemical fertilisers and agricultural implements. Credit facilities were liberalised for the members of co-operative credit societies by such measures as the relaxation of credit limits, financing at concessional rates, installations of pumping sets and oil engines. Thus by the introduction of modern methods there was sought to be brought about both more intensive and extensive cultivation of land.”

Fourthly, full-scale development of the multi-purpose idea in several States like Tamil Nadu, Maharashtra, Karnataka, U.P. was another notable trend in the primary credit structure. These societies were entrusted with the distribution of rationed and other essential commodities.

An important development during this period was the appointment of the Co-operative Planning Committee in 1945 which recommended that “primary societies should be converted into multipurpose societies and that efforts should be made to bring 30 per cent of the rural population and 50 per cent of the villages within the ambit of reorganised societies within a period of 10 years. It also urged that the Reserve Bank should provide greater assistance to co-operatives.”

An indication of the new role of the co-operative movement was given by the Agricultural Finance Sub-Committee (under the Chairmanship of Dr. D. R. Gadgil) which observed that “the spread of cooperation would provide the best and the more lasting solution for most problems of rural economy in general and for the problems of agricultural credit in particular.”

It, however, considered that it might not be possible for the co-operative movement to supply the entire credit needs of agriculturists. It recommended, therefore, that State aid should be given in a much larger measure than had been done in the past so that the co-operatives might be enabled to supply better credit facilities.

The Co-operative Planning Committee suggested that:

(i) The supply of credit touched only one aspect of the life of a cultivator, the activities of the primary societies should be so extended as to cover the whole of his life because “the main causes of the limited progress of the movement was the fact that it did not, especially in its initial stages, take the life of the individual as a whole.”

(ii) That primary credit societies should be so reformed and reorganised as to serve as centres for the general economic development of their members;

(iii) That an attempt should be made to bring 50 per cent of the villages and 30 per cent of the rural population within the ambit of the reorganised primary societies within a period of 10 years, and

(iv) That 25 per cent of the total marketable surplus of agricultural produce of the country should come under co-operation.

Fifthly, though the movement was officially sponsored, its further development took place without much financial aid. The amount given by way of grants-in-aid or subsidies was rather insignificant.

Finally, the movement had a haphazard growth, with hardly any co-ordination between the various branches such as the credit and marketing or between consumers and marketing societies.

The movement, on the whole, did not make substantial progress because of the laissez faire policy of the State and the general lack of co-operative principles, inefficient management, high overdues, unlimited liability of societies, lack of education and training among the members, severe opposition from the moneylenders and unsympathetic attitude and even ridicule of the revenue staff.

In this connection, the remarks of the Rural Credit Survey Committee are noteworthy “the Co-operative form of organisation has to face not merely the competition but also in large degree to the positive opposition of a powerful array of non-co-operative private individuals and institutions.”

The Rural Banking Enquiry Committee (1949-50) while making some useful recommendations regarding agricultural credit generally suggested the formation of rural Co-operative banks and expanding urban banks. Central banks and provincial banks to serve the needs of the rural areas.