In this essay we will discuss about Money. After reading this essay you will learn about:- 1. Definition of Money 2. The Evolution of Money 3. Classification 4. Characteristics 5. Meaning and Nature 6. Functions 7. Role 8. Defects.

Contents:

- Essay on the Definition of Money

- Essay on the Evolution of Money

- Essay on the Classification of Money

- Essay on the Characteristics of Money

- Essay on the Meaning and Nature of Money

- Essay on the Functions of Money

- Essay on the Role of Money

- Essay on the Defects of Money

1. Essay on the Definition of Money:

Money is the stock of assets that can be readily used to exercise purchasing power or command over goods and services or to make transactions.

The rupees in the hands of the public make up India’s stock of money.

Money is the currency used by the central bank—for, e.g., rupee, notes and coins— together with bank deposits withdrawable by cheques. Money is used to facilitate the purchase and sale of goods. When we buy goods we usually pay currency or with a cheque.

Money does not include the wealth which is held in the form of National Saving Certificate, corporate debentures, government bonds, even though these forms of wealth are measured in rupees, because these are not usually used to pay for goods. In short, money is just one form of wealth. It refers to the stock of assets that can be readily used to make transactions.

Theoretical and Empirical Definitions of Money:

There being no unanimity over the definition of money, Prof. Johnson distinguishes four main schools of thought in this regard which are discussed below:

1. The Traditional Definition of Money:

According to the traditional view, also known as the view of the Currency School, money is defined as currency and demand deposits, and its most important function is to act as a medium of exchange. Keynes in his General Theory followed the traditional view and defined money as currency and demand deposits. Hicks in his Critical Essays in Monetary Theory points towards a threefold traditional classification of the nature of money: “to act as a unit of account (or measure of value as Wicksell put it), as a means of payment, and as a store of value.”

The Banking School criticised the traditional definition of money as arbitrary. This view about the meaning of money is very narrow because there are other assets which are equally acceptable as media of exchange. These include time deposits of commercial banks, commercial bills of exchange, etc. By ignoring these assets, the traditional view is not in a position to analyse their influence in increasing their velocity.

2. Friedman’s Definition of Money:

The monetarist (or Chicago) view is associated with Prof. Friedman and his followers at the University of Chicago. By money Friedman means “literally the number of dollars people are carrying around in their pockets, the-number of dollars they have to their credit at banks in the form of demand deposits and commercial bank time deposits”. Thus he defines money as “the sum of currency plus all adjusted deposits in commercial banks”. This is the “working definition” of money which Friedman uses for the empirical study of the monetary trends of the US for selected years 1929,1935,1950,1955 and 1960.

This was a narrower definition of money and the adjustment in both demand and time deposits of commercial banks was devised to take into account the increasing financial sophistication of the commercial banks and the community. But he could not establish a single index of this sophistication. Even with this adjustment, cash and deposit monies were not strictly comparable over long periods.

He also suggested a broader definition of money as “any asset capable of serving as a temporary abode of purchasing power”. So Friedman gives two types of definitions of money. One on theoretical basis and the other on empirical basis.

This led to a lot of controversy. However, he takes a broader view in his definition of money which includes bank deposits, non- bank deposits and any other type of assets through which the monetary authority influences the future level of income, prices, employment or any other important macro variable.

3. The Radcliffe Definition:

The Radcliffe Committee defined money as “note plus bank deposits”. It includes as money only those assets which are commonly used as media of exchange. Assets refer to liquid assets by which it means the monetary quantity influencing total effective demand for goods and services. This is interpreted widely to include credit.

Thus the whole liquidity position is relevant to spending decisions. Spending is not limited to cash or money in the bank but to the amount of money people think they can get hold of either by selling an asset or by borrowing or by receipts of income from, say, sales.

The Committee did not make use of the concept of velocity of circulation because as a numerical constant, it is devoid of any behavioural content. On the basis of crude empirical tests, the Committee did not find either direct or indirect link between money and economic activity via the interest rate. But it gave a new transmission mechanism based on liquidity.

It explained that a movement of interest rates implies significant changes in the capital value of many assets held by financial institutions. A rise in the interest rates makes some less willing to lend because capital values have fallen, and others because their own interest rate structure is sticky. A fall in interest rates, on the other hand, strengthens balance sheets and encourages lenders to seek new business.

4. The Gurley-Shaw Definition:

Gurley and Shaw regard a substantial volume of liquid assets held by financial intermediaries and the liabilities of non-bank intermediaries as close substitutes for money. Intermediaries provide substitutes for money as a store of value. Money proper which is defined as equal to currency plus demand deposits is only one liquid asset.

They have thus formulated a wider definition of money based upon liquidity which includes bonds, insurance reserves, pension funds, savings and loan shares. They believe in the velocity of the money stock which is influenced by non-bank intermediaries. Their views on the definition of money are based on their own and Goldsmith’s empirical findings.

2. Essay on the Evolution of Money:

The word “money” is derived from the Latin word “Moneta” which was the surname of the Roman Goddess of Juno in whose temple at Rome, money was coined. The origin of money is lost in antiquity. Even the primitive man had some sort of money.

The type of money in every age depended on the nature of its livelihood. In a hunting society, the skins of wild animals were used as money. The pastoral society used livestock, whereas the agricultural society used grains and foodstuffs as money. The Greeks used coins as money.

Stages in the Evolution of Money:

The evolution of money has passed through the following five stages depending upon the progress of human civilisation at different times and places.

1. Commodity Money:

Various types of commodities have been used as money from the beginning of human civilisation. Stones, spears, skins, bows and arrows, and axe’s were used as money in the hunting society. The pastoral society used cattle as money.

The agricultural society used grains as money. The Romans used cattle and salt as money at different times. The Mongolians used squirrel skins as money. Precious stones, tobacco, tea, shells, fishhooks, and many other commodities served as money depending upon time, place and economic standard of the society.

The use of commodities as money had the following defects:

(1) All commodities were not uniform in quality, such as cattle, grains, etc. Thus lack of standardisation made pricing difficult.

(2) Difficult to store and prevent loss of value in the case of perishable commodities.

(3) Supplies of such commodities were uncertain.

(4) They lacked in portability and hence were difficult to transfer from one place to another.

(5) There was the problem of indivisibility in the case of such commodities as cattle.

2. Metallic Money:

With the spread of civilisation and trade relations by land and sea, metallic money took the place of commodity money. Many nations started using silver, gold, copper, tin, etc. as money. But metal was an inconvenient thing to accept, weigh, divide and assess in quality.

Accordingly, metal was made into coins of predetermined weight. This innovation is attributed to King Midas of Lydia in the eighth century B.C. But gold coins were in use in India many centuries earlier than in Lydia. Thus coins came to be accepted as convenient method of exchange. But some ingenious persons started debasing the coins by clipping a thin slice off the edge of coins. This led to the hoarding of full-bodied coins with the result that debased coins were found in circulation. This led to the minting of coins with a rough edge.

As the price of gold began to rise, gold coins were melted in order to earn more by selling them as metal. This led the governments to mix copper or silver in gold coins so that their intrinsic value might be more than their face value. As gold became dearer and scarce, silver coins were used, first in their pure form and later on mixed with alloy or some other metal.

But metallic money had the following defects:

(1) It was not possible to change its supply according to the requirements of the nation both for internal and external use.

(2) Being heavy, it was not possible to carry large sums of money in the form of coins from one place to another by merchants.

(3) It was unsafe and inconvenient to carry precious metals for trade purposes over long distances.

(4) Metallic money was very expensive because the use of coins led to their debasement and their minting and exchange at the mint cost a lot to the government.

3. Paper Money:

The development of paper money started with goldsmiths who kept strong safes to store their gold. As goldsmiths were thought to be honest merchants, people started keeping their gold with them for safe custody. In return, the goldsmiths gave the depositors a receipt promising to return the gold on demand.

These receipts of the goldsmiths were given to the sellers of commodities by the buyers. Thus the receipts of the goldsmiths were a substitute for money. Such paper money was backed by gold and was convertible on demand into gold. This ultimately led to the development of bank notes.

The bank notes are issued by the central bank of the country. As the demand for gold and silver increased with the rise in their prices, the convertibility of bank notes into gold and silver was gradually given up during the beginning and after the First World War in all the countries of the world. Since then the bank money has ceased to be representative money and is simply fiat money which is inconvertible and is accepted as money because it is backed by law.

4. Credit Money. Another stage in the evolution of money in the modern world is the use of the cheque as money. The cheque is like a bank note in that it performs the same function. It is a means of transferring money or obligations from one person to another.

But a cheque is different from a bank note. A cheque is made for a specific sum, and it expires with a single transaction. But a cheque is not money. It is simply a written order to transfer money. However, large transactions are made through cheques these days and bank notes are used only for small transactions.

5. Near Money. The final stage in the evolution of money has been the use of bills of exchange, treasury bills, bonds, debentures, savings certificates, etc. They are known as “near money”. They are close substitutes for money and are liquid assets.

Thus in the final stage of its evolution money has become intangible. Its ownership is now transferable simply by book entry. Thus the origin of money has been through various stages: from commodity money to metallic money, and to paper money, and from credit money to near money.

3. Essay on the Classification of Money:

Money can be classified on the following different basis:

(1) The physical characteristics of the materials of which money is made; or the monetary system criterion, and

(2) The nature of the issuer such as a government, central bank, commercial bank, or other, or the acceptability criterion, and

(3) The relationship between the value of money as money and the value of money as commodity or what Keynes called Money of Account and Money Proper. We shall follow this classification while explaining the various kinds of money.

A. Monetary System Criterion:

The monetary system criterion classifies money into:

(1) Metallic money,

(2) Paper money, and

(3) Credit money

(1) Metallic Money:

Money made of any metal such as gold, silver, nickel, copper, etc. is called metallic money. Metallic money is further classified into standard money, token money and subsidiary money.

(i) Standard Money:

Standard money “is money whose value as a commodity for non-monetary purposes is as great as its value as money.” Such money is made of coins whose face value equals their intrinsic or metallic value. The holder of such coins may use them as metal by melting them or as money, because the value of the metal in the coins is the same as their monetary value. Standard money is, therefore, known as full-bodied money. Between 1835-93 the Indian Rupee-coin made of silver was a full-bodied coin. Further, standard money is unlimited legal tender in which any amount of payment can be made.

(ii) Token Money:

Token money is representative money whose intrinsic value of the metal is less than its face value. The rupee coin in circulation in India is a token coin. If it is melted, its metal will not be sold worth one rupee.

(iii) Subsidiary Money:

Subsidiary money is to assist the token money. All coins of the denominations from 5 paise to 25 paise in India are subsidiary money. Such coins are limited legal tender in which payments can be made only up to Rs.25 in India.

(2) Paper Money:

Paper money refers to notes of different denominations made of paper and issued by the central bank and/or the government of the country.

Paper money can be classified into:

(i) Representative paper money,

(ii) Convertible paper money,

(iii) Inconvertible paper money and

(iv) Fiat money.

(i) Representative Paper Money:

Representative paper money is “in effect a circulating warehouse receipt for full-bodied coins or their equivalent in bullion.” It is also known as representative full-bodied money because it is fully backed by gold coins or gold bullion held by the treasury. They are fully convertible into gold coins or bullion. The gold certificates which circulated in the United States prior to 1933 were representative paper money.

(ii) Convertible Paper Money:

Convertible paper money is that which does not have 100 per cent backing in the form of standard coins or bullion. But the holder of paper money can get it converted into bullion or coins on demand. The only difference between representative and convertible paper money is that the former is fully backed by standard coins or bullion while the latter is not fully backed by them. But both types of paper money are convertible.

(iii) Inconvertible Paper Money:

The paper money which does not have any backing of standard coins or bullion and is also not convertible into them is known as inconvertible paper money. Notes issued by central banks of all countries represent inconvertible paper money. They are also known as fiduciary money.

(iv) Fiat Money:

Paper money which circulates on the authority (i.e. fiat) of the government is fiat money. Fiat money is created and issued by the State. But it is not convertible by law and is legal tender. Fiat money is thus representative or token money. One rupee note issued by the Ministry of Finance and token coins issued by the Government of India are fiat money. Practically, there is no difference between fiat money and inconvertible paper money these days.

(3) Credit Money:

Credit money or bank money is transferred by a commercial bank in the form of a cheque or draft. But a cheque or draft is not money. Demand deposits in a bank is money which is withdrawable by a holder of the deposit through a cheque or draft. Thus it is demand deposit which is credit or bank money that is transferable from one person to another through a cheque or draft. But a cheque or draft is not legal tender and may not be accepted as a means of payment or medium of exchange. However, in advanced countries bank money is as important as the paper notes issued by the government or the central bank of the country.

B. Acceptability Criterion:

On the basis of acceptability criterion, money is classified into legal tender money and non-legal tender money.

(1) Legal Tender Money:

Legal tender money is that which the state and the people accept as the means of payment and in discharge of debts. Since it has the authority of the government such money is accepted compulsorily by the people. All notes and coins issued by the government and the central bank of a country are compulsory legal tender in that country. Legal tender money is further divided into limited and unlimited legal tender money.

(i) Limited Legal Tender Money:

Limited legal tender money is that in which payments can be made legally up to a certain limit. All coins of the denominations of 5 paise to 25 paise are limited legal tender in India. Payments in them can be made up to a limit of Rs.25.

(ii) Unlimited Legal Tender Money:

A money is unlimited legal tender when payments can be made in it legally in unlimited quantities. All paper notes and coins of 50 paise and 1 Rupee are unlimited legal tender in India. People have to accept payments in unlimited quantities in notes and these coins.

(2) Non-Legal Tender or Optional Money:

Money which does not possess any legal authority of the state or the central bank is non-legal tender money. Robertson called it “optional money”. Bank money in the form of cheques, drafts, etc. are the forms of non-legal tender money. People are not bound to accept such money because there is no legal sanction behind their issue.

Besides cheques and drafts, there are many other forms of optional money such as time deposits, bonds, securities, debentures, bills of exchange, treasury bills, postal certificates, insurance policies, etc. They are known as “near money” or “money substitutes”. They are almost perfect substitutes for money as a store of value. They possess moneyness or liquidity. They also yield income. They economise in the use of currency. But they do not have any legal status.

C. Money of Account and Money Proper:

Keynes distinguished between money of account and money proper. According to him, “Money of account is that in which Debts and Prices and General Purchasing Power are expressed.” On the other hand, money proper is the actual money in which contracts or debts are settled, such as the Indian Rupee, the British Pound, the American Dollar, the French Franc, the German Mark, the Japanese Yen, the Italian Lira, etc.

Usually, there is no difference between money of account and money proper when the accounts in a country are maintained in money proper. But if accounts are kept in some other currency money of account differs from money proper, as happened in Germany after World War I when the money of account was the American Dollar and the money proper was the German Mark.

However, the two may differ when the value of money as money and the value of money as commodity are different. For example, value of Indian rupee as money of account has remained the same but the value of Indian rupee as commodity or money proper has been changing overtime, that is, it is an unlimited legal tender. It is a token coin or money whose present intrinsic value is negligible in relation to its face value as compared to 1939.

D. Money and Near Money:

Money consists of currency and bank deposit. Coins and currency notes issued by the central bank of a country and cheques of commercial banks of a country are liquid assets. In fact, cheques and bank drafts are almost perfect substitutes for Money. This is because they perform the medium of exchange function of money, but cheques and drafts can be issued at a short notice only in the case of demand deposits.

This is not the case with time deposits which can be withdrawn either at the end of the fixed period or by giving a prior notice to the bank and incurring a penalty. Thus time deposits are not ‘real’ money and for them to become money they must be converted into cash or demand deposits.

However, they are near money for they can be converted into real money in a short period without any loss. For example, a time deposit of Rs.10,000 for three years can always be converted into demand deposit or Rs.10,000 in cash at any time before the completion of three years.

They also fetch a fixed rate of interest which may be reduced if the deposit is converted into cash or demand deposit before the expiry of the fixed period. Thus near money assets serve the store of value function of money temporarily and are convertible into a medium of exchange in a short time without loss in their face value.

Besides time deposits, other near money assets are bonds, securities, debentures, bills of exchange, treasury bills, insurance policies, etc. All these types of assets have a market and are negotiable so that they can be converted into real money within a short time. We discuss how these negotiable instruments are near moneys.

Bonds, securities and debentures fall in the same category. Bonds and securities are issued by the government, while debentures are issued by companies. They are the means to borrow funds for short, medium or long periods and carry a fixed rate of interest. They are near money assets because they are convertible into cash at a short notice in the money market.

A bill of exchange is another form of money. It is an IOU (I owe you). It is drawn by an individual or firm to pay a stated sum of money on a specified date which is never more man 90 days. A bill of exchange is not money by itself but is certainly money on the due date. It is, however, near money if its owner wishes to turn it into cash. It can be easily converted into money at a discount or by receiving less money than its face value.

Treasury bills issued by the government also fall in the category of near money. A treasury bill is a promise by the government to pay a stated sum in the near future usually 30, 60 or 90 days. A treasury bill is also like a bill of exchange which is convertible into money at a discount within a short period.

Life insurance policy is another example of near money. The holder of a life insurance policy can obtain cash in the form of loan on his policy at a short notice. Thus a life insurance policy is a form of liquid asset which can be regarded as near money.

Besides these recognised instruments of near money, some intermediaries have come into existence to provide a market for certain assets. Such intermediaries are financial companies which provide funds on the security of some assets, and brokers who buy and sell property, bonds, debentures, shares, etc. They help in increasing the liquidity of such assets thereby converting them into near money.

Money and near money can now be distinguished. Money is a legal-tender and gives the possessor liquidity in hand. It performs the medium of exchange function. On the other hand, near money assets do not have any legal status. They possess moneyness or liquidity but not ready liquidity like money. They are almost perfect substitutes for money as a store of value.

They are superior to money because they yield income. They also economise, in the use of money proper and tend to reduce the quantity of money used by the people as a medium of exchange, as a medium of deferred payments and as a store of value.

Despite the fact that near money assets do not possess ready liquidity, they are preferred by individuals. According to Professor A.G. Hart, near money is preferred to cash by individuals because it serves as a margin of safety motive. Prof. Dean points out that 80 per cent of near money in the USA is held by individuals.

The tremendous growth of near money assets in the United States is due to the fact that the yield from them is higher than that from demand deposits and that they are safer than cash. Moreover, savings in the near money assets have been encouraged by such special techniques as pay roll saving plan, and commercial bank plans covering automatic regular transfer of specified sums from the demand to time deposits of the customers.

4. Essay on the Characteristics of Money:

Economists have pointed towards the following characteristics or qualities for a thing to be money:

(i) General Acceptability:

For anything to be money, it should be acceptable by everybody. People accept a thing as money which is used by everybody as a medium of exchange. Gold and silver are considered good money materials because they have alternative uses and are generally accepted.

Paper notes are accepted as money when they are issued by the central bank and/or the government and are legal tender. Cheques and Bills of Exchange are not accepted generally. Hence they are not money.

(ii) Durability:

For a thing to be money, it must possess durability. It should be storable and last long without losing its value over a period-of time. Animals and perishable commodities are not good money materials because they do not possess durability. In this sense, gold, silver, alloy, brass etc. are the best materials which are used as money. Paper notes are less durable than these metals. But they are money because they are legal tender.

(iii) Portability:

The material used as money should be easily carried and transferred from one place to another. It should contain large value in small bulk. Gold and silver possess this quality. Hence they are good money materials. But they involve risk in carrying or transferring them from one place to another. Therefore, paper is considered as a better material and is used in the form of notes.

(iv) Cognisability:

The material with which money is made should be easily recognised by sight or touch. Coins and currency notes of different denominations in different designs and sizes meet this quality of good money.

(v) Homogeneity:

The material with which money is made should be of the same quality. All coins of one denomination must be of the same metal, weight, shape and size. Similarly, paper notes of one denomination must have the same quality of paper, design and size.

(vi) Divisibility:

The money material should be capable of being divided into smaller parts without losing value. Gold, silver, and other such materials possess this quality. Gold has the same value in whatever number of parts it may be divided. The same is the case with paper when notes of small and large denominations are issued which facilitate the operation of small and large transactions.

(vii) Stability:

Money should be stable in value because it has to serve as a measure of value. Gold and silver possess this quality because they are not available in abundance. They are neither very scarce because being durable, they can be easily stocked.

Their supplies can thus be increased or decreased when required. So they act as a store of value because their value is stable. But governments prefer paper money to gold and silver because it is cheap and easily available. Its value is kept stable by keeping control over its issue. It is another thing that the central bank of a country is seldom able to exercise complete control over its issue which makes paper money unstable in value.

5. Essay on the Meaning and Nature of Money:

There has been lot of controversy and confusion over the meaning and nature of money. As pointed out by Scitovsky, “Money is a difficult concept to define, partly because it fulfills not one but three functions, each of them providing a criterion of moneyness … those of (i) a unit of account,(ii) a medium of exchange, and (iii) a store of value.”

Though Scitovsky points toward the difficulty of defining money due to moneyness, yet he gives a wide definition of money. Professor Coulborn defines money as “the means of valuation and of payment; as both the unit of account and the generally acceptable medium of exchange.”

Coulborn’s definition is very wide. He includes in it the ‘concrete’ money such as gold, cheques, coins, currency notes, bank draft, etc. and also abstract money which “is the vehicle of our thoughts of value, price and worth.”

Such wide definitions have led Sir John Hicks to say that “money is defined by its functions: anything is money which is Used 3S money: ‘money is what money does. ‘These are the functional definitions of money because they define money in terms of the functions it performs.

Some economists define money in legal terms saying that “anything which the state declares as money is money.” Such money possesses general acceptability and has the legal power to discharge debts. But people may not accept legal money by refusing to sell goods and services against the payment of legal tender money.

On the other hand, they may accept some other things as money which are not legally defined as money in discharge of debts which may circulate’ freely. Such things are cheques and notes issued by commercial banks. Thus besides legality, there are other determinants which go to make a thing to serve as money.

6. Essay on the Functions of Money:

Money performs a number of primary, secondary, contingent and other functions which not only remove the difficulties of barter but also oils the wheels of trade and industry in the present day world.”

We discuss these functions one by one:

1. Primary Functions:

The two primary functions of money are to act as a medium of exchange and as a unit of value.

(i) Money as a Medium of Exchange:

This is the primary function of money because it is out of this function that its other functions developed. By serving as a medium of exchange, money removes the need for double coincidence of wants and the inconveniences and difficulties associated with barter.

The introduction of money as a medium of exchange decomposes the single transaction of barter into separate transactions of sale and purchase, thereby eliminating the double coincidence of wants. This function of money also separates the transactions in time and place because the sellers and buyers of a commodity are not required to perform the transactions at the same time and place. This is because the seller of a commodity buys some money and money in turn, buys the commodity over time and place.

When money acts as a medium of exchange, it means that it is generally acceptable. It, therefore, affords the freedom of choice. With money, we can buy an assorted bundle of goods and services. At the same time, we can purchase the best and also bargain in the market. Thus money gives us a good deal of economic independence and also perfects the market mechanism by increasing competition and widening the market.

As a medium of exchange, money acts as an intermediary. It facilitates exchange. It helps production indirectly through specialisation and division of labour which, in turn, increase efficiency and output. According to Prof. Walters money, therefore, serves as a ‘factor of production,’ enabling output to increase and diversify. In the last analysis money facilitates trade. When acting as the intermediary, it helps one good or service to be traded indirectly for others.

(ii) Money as Unit of Value:

The second primary function of money is to act as a unit of value. Under barter one would have to resort to some standard of measurement, such as a length of string or a piece of wood. Since one would have to use a standard to measure the length or height of any object, it is only sensible that one particular standard should be accepted as the standard. Money is the standard for measuring value just as the yard or metre is the standard for measuring length.

The monetary unit measures and expresses the values of all goods and services. In fact, the monetary unit expresses the value of each good or service in terms of price. Money is the common denominator which determines the rate of exchange between goods and services which are priced in terms of the monetary unit. There can be no pricing process without a measure of value.

The use of money as a standard of value eliminates the necessity of quoting the price of apples in terms of oranges, the price of oranges in terms of nuts, and so on. Unlike barter, the prices of such commodities are expressed in terms of so many units of dollars, rupees, francs, pounds, etc., depending on the nature of the monetary unit in a country.

As a matter of fact, measuring the values of goods and services in the monetary unit facilitates the problem of measuring the exchange value of goods in the market. When values are expressed in terms of money, the numbers of prices are reduced from n (n—1) in barter economy to (n—1) in monetary economy.

Money as a unit of value also facilitates accounting. “Assets of all kinds, liabilities of all kinds, income of all kinds, and expenses of all kinds can be stated in terms of common monetary units to be added or subtracted.”

Further, money as a unit of account helps in calculation of economic importance such as the estimation of the costs, and revenues of business firms, the relative costs and profitability of various public enterprises and projects under a planned economy, and the gross national product. As pointed out by Culbertson, “Prices quoted in terms of money become the focus of people’s behaviour. Their calculations, plans, expectations, and contracts focus on money prices.”

2. Secondary Functions:

Money performs three secondary functions:

(i) As a standard of deferred payments,

(ii) As a store of value, and

(iii) As a transfer of value.

They are discussed below:

(i) Money as a Standard of Deferred Payments:

The third function of money is that it acts as a standard of deferred or postponed payments. All debts are taken in money. It was easy under barter to take loans in goats or grains but difficult to make repayments in such perishable articles in the future. Money has simplified both the taking and repayment of loans because the unit of account is durable. Money links the present values with those of the future. It simplifies credit transactions. It makes possible contracts for the supply of goods in future for an agreed payment of money.

It simplifies borrowing by consumers on hire-purchase and from house building and co-operative societies. Money facilitates borrowing by firms and businessmen from banks and other non-bank financial institutions.

The buying and selling of shares, debentures and securities is made possible by money. By acting as a standard of deferred payments, money helps in capital formation both by the government and business enterprises.

In fine, this function of money develops financial and capital markets and helps in the growth of the economy. But there is the danger of changes in the value of money over time which harms or benefits the creditors and debtors. If the value of money increases over time, the creditors gain and debtors lose. On the other hand, a fan in the value of money over time brings losses to creditors and windfalls to debtors.

To overcome this difficulty, some of the countries have fixed debt contracts in terms of a price index which measures changes in the value of money. Such a contract over time guarantees the future payment of debt by compensating the loser by the same amount of purchasing power when the contract was entered into.

(ii) Money as a Store of Value:

Another important function of money is that it acts as a store of value. “The good chosen as money is always something which can be kept for Jong periods without deterioration or wastage. It is a form in which wealth can be kept intact from one year to the next. Money is a bridge from the present to the future. It is therefore essential that the money commodity should always be one which can be easily and safely stored.”

Money as a store of value is meant to meet unforeseen emergencies and to pay debts. Newlyn calls this the asset function of money. “Money is not, of course, the only store of value. This function can be served by any valuable asset. One can store value for the future by holding short-term promissory notes, bonds, mortgages, preferred stocks, household furniture, houses, land, or any other kind of valuable goods. The principal advantages of these other assets as a store of value are that they, unlike money, ordinarily yield an income in the form of interest, profits, rent or usefulness…, and they sometimes rise in value in terms of money.

On the other hand, they have certain disadvantages as a store of value, among which are the following:

(1) They sometimes involve storage costs;

(2) They may depreciate in terms of money; and

(3) They are “illiquid” in varying degrees, for they are not generally acceptable as money and it may be possible to convert them into money quickly only by suffering a loss of value.”

Keynes placed much emphasis on this function of money. According to him, to hold money is to keep it as a reserve of liquid assets which can be converted into real goods. It is a matter of comparative indifference whether wealth is in money, money claims, or goods.

In fact, money and money claims have certain advantages of security, convenience and adaptability over real goods. But the store of value function of money also suffers from changes in the value of money. This introduces considerable hazard in using money or assets as a store of value.

(iii) Money as a Transfer of Value:

Since money is a generally acceptable means of payment and acts as a store of value, it keeps on transferring values from person to person and place to place. A person who holds money in cash or assets can transfer that to any other person. Moreover, he can sell his assets at Delhi and purchase fresh assets at Bangalore. Thus money facilitates transfer of value between persons and places.

3. Contingent Functions:

Money also performs certain contingent or incidental functions, according to Prof. David Kinley.

They are:

(i) Money as the Most Liquid of all Liquid Assets:

Money is the most liquid of all liquid assets in which wealth is held. Individuals and firms may hold wealth in infinitely varied forms. They may, for example, choose between holding wealth in currency, demand deposits, time deposits, savings, bonds, Treasury Bills, short-term government securities, long-term government securities, debentures, preference shares, ordinary shares, stocks of consumer goods, and productive equipment.” All these are liquid forms of wealth which can be convened into money, and vice-versa.

(ii) Basis of the Credit System. Money is the basis of credit system:

Business transactions are either in cash or on credit. Credit economizes the use of money. But money is at the back of all credit. A commercial bank cannot create credit without having sufficient money in reserve. The credit instruments drawn by businessmen have always a cash guarantee supported by their bankers.

(iii) Equalizer of Marginal Utilities and Productivities.

Money acts as an equalizer of marginal utilities for the consumer. The main aim of a consumer is to maximise his satisfaction by spending a given sum of money on various goods which he wants to purchase. Since prices of goods indicate their marginal utilities and are expressed in money, money helps in equalizing the marginal utilities of various goods.

This happens when the ratios of the marginal utilities and prices of the various goods are equal. Similarly, money helps in equalizing the marginal productivities of the various factors. The main aim of the producer is to maximise his profits. For this, he equalises the marginal productivity of each factor with its price. The price of each factor is nothing but the money he receives for his work.

(iv) Measurement of National Income:

It was not possible to measure the national income under the barter system. Money helps in measuring national income. This is done when the various goods and services produced in a country are assessed in money terms.

(v) Distribution of National Income:

Money also helps in the distribution of national income. Rewards of factors of production in the form of wages, rent, interest and profit are determined and paid in terms of money.

4. Other Functions:

Money also performs such functions which affect the decisions of consumers and governments:

(i) Helpful in making decisions:

Money is a means of store of value and the consumer meets his daily requirements on the basis of money held by him. If the consumer has a scooter and in the near future he needs a car, he can buy a car by selling his scooter and money accumulated by him. In this way, money helps in taking decisions.

(ii) Money as a Basis of Adjustment:

To carry on trade in a proper manner, the adjustment between money market and capital market is done through money.

Similarly, adjustments in foreign exchange are also made through money. Further, international payments of various types are also adjusted and made through money.

It is on the basis of these functions that money guarantees the solvency of the payer and provides options to the holder of money to use it any way, he likes.

7. Essay on the Role of Money:

Money is of vital importance to an economy due to its static and dynamic roles. Its static role emerges from its static or traditional functions. In its dynamic role, money plays an important part in the life of every citizen and in the economic system as a whole.

Static Role of Money:

In its static role, the importance of money lies in removing the difficulties of barter in the following ways:

(i) By serving as a medium of exchange, money removes the need for double coincidence of wants and the inconveniences and difficulties associated with barter. The introduction of money as a medium of exchange breaks up the single transactions of barter into separate transactions of sales and purchases, thereby eliminating the double coincidence of wants. Instead of exchanging commodities directly with commodities i.e. C ↔ C, commodities as C→M→ C, where C refers to commodities and M to money.

(ii) By acting as a unit of account, money becomes a common measure of value. The use of money as a standard of value eliminates the necessity of pouting the price of apples in terms of organs, the price of organs in terms of nuts, and so on. Money is the standard of measuring value and value expressed in money is price. The prices of different commodities are expressed in terms of so many units of dollars, rupees, pounds, etc. depending on the nature of monetary unit in a country. The measurement of the values of goods and services in the monetary unit facilitates the problem of measuring the exchange values of goods in the market.

(iii) Money acts as a standard of deferred payments. Under barter, it was easy to take loans in goats or grains but difficult to make repayments in such perishable articles in the future. Money has simplified both taking and repayment of loans because the unit of account is durable. It also overcomes the difficulty of indivisibility of commodities.

(iv) By acting as a store of value, money removes the problem of storing of commodities under barter. Money being the most liquid asset can be kept for long periods without deterioration or wastage.

(v) Under barter, it was difficult to transfer value in the form of animals, grains, etc. from one place to another. Money removes this difficulty of barter by facilitating the transfer of value from one place to another. A person can transfer his money through draft, bill of exchange, etc. and his assets by selling them for cash at one place and buying them at another place.

Dynamic Role of Money:

In its dynamic role, money plays an important part in the daily life of a person whether he is a consumer, a producer, a businessman, an academician, a politician or an administrator. Besides, it influences thee economy in a number of ways.

(1) To the Consumer:

Money possesses much significance for the consumer. The consumer receives his income in the form of money rather than in goods and services. With money in hands, he can get any commodity and service he likes, in whatever equalizer of marginal utilities for the consumer.

The main aim of a consumer is to maximise his satisfaction by spending his limited income on different goods which he wants to purchase. Since prices of goods indicate their marginal utilities and are expressed in money, money helps in equalizing the marginal utilities of goods. This is done by substituting goods with higher utilities for others having lower utilities. Thus money enable a consumer to make a rational distribution of his income on various commodities of his choice.

(2) To the Producer:

Money is of equal importance to the producer. He keeps his account of the values of inputs and outputs in money. The raw materials purchased, the wages paid to workers, the capital borrowed, the rent paid, the expenses on advertisements, etc. are all expenses of production which are entered in his account books.

The sale of products in money terms are his sale proceeds. The difference between the two gives him profit. Thus a producer easily calculates not only his costs of production and receipts but also profit with the help of money. Further, money helps in the general flow of goods and services from agricultural, industrial and tertiary sectors of the economy because all these activities are performed in terms of money.

(3) In Specialisation and Divisions of Labour:

Money plays an important role in large scale specialisation and division of labour in modern production. Money helps the capitalist today wages to a large number of worker engaged in specialised jobs on the basis of division of labour. Each worker is paid money wages in accordance with the nature of work done by him. Thus money facilitates specialisation and division of labour in modern production.

These, in turn, help in the growth of industries. It is, in fact, through money that production on a large scale is possible. All inputs like raw materials, labour, machinery, etc. are purchased with money and all output is sold in exchange for money. As rightly pointed out by Prof. Pigou, “In the modern world industry is closely enfolded in a garment of money.”

(4) As the Basis of Credit:

The entire modern business is based on credit and credit is based on money. All monetary transactions consist of cheques, drafts, bills of exchange etc. These are credit instruments which are not money. It is the bank deposits that are money. Banks issue such credit instruments and create credit. Credit creation, in turn, plays a major role in transferring funds from depositors to investors. Thus credit expands investment on the basis of public saving lying in bank deposits and helps in maintaining a circular flow of income within the economy.

(5) As a Means to capital Formation:

By transforming savings into investment, money acts as a means to capital formation. Money is a liquid asset which can be stored and storing of money implies savings, and savings are kept in bank deposits to earn interest on them. Banks, in turn, lend these savings to businessmen for investment in capital equipment, buying of raw materials, labour, etc. from different sources and places. This makes capital mobile and leads to capital formation and economic growth.

(6) As an Index of Economic Growth:

Money is also an index of economic growth. The various indicators of growth are national income, per capita income and economic welfare. These are calculated and measured in money terms. Changes in the value of money or prices also reflect the growth of an economy. Fall in the value of money (or rise in prices) means that the economy is not progressing in real terms. On the other hand, a continuous rise in the value of money (or fall in prices) reflects retardation of the economy. Somewhat stable prices imply a growing economy. Thus money is an index of economic growth.

(7) In the Distribution and Calculation of Income:

The rewards to the various factors of production in a modern economy are paid in money. A worker gets his wages, capitalist his interest, a landlord his rent, and an entrepreneur his profit. But all are paid their rewards in money. An organizer is able to calculate the marginal productivity of each factor in terms of money and pay it accordingly. For this, he equalises the marginal productivity of each factor with its price. Its price is, in fact, its marginal productivity expressed in terms of money. As payments are made to various factors of production in money, the calculation of national income becomes easy.

(8) In National and International Trade:

Money facilitates both national and international trade. The use of money as a medium of exchange, as a store of value and as a transfer of value has made it possible to sell commodities not only within a country but also internationally. To facilitate trade, money has helped in establishing money and capital markets. There are banks, financial institutions, stock exchanges, produce exchanges, international financial institutions, etc. which operate on the basis of the money economy and they help in both national and international trade.

Further, trade relations among different countries have led to international cooperation. As a result, the developed countries have been helping the growth of underdeveloped countries by giving them loans and technical assistance. This has been made possible because the value of foreign aid received and its repayment by the developing countries is measured in money.

(9) In Solving the Central Problems of an Economy:

Money helps in solving the central problems of an economy; what to produce, for whom to produce, how to produce and in what quantities. This is because on the basis of its functions money facilitates the flow of goods and services among consumers, producers and the government.

(10) To the Government:

Money is of immense importance to the government. Money facilitates the buying and collection of taxes, fines, fees and prices of services rendered by the government to the people. It simplifies the floating and management of public debt and government expenditure on development and non- developmental activities.

It would be impossible for modern governments to carry on their functions without the use of money. Not only this, modern governments are welfare states which aim at improving the standard of living of the people by removing poverty, inequalities and unemployment, and achieving growth with stability. Money helps in achieving these goals of economic policy through its various instruments.

(11) To the Society:

Money confers many social advantages. It is on the basis of money that the superstructure of credit is built in the society which simplifies consumption, production, exchange and distribution. It promotes national unity when people use the same currency in every nook and corner of the country. It acts as a lubricant for the social life of the people, and oils the wheels of material progress. Money is at the back of social prestige and political power.

Thus money is the pivot round which the whole science of economics clusters.

Role or Money in a Capitalist Economy:

A capitalist economy is one in which each individual in his capacity as a consumer, producer and resource owner is engaged in economic activity with a large measure of economic freedom. Individual economic actions are governed by the instruction of private property, profit motive, freedom of enterprise and consumers’ sovereignty. All factors of production are privately owned and managed by individuals who are at liberty to dispose them of within the prevalent laws. Individuals have the freedom to choose any occupation, and to buy and sell any number of goods and services.

Such an economy is essentially a money economy where money plays an important role in its functioning. Consumers and producers receive income in money. Consumers receive money income in the form of wages, rents, interest an dividends by selling the services of the factors of production which they own in the form of labour, land, and capital respectively. They are free to spend their money income on whichever goods and services they wish to buy. They may partly spend their money income and partly save in the form of money.

Big and small firms, in turn, buy the services of the factors of production for producing commodities. These services are purchased in money terms. The entire productive process in a capitalist economy is determined by the profit motive. Profit is the difference between outlay and receipt. All these—profit, outlay and receipt— are calculated in terms of money.

In fact, there is a circular flow of money in such an economy. Allirms demand the services of the factors of production to produce consumer goods. All factors of production are paid for their services in money, who buy consumer goods with it. Thus money flows back to firms which again make monetary payments to consumers for the services rendered by them in the further production of goods of varied types.

(i) Money and the Price Mechanism in a Capitalist Economy:

The most significant role of money lies in the functioning of the price mechanism. The price system functions through prices of goods and services. Prices determine the production of innumerable goods and services. They organise production and help in the distribution of goods and services. Since prices are expressed in money, the price mechanism under capitalism cannot function without money.

In a capitalist economy where means of production are owned privately and production is also carried out by private enterprise, money performs the important function of solving the central problems of such an economy. This is done through the price mechanism. The price mechanism operates automatically without any direction and control by the government.

The central problems of a capitalist economy as to what, how much, and how and for whom to produce are solved through the price mechanism. We discuss them as under. This problem of what, how much and how to produce are solved by the price mechanism on the basis of the profit motive. Profit is the difference between expenditure and receipt of a firm. The size of profit depends upon prices of commodities.

The larger the difference between price and costs, the higher is the profit. Again the higher the prices, the greater are the efforts of the producers to produce the different types of commodities in different quantities. On the other hand, prices depend upon consumers’ choices of the various commodities. It is also the consumer’s choices which determine what to produce, how much to produce, how to produce and for what type of consumers.

It is, it fact, competition between consumers and producers which equalises the demand and supply of both goods and services in a capitalist economy. There being sufficient flexibility under capitalism, prices adjust themselves to changes in demand, in production techniques, and in the supply of factors of production.

Changes imprecise, in turn, bring adjustments in production, factor demand and consumer incomes. Money is, therefore, the basis of the price mechanism under capitalism. It is a pivot around which the entire capitalist economy revolves. Since such an economy functions without any government interference, money plays a crucial role in maximising the wants of consumers and profits of producers.

For the Consumer:

Under capitalism, the consumer is the king who buys only those commodities which give him the maximum satisfaction with a given money income. This he does by equalizing the marginal utilities of different goods he wishes to buy.

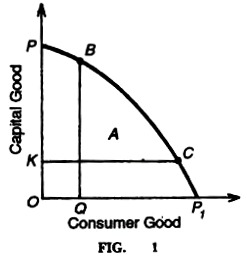

When the price of each commodity expressed in money equals its marginal utility, the consumer gets maximum satisfaction. Thus money enables a consumer to make a rational choice out of the various commodities he wants to buy with his given money income. Figure 1 illustrates this argument. Suppose only two commodities are produced in a capitalist economy.

They are capital goods and consumer goods taken on the vertical and horizontal axes respectively. The production possibility curve PP1 represents the area of choice for the consumer. It is for the producer to decide whether to produce capital goods or consumer goods depending on consumer’s rational choice. The consumer will choose either combination B or C which gives him the maximum satisfaction with a given money income. At combination A he will be buying lesser quantities of the two goods and will beat a lower level of satisfaction than at any point on the PP1curve.

For the Producer:

Money is equally important for the producer who buys and sells inputs and outputs in money. His aim being to maximise profits, he calculates the marginal cost and marginal revenue in money. Profits appear when marginal revenue exceeds marginal cost, and they lead to further production.

When marginal cost exceeds marginal revenue, losses appear and production is curtailed. But these situations do not continue for long. The price mechanism restores the equilibrium between marginal revenue and marginal cost at prices which do not need further adjustments. Thus producers earn normal profit which they receive in the form of money.

(ii) Basis of Capitalist Production:

In fact, money is the very basis of the capitalist production. By facilitating the purchase of inputs, and by increasing specialisation and division of labour, money helps in the growth of research in the agricultural, industrial and tertiary sectors of a capitalist economy.

Since all these sectors are mutually dependent and are based on mutual exchanges through money, capitalist production tends to increase. In other words, money help in capitalist production through a circular flow of goods and services from these sectors.

(iii) Basis of Credit:

The entire capitalist system of production is based on credit. Credit instruments are a form of money which are issued by banks to facilitate trade, commerce, agriculture, industry, transport, etc. under capitalism. It is on the basis of credit instruments that banks advance loans to the different sectors of a capitalist economy.

The amount of credit is determined by the interest rate which expresses the price of loanable funds, and loans find their expression in money.

(iv) Means of Capital Formation:

The very basis of capital and money is the most liquid form of capital. The growth of a capitalist economy depends upon the capital accumulation. And capital accumulation is a process whereby people save out of their money incomes, deposit them with banks and other financial institutions which, in turn, lend them to agriculturists, industrialists, transporters and other businessmen for investment in capital assets.

The different stages in the process of capital formation under capitalism—receiving income, saving and investing—are all performed in money terms.

(v) Link between the Present and the Future:

Money establishes a link between the present and future through the freedom of enterprise and freedom of consumption under capitalism. The freedom of consumption the part of the consumer leads to freedom to save a part of his money income. Saving leads to the production of capital goods via investment and capital goods contribute to the growth of the economy.

Thus it is through money that consumers save in the present and saving helps in production in the future. Similarly, freedom of enterprise under capitalism helps the businessman and the trader to make payments in the future for bargains made in the present. This is possible through money when the goods are stored in the present and sold in the future. It is in this way that money helps to establish a link between the present and the future.

(vi) Leads to Business Cycles:

Besides these apparent merits of money in a capitalist economy, it has one serious defect in that an excess of money leads to inflation and its shortage leads to deflation. These changes in the quantity of money result in cyclical fluctuations with their attendant consequences on the economy. In fact, an excess of money supply creates more demand which, in turn, leads to overproduction, to glut of commodities in the market and finally to depression and mass unemployment.

There is thus wastage of resources and loss in productivity when there are business cycles in a capitalist economy. But Schumpeter regarded business cycles as the cost of economic development, a permanent feature of the dynamic path of a capitalist economy which takes it to a higher level of development every time a cycle takes place.

In fine money plays a crucial role in the functioning of a capitalist economy.

Role or Money in a Socialist Economy:

In a socialist economy, the central authority owns and controls the means of production and distribution. All mines, farms, factories, financial institutions, distributing agencies (such as internal and external trade, shops, stores, etc.) means of transport and communications, etc., are owned, controlled and regulated by government departments and state corporations. Therefore, the pricing process in a socialist economy does not operate freely but works under the control and regulation of the central planning authority.

Marx believed that money had no role to play in a socialist economy because it led to the exportation of labour at the hands of capitalists. He, therefore, advocated the habilitation of money and exchange by bartering goods measured in terms of labour value.

In keeping with the Marx an ideas, the Bolshevik Government in Russia eliminated money as a medium of exchange in 1917. Money payments for the use of various services and goods were abolished. “But barter transactions proved to be too clumsy. Although some communist writers had prematurely hailed the dying out of money, it became obvious that the socialist economy needed a stable currency nearly as much as a private enterprise economy.”

Accordingly, market exchanges, money and monetary incentives were reintroduced in the New Economic Policy (1921-27) in the USSR. Since then the Soviet economy has been using money in production, distribution and exchange such that money acts as a medium of exchange, a store of value, and a unit of account.

We have given above a brief description of the role of money in the Soviet economy which is the finest variant of a socialist economy in action.

Theoretically, the role of money in a socialist economy is different from that in a capitalist economy.

(i) Money and Price Mechanism in a Socialist Economy:

The price mechanism has little relevance in a socialist economy because it is regarded as a distinguishing feature of a free market economy. In a socialist economy the various elements of the price mechanism—costs, profits and prices—are all planned and calculated by the planning authority in accordance with the objectives and targets of the plan. Thus rational economic calculation or allocation of resources is not possible in a socialist economy. Let us find out how a socialist society solves the central problems of an economy, what, how and for whom to produce.

In a socialist state, it is the central planning authority that performs the functions of the market. Since all the material means of production are owned, controlled and directed by the government, the decisions about what to produce are taken within the framework of a central plan.

The decisions, as to the nature of goods to be produced and their quantities, depend upon the objectives, targets and priorities laid down by the central planning authority. The prices of the various commodities are also fixed by this authority. Prices reflect the social preferences of the common man. Consumer’s choice is limited only to the commodities that the planners decide to produce and offer.

The problem of how to produce is also decided by the central planning authority. “It establishes the rules for combining factors of production and choosing the scale of output of a plant, for determining the output of an industry, for the allocation of resources, and for the parametric use of prices in accounting.”

The central planning authority lays down two rules for the guidance of plant managers. One, that each manager should combine productive goods and services in such a manner that the average cost of producing a given output is the minimum. Two, that each manager should choose that scale of output which equalises marginal cost to price.

Since all resources in the economy are owned and regulated by the government, the raw materials, machines and other inputs are also sold at prices which are equal to their marginal cost of production. If the price of a commodity happens to be above its average cost, the plant managers will earn profits, and if it is below the average cost of production, they will incur losses. In the former case, the industry would expand and in the latter case it would cut down production, and ultimately a position of equilibrium well be reached by the process of trial and error.

The process of tried and error would, however, proceed on the basis of historically given prices which would necessitate relatively small adjustments in prices from time to time. Thus “all decisions of the managers of production and of the productive resources in public ownership and also all decisions of individuals as consumers and as suppliers of labour are made on the basis of these prices. As a result of these decisions the quantity demanded and supplied of each commodity is determined.

If the quantity demanded of a commodity is not equal to the quantity supplied, the price of that commodity has to be changed. It has to be raised if demand exceeds supply and lowered if the reverse is the case. Thus the central planning board fixes a new set of prices which serves as a basis for new decisions, and which results in a new set of quantities demanded and supplied.”

The problem of for whom to produce is also solved by the state in a socialist economy. The central planning authority takes this decisions at the time of deciding what and how much to produce in accordance with the overall objectives of the plan. In making this decision, social preferences are given weightage.

In other words, higher weightage is given to the production of those goods and services which are needed by the majority of the people over luxury items. They are based on the minimum needs of the people, and are sold at fixed prices through government stores. Since goods are produced in anticipation of demand, an increase in demand brings about shortages and this leads to rationing.

Thus in a socialist society the problem of income distribution is automatically solved because all resources are owned by the state and their rewards are also fixed and paid by the state. Economic surpluses are deliberately created and utilised for capital accumulation and growth.

(ii) Capital Accumulation:

Besides, capital accumulation is possible through money. It is money that provides liquidity and mobility required for capital accumulation. In a socialist economy the sources of investment funds are basically the same as under a capitalist economy. The turnover tax, planned profits of public enterprises, amortization quotas and taxation of agricultural produce in kind or in low procurement prices are all expressed in money and help in capital accumulation.

Foreign Trade:

Moreover, socialist economies do not enter into foreign trade on bilateral trade relations based on commodity transactions. Rather, being members of the World Bank and the IMF, they make payments in monetary terms in their international trade relations.

Circular Flow of Money:

There is also circular flow of money in a socialist economy. The producing units receive funds for investment from the state budget as grants or as loans from the state bank to purchase the necessary inputs and for making payments to workers. The workers spend their wages on consumer goods.

The producing units receive revenues from sales, which, in turn, go into tax payments and profit earnings and as repayments of loans to the state bank. These funds again flow from the state budget and the state bank to the producing units. Thus money helps in the circular flow of goods and services in a socialist economy.

To conclude, the role of money in a socialist economy may be less important as compared to a capitalist economy due to state regulation and control. Nevertheless, it helps in fixing prices, wages, incomes and profits. It guides a socialist economy in determining the allocation of its resources equitably, in capital accumulation and flow of resources within and outside the economy.

8. Essay on the Defects of Money:

The Bible says, “The love of money is the root of all evil.” Rightly so. Perhaps acting on this saying of the Bible the classical economists did not attach much importance to money. They regarded it as a veil or garment or wrapper for goods and services. According to them, money is simply a tool of convenience to facilitate the exchange of goods and services, but it is not a determinant of the quantities produced.

The evils of money are shrouded behind a monetary veil, and what really happens behind the veil is sometimes quite different from what appears to take place on the surface. This extreme view has been discarded.

Now economists regard money not merely as veil but also as an extremely valuable social instrument promoting wealth and welfare. But money which is a useful servant, often misbehaves when it tries to act like a master. This leads to a number of economic and non-economic defects of money.

Economic Defects:

The economic defects are as under:

(1) Instability in the Value of Money:

The first drawback about money is that its value does not remain stable over time. When the value of money falls, it means rise in the price level or inflation. On the contrary, rise in the value of money means fall in the price levels or deflation. These changes are brought about by increase or decrease in the supply for money. Large changes in the value of money are disastrous and even moderate changes have certain disadvantages.

Inflation or fall in the value of money causes direct and immediate damage to creditors and consumers. On the contrary, deflation or rise in the value of money brings down the level of output, employment and income. Thus instability in the value of money adversely affects consumers, producers and other sections of the society.

(2) Unequal Distribution of Wealth and Income:

The second defect of money is that changes in the value of money lead to unequal distribution of wealth and income. Inflation or deflation which brings benefits to some and damages to others leads to redistribution of wealth and income not only between social and industrial classes, but between different persons in the same class. Such changes in the structure of the society. Widen the differences between the rich and the poor and lead to class conflict.

(3) Growth of Monopolies:

Too much of money leas to the concentration of capital in the hands of a few capitalists. This leads to growth of monopolies which exploit both consumers and workers.

(4) Wastage of Resources:

Money is the basis of credit. When banks create too much of credit, it may be used for productive and unproductive purposes. If much credit is used for production, it leads to over capitalisation and overproduction, and consequently to wastage of resources. Similarly, if liberal credit facilities are given for unproductive uses, they also lead to wastage of resources.

(5) Black Money:

Money being the store of value lures people to hoard it. The tendency to hoard money and become rich is the root cause of the evil of black money. When people evade taxes and conceal their income and hoard it, it is black money. This leads to a “parallel” economy within the country which encourages conspicuous consumption, black marketing speculation, etc.

(6) Cyclical Fluctuations:

Another defect of the institution of money is that it leads to cyclical fluctuations in the economy. When the supply of money increases it leads to a boom and when it contracts there is a slump. In a boom, output, employment and income increase which lead to overproduction. On the contrary, they decline during a depression, thereby leading to under consumption. Such cyclical fluctuations bring untold miseries to the people.

Non-Economic Defects:

Money has the following non-economic defects:

(1) Besides the above noted economic drawbacks of money the institution of money has brought down the moral, social and political fibre of the society. It leads to corruption, turpitude, political bankruptcy and artificiality in religion based on materialism. In fact, money is “the cause of theft and murder, of deception and betrayal. Money is blamed when the prostitute sells her body and when the bribed judge perverts the law. Significantly enough avarice is called the love of money; all evil is attributed to it.”

(2) Political Instability:

Over-issue of money leading to hyper-inflation leads to political instability and downfall of government. This has happened in many Latin American countries.

(3) Tendency to Exploit:

People who want to amass money and wealth, adopt underhand methods and have tendency to exploit others. Even nations are not far behind in this. As pointed out by Davenport, “Money has enabled strong nations to destroy backward communities to win them on their side with the help of financial aid.”

Conclusion:

All these defect are not due to money but are the result of the attribute of man towards the use of money. It is of immense importance to every type of society whether it be capitalist or socialist. It is impossible to imagine this world without money. Money is an indispensable lubricant, a tool of convenience, for a continuous and smooth functioning of the economic machine.

But its uncontrolled use, instead of solving, creates many complicated problems. It is these complex problems that led Disraeli to remark. “Money has made more people mad than love.” So the best way is to keep money under control like a faithful and obedient money is the government which can achieve this by a judicious monetary policy.