Here is an essay on ‘Money Market’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Money Market’ especially written for school and college students.

Essay on Money Market

Essay Contents:

- Essay on the Meaning and Definitions of Money Market

- Essay on the Nature or Features of Money Market

- Essay on the Instruments of Money Market

- Essay on the Shortcomings of Indian Money Market

- Essay on the Measures to Improve Indian Money Market

Essay # 1. Meaning and Definitions of Money Market:

Money market refers to all those activities and institutions which relate to sale and purchase of money. Sale and purchase of money refers to granting and receiving loans. Generally, loans are both short-term and long-term but there is only exchange of short-term loans in the money market.

In other words, like the market of commodities, money too has its market and there are sellers and purchasers in this market. The purchaser of market includes all those people, traders and industrialists who take loan from this market for the purpose of production. On the other hand, the seller of money includes those people and creditors who give their money as loan to those people who need it.

Just as in the market of goods and commodities, the prices are determined by the force of demand and supply, similarly in the money market, the value of money is determined by the demand and supply of money. This determined value is referred to as the rate of interest.

The important definitions of money market are as follows:

(1) According to Crowther, “Money market is the collective name given to the various firms and institutions that deal in the various grades of near money.”

(2) According to Prof. K.C. Chacko, “Money market may be defined as a place where short-term funds are bought and sold.”

(3) According to Sayers, ‘The money market properly speaking is the market for short term and day to day loans.

(4) According to a Publication of Reserve Bank of India, “Money market is the centre for dealing mainly of short-term character, in monetary assets. It meets the short-term requirements of borrower and provides liquidity or cash to tenders.”

On the basis of above definitions, it can be said that money market refers to that total area where the short-term seller and purchaser of money come in contact with one another and determine the value of money through its demand and supply to meet the requirements of one another. This determined value is called the rate of interest.

Essay # 2. Nature or Features of Money Market:

The main features of money market are described below:

(1) Dichotomy:

The most important feature of Indian Money Market is its dichotomy. It means that it is divided into two sectors—organised and unorganised. There is lack of proper contact and co-operation between these two. Reserve Bank of India, State Bank of India and other commercial banks, foreign banks etc. fall in the category of organised sector while the money lenders and native bankers are included in the unorganised sector.

(2) Transactions:

Transactions in the money market can be done with or without the help of brokers or mediators.

(3) Speedy Transactions:

The speed of practical activities in the money market is very fast. Most of the activities in it are done through telephone and the concerned paper work is done later. So, it is also called over the phone market.

(4) More Liquidity:

There is excess liquidity in the money market. It helps in providing ready market for money market instruments.

(5) Narrow Market:

It is a feature of Indian Money Market that it is the narrow market of government and semi-government securities. It limits the area of open market operations of credit control.

(6) Lack of Control of Unorganised Sector:

There is control of the Central Bank on the organised sector of Indian money market but there is no control of any institution on the unorganised sector. Consequently, the rate of interest in this sector is high.

(7) Appropriate Approach:

Money market provides an appropriate approach to the users of short-term funds to meet their requirements on proper conditions and interest rates. In other words, it establishes a balance between short-term financial demand and supply.

(8) Main Part of Financial Market:

Money market is the main part of financial market. It meets the short-term financial requirements of traders, industrialists and the government.

(9) Insufficient Development of Sub-Market:

There are many sub- markets of Indian money market but all these are not well developed. For example, despite many efforts the bill market in India is undeveloped.

(10) Consists of Many Sub-Markets:

Money market is a group of many sub-markets. In includes call money market, Treasury bill market, commercial paper market etc.

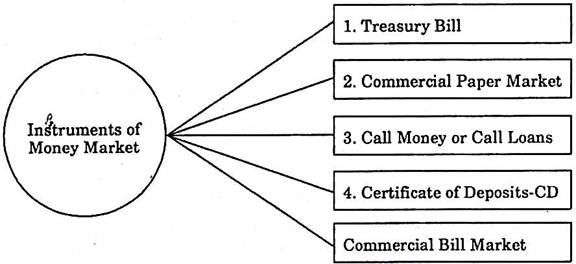

Essay # 3. Instruments of Money Market:

Money market is a group of many sub-markets. There is competition among these sub-markets.

The instruments through which the transaction of short- term loans takes place in these sub markets are as follows:

(1) Treasury Bill:

Treasury bill refers to that instrument of money market which is issued by Reserve Bank of India on behalf of the government of India to meet the short-term financial requirements of central government. These bills are generally purchased by commercial banks, non-banking financial institutions, Life Insurance Corporation, General Insurance Corporation, Unit Trust of India etc.

The maturity period of Treasury Bills are generally 14 days, 91 days, 182 days or 364 days. The nature of this bill is that of negotiable instrument and these can be transferred independently. These bills are considered extremely liquid and safe and no interest is paid on these. On the other hand, they are issued on discount. The minimum amount of this instrument is Rs. one lakh. However, it can be purchased by common people also but due to low rate of interest, they don’t invest in it.

Dealing Process:

Treasury bill is issued on a low price as compared to their market value while the maturity payment is on the face value. The difference between the face value and the issue value is the profit of the investors. The difference is called discount. No interest is paid on the Treasury bill, so it is also called Zero Coupon Bond.

The determination of discounting on the Treasury bill can be in two ways:

(i) On the Basis of Pre-Determined Discount Rate:

Pre-determined discount rate refers to the system of determining the amount of discount of the time of issuing of the bill itself. For example, if the treasury bill of Rs. 1 lakh is issued for a certain period at Rs. 95 thousand, the investor will get a profit of Rs. 5 thousand in that particular period.

(ii) On the Basis of Auction:

To issue Treasury bill on the basis of auction, Reserve Bank of India invites tenders through advertisement in newspapers. Among the different tenders received, the one with the minimum rate of discount is accepted.

These days, Treasury Bills are issued mostly on the basis of auction:

(2) Commercial Paper Market:

Commercial paper is an unsecured and unsafe Promissory Note. So, it is issued only by the reputed companies. Its purchasers include banks, Insurance Companies, Unit Trust of India and firms etc. It is issued generally to obtain working capital. Its period is generally up to 12 months. The minimum face price of a commercial paper is at least Rs. 5 lakhs. It can be sold directly or indirectly, it means the company can sell these commercial papers directly to the purchasers or it can do so with the help of certain agency.

Dealing Process:

This instrument is very popular in USA, England, Japan, Australia etc. It was started in India in 1990. It is issued for a maximum period of 12 months. Generally, it is issued on discount but sometimes it is issued on certain interest rates. There is no active secondary market for it but the issuing company repurchases it on request.

(3) Call Money or Call Loans:

It refers to such loan instrument which is paid on the basis of short notice. The period of loan in it is from 1 to 15 days with the view of liquidity, its place is just after cash. The loan receiver are those banks which face temporary shortage of cash and the loan provider are those banks which have temporary surplus of cash.

It is used by banks to control SLR (Statutory Liquid Ratio). These days, insurance companies, financial institutions and mutual funds also supply short term funds. The transactions of call money are done generally through telephone and documentary formality.

Dealing Process:

The number of those who deal with the help of this instrument is very limited but the amount of every dealing is very high. The minimum amount of this instrument is Rs. 10 crore but most of the dealing are of Rs. 100 crore. Its initial dealing is through telephone and paper work is completed later.

The creditor grants credit to the debtor by issuing a cheque of Reserve Bank of India. The debtor pays the loan through a cheque of Reserve Bank of India and gets back receipt. This loan is for a very short term but can be renewed as per need.

(4) Certificate of Deposit (CD):

Certificate of Deposit is a negotiable document. It can be transferred through endorsement after a certain period. It is issued by scheduled commercial banks and other financial institutions like IFCI, SIDBI, EXIM Banks etc. to people, federations, companies, corporations etc. The minimum marked price of certificate of deposit is Rs. 5 lakhs and it is essential for an investor to take certificate of deposit for the minimum amount of Rs. 25 lakhs. Its period is from 91 days to 1 year.

Dealing Process:

The duration of certificate of deposit is from 91 days to 3 year. It is issued on discount; it can be endorsed to any person after 45 days of purchasing. The stamp duty on it has to be paid on the basis of market price.

(5) Commercial Bill Market:

Bill Market refers to that sector in which short-term bills are purchased and sold. An organised bill market is very essential for the proper development of money market of any country, but unfortunately there has not been proper development of bill market in India so far now.

In the modern time, the transactions of goods are done both on cash and credit. In the situation of selling on credit, the seller wants to get an assurance of payment on a certain time from his purchaser or debtor. The purchaser can give the assurance of payment with the help of various kinds of credit instruments. These include bill of exchange, promissory note, hundi etc.

According to section 5 of Indian Negotiable Instrument Act, 1881, “A Bill of Exchange is an instruments in writing, an unconditional order signed by the maker directing to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument.”

Bill of exchange is considered legal when such permission is accepted in written by the debtor.

Characteristics of Bill of Exchange:

The main characteristics of bill of exchange are as follows:

(i) It is an unconditional written order.

(ii) It is an order of payment and not a request for payment.

(iii) This order is unconditional.

(iv) This contains the signature of the drawer.

(v) It contains the acceptance of debtor.

(vi) The date of payment is fixed.

(vii) It is stamped as per rules.

(viii) It can be endorsed.

(ix) The payee of bill of exchange is a certain person.

(x) Its payment is made in the money in circulation in the country.

Parties to a Bill of Exchange:

A bill of exchange has three parties:

(1) Drawer:

The drawer of a bill of exchange is that seller or creditor who is authorised to get its payment. It also contains the signature of the drawer.

(2) Drawee or Acceptor:

It is the debtor. Bill of exchange is written in the name of this person. The drawee signs on it for its acceptance.

(3) Payee:

It is the person who has to obtain the amount of the bill. Generally, the obtainer of the amount is drawer of the bill, but in the case of endorsement or discounting the bill with bank, the obtainer of the amount becomes the person in whose name the bill has been endorsed or the bank respectively.

Dealing Process:

When a seller sells goods on credit, he draws a bill of exchange in the name of the purchaser. The purchaser signs the bill to indicate his acceptance and returns it to the seller or creditor. This is a short term document which is generally issued for 90 days. Days of grace for a period of 3 days are also given for its payment.

On the date of maturity, the creditor takes the amount from his debtor and returns the bill. If the purchasers need the amount before period, he can get it discounted with the bank. Besides, there can also be endorsement of bill of exchange.

Advantages or Importance of a Bill of Exchange:

The main advantages or importance of the use of a bill of exchange are as follows:

(i) The use of bill of exchange leads to the expansion of credit and also of trade.

(ii) It is an evidence of loan.

(iii) It is a legal document. So, as per need it can be produced in the court as evidence.

(iv) It can be discounted with the bank and instant financial requirement can be met.

(v) It can be endorsed in the favour of other person.

(vi) Loan can be obtained from financial institution using it as mortgage.

(vii) There is saving of liquid money with the help of its use.

(viii) It can be used in foreign payment also.

(ix) It is easy to make financial planning as the date of payment is fixed.

(x) The trade remains unaffected even in the scarcity of cash.

Bill Market in India:

Bill market has been undeveloped in India. The Indian Central Banking Inquiry committee had recommended for a well organised bill market in India in 1931. But then British government did not pay any attention to this recommendation. Consequently, there could not be any development in this direction.

There are following causes for the unavailability of a developed and organised bill market in India:

(1) Hundi had been in use in India since ancient time. Hundis are written in the regional languages. So there is a lack of uniformity in form, language and types of Hundis. The bill of exchange could not be used on the national level due to these dissimilarities.

(2) Cash credit has had an important contribution in the development of commercial banks in India. Due to the easy availability of cash credit the bill of exchange could not get much popularity.

(3) High cost due to stamp on bill of exchange was also a barrier of development.

(4) High rate of discounting in the case of getting it discounting with banks also became a barrier in its use.

(5) There has been lack of institutions getting the bill accepted on behalf of customers.

(6) The tendency of commercial banks to invest money in government securities also created barrier in the development of bill market.

(7) The Reserve Bank also started its attempts very late in this direction.

(8) The lack of awareness for its use among the traders has also been a barrier in its use.

Bill Market Scheme of Reserve Bank:

Reserve Bank started a bill market scheme from 16th Jan. 1952 with the objective of encouraging the bill market in India. According to this scheme, Reserve Bank gave the banks the facility that they can convert the demand promissory notes obtained from their customers in return for cash credit, overdraft or loans into certain promissory notes of 90 days or bills of the same time.

At the same time they were also allowed to take demand loan from Reserve Bank on the mortgage of these tenure bills. Initially, this scheme was limited for those scheduled banks only which had at least Rs. 10 crore as their total deposit. A bank had to take loans for a minimum amount of Rs. 25 lakh and the minimum amount of bill were determined to be Rs. 1 Lakh. The small banks were not able to get the benefit of this scheme due to these conditions.

Again in June 1953, this scheme was implemented on banks having a deposit of Rs. 5 crore or more. In July 1954, all those schedule banks which had the license of doing banking work were included in this scheme. It means the condition of amount of deposit was removed. At the same time, the limitation of loans to be taken by banks was reduced from Rs. 25 lakh to 110 lakh.

Initially, this scheme was for one year and its minimum amount was determined to be Rs. 2 lakh. The minimum amount for every bill was determined to be Rs. 20 thousand. From October 1959, the minimum amount of Loan was reduced to be Rs. 1 Lakh and the minimum amount per bill was determined to be Rs. 10 thousand. From Jan. 1961, the amount per bill was reduced to be Rs. 5 thousand.

An amendment in the Reserve Bank of India Act was made in September 1962 and the period of export bill for sale and purchase and rediscounting was increased up to 180 days. To encourage the export, Reserve Bank of India launched Export Bill Credit Scheme from March 1963. According to it, the scheduled bank declares the export bills under their authority and writes promissory notes to RBI. They get loan from RBI on the basis of this promissory note.

New Bill Rediscounting Scheme, 1970:

According to the recommendations of the observation committee set up in February, 1970, RBI launched a new scheme in November 1970. It was called Bill Rediscounting Scheme, 1970.

There was an arrangement in this scheme that RBI will accept such trade bills for rediscounting which have been presented by the licensed scheduled banks and the bill has been written by the licensed banks and also accepted by the licensed banks. If it is not so, it must contain the signature of any licensed scheduled bank.

The general period of the bill was determined to be 90 days but in special circumstances, it was allowed to accept bills for 120 days also. The minimum amount of every bill of exchange presented before RBI for rediscounting was determined to be Rs. 5 thousand.

At the same time, the total amount of bill of exchange presented before RBI at a time should not be less that Rs. 50 thousand. It was expected from scheduled banks that they should get more and more benefits from this scheme and get the bill discounted by them rediscounted by RBI.

Two important steps were taken by RBI in 1974-75 under Bill rediscounting scheme.

These steps are as follows:

(i) The scheduled commercial banks could have their bill of exchange rediscounted by some other institutions besides RBI such as other commercial banks, Life Insurance Corporation, General Insurance Corporation, Unit Trust of India etc.

(ii) The facilities of rediscount ting of bills were provided from the Ahmedabad office of RBI since 1st April, 1975.

Evaluation:

However the Bill Market scheme of RBI has played a commendable role in encouraging the bill market in India, it had certain lackings:

(i) It was a major drawback of this scheme that it did not provide the system of independent sale and purchase of bills. Instead, it made arrangement for changing bills into tenure bill by scheduled banks.

(ii) It was expensive to change demand bills into tenure bills.

(iii) It was not favourable for smaller banks because they fell short of the minimum limits of loans and bills.

(iv) It was not capable of fulfilling the long term financial requirements.

(v) Non-banking finance institutions were kept away from this scheme.

(vi) This scheme could meet only seasonal requirements.

(vii) There was lack of flexibility in the condition of getting loan under this scheme.

(viii) There was no provision for agricultural loan in this scheme.

Suggestions for the Development of Bill Market:

Following suggestion can be given for the development of bill market in India:

(i) However stamp duty was reduced by the government of India, according to the recommendations of Indian Central Banking Inquiry committee, there is need of more reduction in it.

(ii) There should be standardisation of bills and hundis in use in India for the organised development of bill market.

(iii) Clearing houses should be set up in the country and they provide the same kind of assistance in the payment of bills they provide to banks.

(iv) To encourage the agricultural bills written on the basis of standing crops could be accepted and there should be arrangement of granting loans on the basis of their mortgage.

(v) Acceptance houses should be established on large scale in the country.

(vi) There should be establishment of licensed godowns in large number so that agricultural bills can be written on the basis of agricultural products kept in godowns.

(vii) The use of hundis of native bankers should also be encouraged like other bills.

Essay # 4. Shortcomings of the Indian Money Market:

It’s essential to have a developed money market for the consolidation of Indian economy. But the Indian money market is still undeveloped.

Their main shortcomings are:

(1) Lack of Organisation and Cooperation:

Indian money market is divided into two parks organised and unorganised. There is neither organisation nor cooperation between these two. The sub-market of the money market also competes among them. Such a situation is not proper for the economy of any country.

(2) Multiplicity of Indigenous Bankers and Mahajans:

Indigenous bankers and mahajans have much influence in the Indian money market. They don’t have any control of RBI over them. As a result, it is not affected by the interest rate of the market. Sometimes due to this monetary policy of RBI doesn’t succeed properly.

(3) Dissimilarities in Interest Rates:

There is difference in the interest rates of the organised and unorganised sectors. At the same time there is difference in the interest rates within the organised sector itself. The different rates of interest are affected on the loans of different institutions. It is a major shortcoming of the money market.

(4) Seasonal Scarcity of Money:

There is a peak period with the respect of transactions of loan in the Indian money market from Oct-Nov. to April-May. In this period, there is an increased demand of money but there is no increase in the supply. Consequently, the rate of interest increases in this period.

The increase in the demand of money in this period is to meet agricultural requirements. Again, during the thin period the demand of money is less and it lowers the rate of interest of the economy. Fluctuation in interest rate is not in favour of the economy.

(5) Lack of all India Money Market:

Indian money market is divided into regional sub-market. There is lack of an all India money market. There is also lack of mutual communication in these regional markets.

(6) Lack of Organised Bill Market:

The bill market is still underdeveloped in India for various reasons while the bill market is not only an effective organ of the money market but it benefits the purchasers, sellers and banks.

(7) Lack of Clearing Houses:

However, there are large numbers of clearing houses in the country, but their member is still insufficient. Most of the clearing houses in the country are organised by the State Bank of India. There are many faults in its working which causes inconvenience to customers.

Essay # 5. Measures to Improve Indian Money Market:

Money Market is an important organ of the economy of the country. So, many steps have been taken from time to time by the government to remove the shortcomings of this market. RBI was established in 1935 and it was nationalised in 1949. Banking companies Act was implemented in 1949 and there have been several amendments in it at various points of times.

Again, the establishment of SBI and nationalisation of commercial banks are considered steps taken for the improvement of money market. A committee, popularly known as Sukhmay committee, was set up to give recommendations for the improvement and development in the monetary system.

This committee gave many recommendations in 1985. RBI set up a work force, in the chairmanship of Mr. N. Bhaghal to consider over these recommendations. It presented its report in 1987. Many measures for the improvement in the money market were taken on the basis of these recommendations. RBI set up Discount and finance House of India—DFHI with the cooperation of the public sector banks and the other major financial institutions.

The commercial paper and deposit certificate were started in 1988-89. The regulation of interest rate was made flexible and the determination of it started to take place with the forces of demand and supply. There was also expansion of government security market. A new credit evaluation agency called Onida Individual Credit Rating Agency of India Limited ONICRA was started in November 1993 for evaluation of personal credit.

This eased the job of credit evaluation of the persons demanding credit for trade. However, the dominance of indigenous bankers and mahajans still continues. Their activities have weakened after the foundation of Regional Rural Banks.

Despite the above mentioned steps, there is the need of adopting following measures:

(i) RBI should determine solid policies for the regulation of unorganised sector of money market.

(ii) It should observe whether the rural people are properly profited by the development of co-operative banks or not.

(iii) There should be standardisation of hundis by bringing uniformity in these.

(iv) There should be increase in the numbers of clearing houses.

(v) There should be development of bill market.

(vi) The mutual cooperation and organisation of financial markets should be strengthened.

(vii) There should be increase in the facility of money transfer considering the common people.

(viii) The use of credit instruments should be promoted.

(ix) The branches of banks should be established in the areas where these are not presented.

(x) The banking habit should be developed among people.