After reading this article you will learn about:- 1. Evolution and Development of Public Sector Enterprises in India 2. Public Enterprises of State Governments 3. Role of Public Sector in the Indian Economy 4. Position of CPSEs in India during 2010-11 5. Changes in Public Opinion on the Public Sector Enterprises in India and Other Details.

List of Essays on Public Sector Enterprises in India

Essay Contents:

- Essay on the Evolution and Development of Public Sector Enterprises in India

- Essay on the Public Enterprises of State Governments

- Essay on the Role of Public Sector in the Indian Economy

- Essay on the Position of CPSEs in India during 2010-11

- Essay on the Changes in Public Opinion on the Public Sector Enterprises in India

- Essay on the Performances of Public Sector Enterprises in India

- Essay on the Problems of Public Sector Enterprises in India

1. Essay on the Evolution and Development of Public Sector Enterprises in India:

During the pre-independence period, public sector participation in economic activity was virtually absent in Indian economy. The only organisations which were under the management and control of the government during those days were the Railway, the Port Trust, the Posts and Telegraphs, the Aircraft and Ordinance Factories. In the post-independence period, a huge expansion of the public sector was undertaken particularly after the introduction of Industrial Policy, 1956.

In the meantime things have changed a lot after the proclamation of 1956 policy. Since then public sector started to receive a lot of additional facilities in respect of credit, physical resource allocation, foreign exchange, market preference etc. inspite of the promise made in the policy to provide equal treatment to both public and private sector.

Public enterprises at present constitute a major national capability in terms of their scale of operations, coverage of the national economy, technological capabilities and stock of human capital. These enterprises include departmental enterprises (e.g., railway, post and telecommunication), financial institutions (SBI, IFCI, IDBI) and non-departmental enterprises or Government Companies e.g., SAIL, IPCL).

Non-departmental enterprises account for 75 per cent of value addition, more than 50 per cent of gross investment and about one-third of the total employment in PSEs. PSEs contribute the entire output of petroleum, lignite, copper and lead, 98 per cent of zinc, over 70 per cent of the coal, more than half of steel and aluminium and about one- third of fertilizers.

Central Government Enterprises:

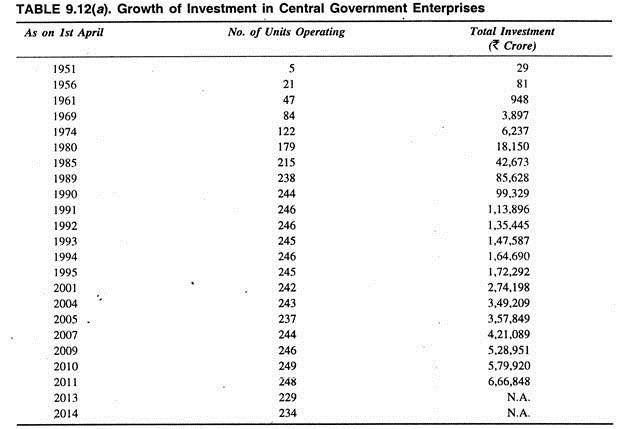

Total number of public sector enterprises in India under the Central Government, excluding banks, financial institutions, departmental undertaking like Railway, Ports etc. has increased from 5 in 1951 to 234 in 2014. Total amount of investment has also increased from a mere Rs 29 crore in 1951 to Rs 6, 66,848 crore in 2011 showing an increase of 14.8 per cent over 2009-10. Table 9.12(a) shows the growth of investment in Central Government undertaking.

Average rate of growth of investment in Central Public Enterprises (at current prices) during the period 1960-61 to 1968-69 was 19.3 per cent which gradually declined to 9.9 per cent during the period 1968-69 to 1973-74 and then again increased to above 20.1 per cent during the period 1980-81 to 1997-98. Thus, there was a sudden spurt in the investment of public sector enterprises during the 1960s and also during 1980s.

Regarding the patterns of investment in Central Government Undertakings, Public Enterprises Survey, 2004-05 reveals same interesting picture. Table 9.12(a) also clarifies the situation.

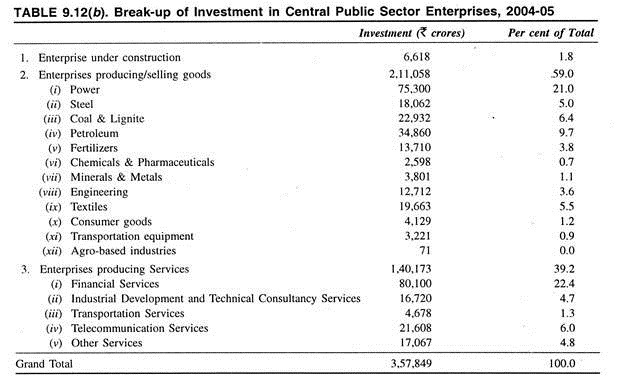

Table 9.12(b) reveals that the bulk of the investment is made in those enterprises producing and selling goods and at the end of March 2005, Rs 11,058 crore, i.e., 59.0 per cent of investment was made in this category of industries. Within this category, the major portion of the investment (53.0 per cent) is made on basic industries such as power, steel, coal and lignite, Petroleum, Fertilizer, chemicals, Pharmaceuticals, Minerals and Metals, Engineering etc.

Moreover, 39.2 per cent, i.e., Rs 1, 40,173 crore is invested on enterprises producing services. Among the services enterprises, financial services occupied the most important position accounting for Rs 80,100 crore, i.e., 22.4 per cent followed by Telecommunication Services (6.0 per cent) and Industrial development and Technical Consultancy Services (4.7 per cent), Transportation Services (1.3 per cent) and Other Services (4.8 per cent).

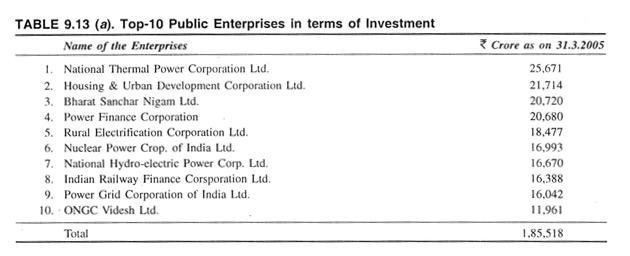

The Public Enterprises Survey, 2004-05 also reveals the giant top-10 enterprises of Central Public Sector Enterprises (CPSEs). The table 9.13 (a) reveals that the total volume of investment made in these giant top- 10 CPSEs accounted for Rs 1,85,518 crore as on 31st March, 2005, which was about 52.0 per cent of the total investment made in 237 CPSEs.

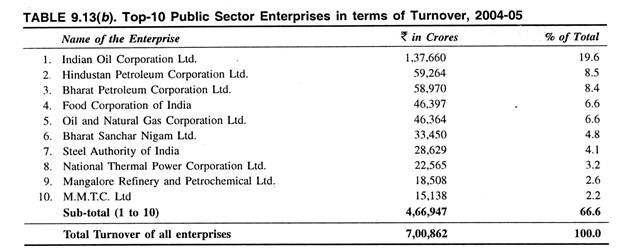

Table 9.13 (a) reveals that in terms of investment, National Thermal Power Corporation Ltd. clearly topped the list of top-10 CPSEs in India followed by Housing and Urban Development Corporation Ltd. However, in terms of gross turnover in 2004-05, the Indian Oil Corporation Ltd. (IOC) topped the list of top-10 CPSEs with a total turnover of Rs 1,37,660 crore (19.6 per cent), followed by Hindustan Petroleum Corporation Ltd. Rs 59,264 crore (8.5 per cent) and Bharat Petroleum Corporation Ltd. Rs 58,970 crore (8.4 per cent).

These top three petroleum companies jointly contributed 36.5 per cent (Rs 2, 55,894 crore) of the total turnover of CPSUs. Again these top-10 enterprises jointly contributed Rs 4, 66,947 crore or 66.6 per cent of the total turnover of Rs 7, 00,862 crore of all CPSUs. Table 9.13(b) reveals a clear picture on the aforesaid issue.

Navaratna, Maharatna and Miniratna Schemes:

In order to delegate enhanced financial and operational powers to the CPSEs, the Government had introduced the Navaratna and Miniratna schemes. During 2009-10, the government introduced the Maharatna scheme to empower mega Navaratna CPSEs to expand their operations both in domestic as well as foreign markets. Two more CPSEs, i.e., Oil India and Rashtriya Ispat Nigam Ltd. were granted Navaratna status in 2010-11 and there are now 16 Navaratna CPSEs as a result.

Three more CPSEs, namely the bridge & Roof Company Ltd. Bharat Pump & Compressors Ltd. and National Seed Corporation Ltd. were granted Miniratna status during the year and presently there are 62 Miniratna CPSEs working in our country.

Maharatna Scheme:

Maharatna Scheme was introduced by the government in December 2009 with the objective to delegate enhanced powers to the Boards of identified large sizes Navaratna CPSEs to facilitate further expansion of their operations, both in domestic and global markets.

In addition to having Navaratna powers, the Maharatna CPSEs have been delegated additional powers in the area of joint venture subsidiaries and human resource development. Accordingly, the Maharatna CPSEs can invest Rs 5,000 crore in one project (Rs 1,000 crore for Navaratana CPSEs) and can create below Board level posts upto E-9 level.

In 2010-11, the government conferred Maharatna status to 4 CPSEs namely:

(i) Indian Oil Corporation Limited,

(ii) Oil and Natural Gas Commission Limited,

(iii) NTPC Limited, and

(iv) Steel Authority of India Limited.

Navaratna Scheme:

In 1997, the government introduced the Navaratna Scheme in order to identify CPSEs that enjoy comparative advantages in their respective sectors and to support them in their drive to become global giants. The Navaratna CPSEs have been provided additional autonomy and delegation of powers in order to incur capital expenditure to enter into technology joint ventures/strategic alliances, to effect organizational restructuring, to create and wind-up ports-up to Board level and also to raise capital both from domestic and international markets.

Presently, there are 16 Navaratna CPSEs viz.:

(i) Bharat Electronics Limited,

(ii) Bharat Heavy Electricals Limited,

(iii) Bharat Petroleum Corporation Limited,

(iv) Coal India Limited,

(v) GAIL (India) Limited,

(vi) Hindustan Aeronautics Limited,

(vii) Hindustan Petroleum Corporation Limited,

(viii) Mahanagar Telephone Nigam Limited,

(ix) National Aluminium Company Limited,

(x) NMDC Limited,

(xi) Oil India Limited,

(xii) Power Finance Corporation Limited,

(xiii) Power Grid Corporation of India Limited,

(xiv) Rural Electrical Corporation of India Limited,

(xv) Shipping Corporation of India Limited and

(xvi) Rashtriya Ispat Nigam Limited. Thus, the Navaratna CPSEs are enjoying a prestigious status and enhanced power to run its enterprises.

Miniratna Scheme:

In 1997, the government introduced the Miniratna Scheme with the objective of making public sector enterprises more efficient and competitive and also to grant enhanced autonomy and delegation of powers to the profit making public sector enterprises. The enhanced powers offered to Miniratna CPSEs include the power to (i) incur capital expenditure, (ii) enter into joint ventures; (iii) set up technological and strategic allowance, (iv) formulate schemes of human resource management.

The administrative ministries are also empowered to declare a CPSE as a Miniratna if it fulfills the eligibility conditions. Presently, there are 61 Miniratna CPSEs (47 category 1 and 14 category II). Thus, Miniratna CPSEs are also enjoying enhanced powers in order to improve the efficiency of its activities.

2. Essay on the Public Enterprises of State Governments:

About the State Level Public Enterprises (SLPEs), much information is not available. The Institute of Public Enterprises compiled certain information’s regarding these State Level Public Enterprises. At the end of March 1986, there were 636 SLPEs spread over 24 states and their total investment was to the extent of Rs 10,000 crore as compared to Rs 2,860 crore in March 1977.

Including State Electricity Boards and State Transport Corporations total investment of these state enterprises was Rs 25,000 crore at the end of March 1986 as compared to Rs 9,576 crore in 1977. During this 1977-86 period the annual average rate of growth of investment in SLPEs was nearly 20 per cent. At the end of March 1993, the number of SLPEs was about 700.

Total Investment in Public Sector Enterprises (Central and State):

It would be better to look into the total investment in public sector enterprises including both Central and State level public sector enterprises. In 2004-05, total investment of Central Public Sector Enterprises was to the extent of Rs 3,57,850 crore and that of State Public Sector Enterprises was Rs 1,62,000 crore as on 31st March, 2000.

Moreover departmental enterprises like Railways, Posts and Telegraphs and other departments have also invested around Rs 50,000 crore. Taking all these enterprises together, total public sector investment in the entire country taking all kinds of enterprises (departmental and non-departmental) existing at centre, State and local level stood at Rs 5,69,850 crore.

3. Essay on the Role of Public Sector in the Indian Economy:

Public sector in India has been playing an important role in shaping the basic structure of economy. Although the public sector in India is under severe criticism at present due to its overall poor performance but its role in Indian economy cannot be nullified.

The following are some of the positive roles played by the public sector in the economy of the country:

a. Income:

Public sector in India has been playing a definite positive role in generating income in the economy. The share of public sector in net domestic product (NDP) at current prices has increased from 7.5 per cent in 1950-51 to 21.7 per cent in 2003-04. Again the share of public sector enterprises only (excluding public administration and defence) in NDP was also increased from 3.5 per cent in 1950-51 to 11.12 per cent in 2005-06.

b. Capital Formation:

Public sector has been playing an important role in the gross domestic capital formation of the country. The share of public sector in gross domestic capital formation has increased from 3.5 per cent during the First Plan to 9.2 per cent during the Eighth Plan.

The comparative shares of public sector in the gross capital formation of the country also recorded a change from 33.67 per cent during the First Plan to 50 per cent during the Sixth Plan and then declined to 21.9 per cent in 2005-06.

But the Public sector is not playing a significant role in respect of mobilisation of savings. The share of public sector in gross domestic savings increased from 1.7 per cent of GNP during 1951-56 to only 3.6 per cent during 1980-85. During 1980s, the share of public sector in gross domestic savings declined from 16.2 per cent in 1980-81 to 7.7 per cent in 1988-89.

In this connection Narottam Shah observed, “The failure of the public sector contributes only 21 per cent of the nation’s savings; that also in part, through heavy taxation and semi-fictitious profits of the Reserve Bank. The remaining 79 per cent of the nation’s savings came from the private sector.” Again the share of public sector in gross domestic savings increased from 4.78 per cent in 1990-91 to 6.61 per cent in 2005-06.

c. Public Sector and Employment:

Public sector is playing an important role in generating employment in the country. Public sector employments are of two categories, i.e., (a) public sector employment in government administration, defence and other government services and (b) employment in public sector economic enterprises of both Centre State and Local bodies.

In 1971, the public sector offered employment opportunities to about 11 million persons but in 2003 their number rose to 18.6 million showing about 69 per cent increase during this period.

Again in 2003, the public sector offered employment opportunities to 18.6 million persons which was 69 per cent of the total employment generated in the country as compared to 71 per cent employment generated in 1991. However, there is considerable decline in the annual growth rate of employment in the public sector from 1.53 per cent during 1983-1994 to 0.80 per cent during 1994-2004.

Moreover, about 69.0 per cent of the total employments are generated in the public sector. Moreover, at the end of March 2004, about 51.7 per cent of the total employment (i.e. about 96 lakh) generated in public sector is from Government administration, community, social and personal services and the remaining 48.3 per cent (i.e., nearly 89.7 lakh) of the employment in public sector is generated by economic enterprises run by the Centre, State and Local Governments.

The maximum number of employment is derived from transport, storage and communications (28.1 lakh). The public sector manufacturing is the next industry which generated employment to the extent of 11.91 lakh persons.

d. Infra-Structure:

Without the development of infrastructural facilities, economic development is impossible. Public sector investment on infrastructure sector like power, transportation, communication, basic and heavy industries, irrigation, education and technical training etc. has paved the way for agricultural and industrial development of the country leading to the overall development of the economy as a whole. Private sector investments are also depending on these infrastructural facilities developed by the public sector of the country.

e. Strong Industrial Base:

Another important role of the public sector is that it has successfully built the strong industrial base in the country. The industrial base of the economy is now considerably strengthened with the development of public sector industries in various fields like—iron and steel, coal, heavy engineering, heavy electrical machinery, petroleum and natural gas, fertilizers, chemicals, drugs etc.

The development of private sector industries is also solely depending on these industries. Thus by developing a strong industrial base, the public sector has developed a suitable base for rapid industrialisation in the country. Moreover, public sector has also been dominating in critical areas such as petroleum products, coal, copper, lead, hydro and steam turbines etc.

f. Export Promotion and Import Substitution:

Public sector enterprises have been contributing a lot for the promotion of India’s exports. The foreign exchange earning of the public enterprises rose from Rs 35 crore in 1965-66 to Rs 5,831 crore in 1984-85 and then to Rs 34,893 crore in 2003-04.

Thus, the export performance of the public sector enterprises in India is quite satisfactory. The public sector enterprises which played an important role in this regard include—Hindustan Steel Limited, Hindustan Machine Tools Limited, Bharat Electronics Ltd., State Trading Corporation and Metals and Minerals Trading Corporation.

Some public sector enterprises have shown creditable records in achieving import substitution and thereby saved precious foreign exchange of the country. In this regard mention may be made of Bharat Heavy Electricals Limited, Bharalt Electronics Ltd., Indian Oil Corporations, Oil and Natural Gas Commission. Hindustan Antibiotics Ltd. etc. which have paved a successful way for import substitution in the country.

g. Contribution to Central Exchequer:

The public sector enterprises are contributing a good amount of resources to the central exchequer regularly in the form of dividend, excise duty, custom duty, corporate taxes etc. During the Sixth Plan, the contribution of public enterprises to the central exchequer was to the tune of Rs 27,570 crore.

Again this contribution has increased from Rs 7,610 crore in 1980-81 to Rs18, 264 crore in 1989-90 and then to Rs 1, 56,124 crore in 2010-11. Out of this total contribution, the amount of dividend contributed only 23.76 per cent of it.

h. Checking Concentration of Income and Wealth:

Expansion of public sector enterprises in India has been successfully checking the concentration of economic power into the hands of a few and thus is redressing the problem of inequalities of income and wealth of the economy. Thus, the public sector can reduce this problem of inequalities through diversion of profits for the welfare of the poor people, undertaking measures for labour welfare and also by producing commodities for mass consumption.

i. Removal of Regional Disparities:

From the very beginning industrial development in India was very much skewed towards certain big port cities like Mumbai, Kolkata and Chennai. In order to remove regional disparities, the public sector tried to disperse various units towards the backward states like Bihar, Orissa, Madhya Pradesh.

Thus, considering all these foregoing aspects it can be observed that inspite of showing poor performance the public sector is playing dominant role in al-round development of the economy of the country.

4. Essay on the Position of CPSEs in India during 2010-11:

It would be better to look at the present position of Central Public Sector Enterprises (CPSEs) working in India. There were 248 Central Public Sector Enterprises (CPSEs) under the administrative control of various Ministries/Departments as on March 31, 2011, with a cumulative investment of Rs 6,66,848 crore.

The largest investment is in the “industrial sector” comprising electricity, manufacturing, mining and construction sectors, which is about 62.58 per cent of the total financial investment.

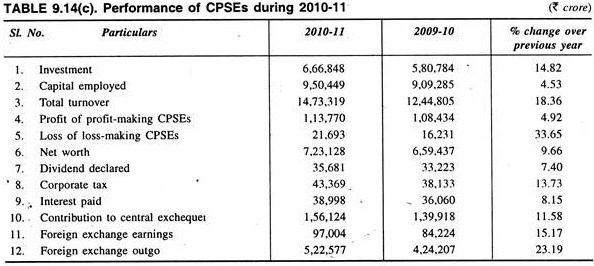

There were 16.14 lakh (excluding casual workers and contract labour) persons employed in 248 CPSEs; nearly one-fourth of the employed persons were in the managerial and supervisory cadres. The major highlights of the CPSEs during 2010-11 are given in Table 9.14(c).

It is observed from the Table 9.14(c) that the cumulative investment of CPSEs at the end of March 2011 stood at Rs 6, 66,848 crore showing a change of 14.82 per cent increase over the previous year. Total turnover of CPSEs increased from Rs 12,44,805 crore in 2009-10 to Rs 14,73,399 crore showing an increase of 18.36 per cent over the previous year.

The growth of turnover of CPSEs in the manufactured sector was 64.62 per cent followed by services (18.91 per cent), mining (11.75 per cent), electricity (4.69 per cent), and agriculture (0.03 per cent) sectors. Outs of the net profit of Rs 92,077 crore earned during 2010-11, the profit of profit making CPSEs (158) was Rs 1,13,770 crore, the total losses of loss-making enterprises (62) stood at Rs 21,693 crore.

The share of manufacturing in gross block, during 2010-11, was 27.8 per cent. The share of mining, electricity and services in total investment, in terms of gross block was 23.0 per cent, 25.2 per cent and 23.2 per cent respectively. Growing losses in loss making enterprises has become a point of concern for the entire sector.

The year also witnessed severe financial ‘under-recoveries’ by public sector oil marketing companies (OMCs) as these companies has to keep the prices of petroleum products low in the domestic market despite high input prices of crude oil. Moreover foreign exchange earnings of the CPSEs amounted to Rs 97.004 crore during 2010-11 which was comparatively lower than the total foreign exchange outgo of Rs 5,22,577 crore.

As many as 44 CPSEs are listed on the Stock Exchanges of India. Market capitalisation of all listed CPSEs stood at Rs 6,53,924 crore as on March 31,2007 and the same as a percentage of market capitalisation of BSE was 18.35 per cent as on March 31,2007. The net worth of all CPSEs increased from Rs 6,59,437 crore in 2009-10 to Rs 7,20,128 crore in 2010-11 showing an increase of 9.66 per cent.

Foreign exchange earnings of all CPSEs increased from Rs 84,224 crore to Rs 97,004 crore in 2010-11 showing an increase of 15.17 per cent. Finally, the contribution to exchequer of all CPSEs increased from Rs 1,39,918 crore in 2009-10 to Rs 1,56,124 crore in 2010-11 showing an increase of 11.58 per cent over the previous year.

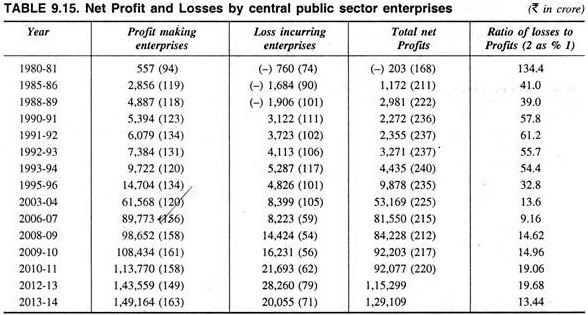

Table 9.15 reflects on the changing profitability situation of these public sector enterprises in India in recent years.

Table 9.15 reveals two different trends. Firstly, these public sector enterprises as a whole earned a net loss to the extent of (-) Rs 203 crore in 1980-81. But later on with the increase in the volume of profit earned by those profit making enterprises, the volume of net profit of these enterprises in general has become positive and thus the net profit gradually increased from Rs 1,172 crore in 1985-86 to Rs 2,981 crore in 1988-89 and Rs 53,169 crore and Rs 1, 29,109 crore in 2003-04 and 2013-14 respectively.

Thus, there is a definite trend of decline in the ratio of losses of loss taking enterprises to the profits making enterprises from 134.4 per cent in 1980-81 to 41 per cent in 1985-86 and to 33 per cent in 1995-96 and then to 13.4 per cent in 2013-14.

Secondly, the most important part of it, the volume of losses incurred by some public sector enterprises increased from Rs 760 crore in 1980-81 to Rs 1,684 crore in 1985-86 and to Rs 1,906 crore in 1988-89, and then to Rs 4,826 crore and Rs 20,095 crore in 1995-96 and 2013-14 respectively, i.e., during these 33 years the volume of net losses of these loss-incurring enterprises has increased by nearly 2,754 per cent. Moreover, during the same period, the number of loss-incurring enterprises has also decreased from 74 to 72. This no doubt reflects on the profitability outlook of public sector enterprises.

According to the recent report prepared by leading global business information provider, Dun and Bradstreet entitled “India’s Top PSUs 2009,” the aggregate total income of the profiled CPSUs stood at little over Rs 14,675 billion during 2007-08 representing a growth of 16.8 per cent and is approximately 31.1 per cent of country’s GDP at current prices.

The aggregate net profit reported by the 121 CPSEs sums up to Rs 1,221.36 billion in 2007-08 which shows a growth of around 10 per cent over the previous year.

However, the performance of public enterprises varies widely and some of them have profitability ratios comparable to private enterprises and some other have either very poor profitability ratios or have negative profitability ratios.

Thus, the profitability of PSUs in terms of ratios of gross margins and gross profits to capital employed have not improved during the period 1980-81 to 1991-92. However, the ratio of net profit of capital employed showed marginal improvements since 1992-93 and recorded considerable improvement during the period 2001-02 to 2013-14.

The loss making public enterprises also represent a variety of product or industry group and market structures. There are 15 large enterprises which are monopolies and operate in the core sector, while the remaining enterprises function in a competitive environment producing variety of goods and services. As between these categories, the monopolies account for about three-fourth of the capital employed and one- fourth of the accumulated losses; the competitive enterprises employing a quarter of the capital, make three quarter of the losses.

The loss making monopolies mentioned above include—FCI, IAC, DTC, CIL, Bharat Gold Mines, NFDC and NERAMC, Rashtriya Ispat Nigam and Hindustan Shipyard, NTC Ltd. and REC Ltd.

The remaining loss incurring enterprises, of which about half constitute sick units taken over by the Government from the private sector, account for bulk (about three-fourths) of the losses of public enterprises.

The loss per employee in these enterprises exceeds the average wage rate. The Government has been borrowing from the market at a high cost in order to support them. These enterprises, therefore, deserve special attention in economic restructuring.

What is more peculiar is that even the loss incurring enterprises are sometimes paying bonus to employees at the rate of 8.33 per cent without making any effort to raise its productivity leading to erosion of capital of its own.

Thus, with the gradual increase in the volume of investment in the public sector enterprises, both the amount of losses incurred by these loss-incurring enterprises and their number are increasing at a very high rate leading to a high reduction in the volume of profit earned by these public sector enterprises as a whole. This negative trend has no doubt endangered the overall efficiency level of these public sector enterprises of the country.

Moreover, two important points need to be mentioned regarding the performances of these public sector enterprises. Firstly a narrow range of profit-making enterprises comprising petroleum industries, financial services, power and telecommunication services are contributing the major portion of the profits. Again the major loss incurring enterprises include textiles, consumer goods, fertilizer and chemicals, engineering goods and pharmaceuticals.

Secondly, the achievement of higher profitability ratio in some public enterprises is mostly resulted from higher administrated prices for its products and services (viz. telecom services) instead of its attempts through cost reductions, efficiency improvement and capacity utilisation.

However, the performance of the CPSEs is improving as a result of liberalisation and reform measures.

The recent achievement includes:

(i) The share of CPSEs in GDP at market prices stood at 11.2 per cent in 2005-06 and 11.68 per cent in 2004-05;

(ii) The cumulative investment of all CPSEs at end- March, 2011 was Rs 6, 66,848 crore. The share of manufacturing CPSEs in such investment was the highest at 51 per cent followed by service CPSEs at 40 per cent, mining CPSEs at 7 per cent;

(iii) In respect of capacity utilisation, 51 per cent of all CPSEs are operated at 75 per cent or higher; 16 per cent at 50 to 75 per cent, and the residual 33 per cent is at less than 50 per cent;

(iv) The accumulated losses of all CPSEs declined by Rs 10,578 crore, from Rs 83,725 crore in 2004-05 to Rs 73,149 crore;

(v) 44 CPSE, are listed on the domestic stock exchanges;

(vi) At the end of March, 2006 the 239 CPSEs employed over 16.49 lakh people excluding casual workers.

The National Common Minimum Programme (NCMP) has made stipulation for a strong and effective public sector whose social objectives are met without prejudice to its commercial functioning. Efforts are also being made to modernize and restructure sick CPSEs and for the revival of sick industry. In order to ensure and encourage efficiency in the functioning of the CPSEs, the Government has taken various steps to professionalise the Board of CPSEs.

Again on the recommendations of Arjun Sen Gupta Committee, the Government during 1987-88, introduced the concept of Memorandum of Understanding (MOU) to ensure clarity in the functioning of CPSEs and proper balance between accountability and autonomy for better results and also for overall improvement of its performance. The number of CPSEs signing MOUs went up from 4 in 1987-88 to 112 in 2006-07.

In order to improve the competitive spirit, an attempt has also been made to evaluate the performance of the CPSEs on the basis of (a) sales, (b) growth of sales, (c) net profit, (d) growth in net profit, (e) return on net worth, (f) earnings per share and (g) dividend pay-out ratio. However, in recent years the performance of CPSEs has been improving.

5. Essay on the Changes in Public Opinion on the Public Sector Enterprises in India:

There was a time when most of the Indian people were very much in favour of public sector enterprises even without going into details of this sector. But with the gradual increase in the volume of investment at a very high level, increasing volume of losses by some of the enterprises along with overall low rate of return on capital employed, general opinion has now been turning towards a different direction.

Following are some of the reflections in this regard:

(a) Poor Profitability Argument:

Inspite of its huge investment as the public sector enterprises could not contribute a satisfactory rate of return even after 40 years planning compared to private sector enterprises, thus the public sector enterprises in India are gradually becoming less attractive and less popular leading to erosion of faith of the general people on this sector.

(b) Constant Under-Utilisation:

Constant under-utilisation of production capacities in almost all the public sector enterprises in India forced the sector to become totally inefficient leading to an erosion of images of thus huge organisation before the people.

(c) Increasing Unaccountability:

Increasing unaccountability of public sector management to the general people due to inefficient political system makes it totally ineffective.

(d) Increasing Volume of Losses:

Increasing volume of losses incurred by the loss-incurring enterprises along with their increasing number makes the sector totally burdensome to both the people and also to the government as huge budget is now required to run such enterprises.

6. Essay on the Performances of Public Sector Enterprises in India:

It is high time that the performance of public sector enterprises should be evaluated from different angles. Thus, the performance of public sector enterprises should be viewed from various angles of efficiency, profitability, social rate of return etc.

Following are some of the performances of public sector enterprises in India:

i. Employment Generation:

In the various Five Year Plans although we have invested around 60 per cent of our total planned resources on the development of public sector but this sector generated employment to the extent of only 181.97 lakh till 2004.

But the total employee strength of Central Public Sector Enterprises (CPSEs) has been coming down from 20 lakh in 2001-02 to 16.14 lakh in 2006-07 and then to 15.7 lakh in 2007-08. About 5.94 lakh employees had opted for Voluntary Retirement Scheme (VRS) till March, 2008.

Thus, total number of persons employed in the public sector enterprises is about 6.6 per cent of the total number of workforce in the country. In India, 90 per cent of the total numbers of workforce are employed in unorganised sector and the rest 10 per cent are employed in organised sector.

Out of this total employment generated in the organised sector in 1991, 7.13 per cent of these workers were employed in the public sector. Thus, in respect of employment generation the share of public sector enterprises remained very poor as these enterprises were mostly capital-intensive in nature.

ii. Contribution to NDP:

Inspite of huge investment the public sector enterprises contributed a little portion of the Net Domestic Product of the country. Although average rate of growth of investment in the public enterprises remained very high (i.e., 16 per cent to 21 per cent) but the share of public sector enterprises in N.D.P. increased at a very slow rate i.e., from 3 per cent in 1950-51 to 7.5 per cent in 1970-71 and then to 11.12 per cent in 2005-06.

iii. Contribution to Gross Domestic Capital Information:

The share of public sector enterprises in gross domestic capital formation has also increased at a very slow rate, i.e., from 3.5 per cent during the First Plan to only 10.7 per cent during Seventh Plan period.

iv. Foreign Exchange Earnings:

The foreign exchange earning of the public sector enterprises has gradually increased from Rs 35 crore in 1965-66 to Rs 170 crore in 1969-70 and then to Rs 10,345 crore in 1992- 93. But in physical terms the rate of growth of these earnings would be much less.

v. Contribution to Government Exchequer:

The contribution of the public sector enterprises towards Government exchequer through dividend, corporate tax, excise duties, custom duties and other has increased from Rs 7,985 crore during the Fourth Plan to Rs 85,445 crore during the Tenth Plan. But a good portion of this contribution has been done at the cost of increased tax burden on the people of the country.

vi. Profitability:

In respect of profitability, the public sector enterprises are showing a dismal picture. Although some public enterprises are earning a good amount of profit but a good number of other public enterprises are incurring a huge loss leading to a fall in the amount of overall net profit earned by the public sector enterprises in general.

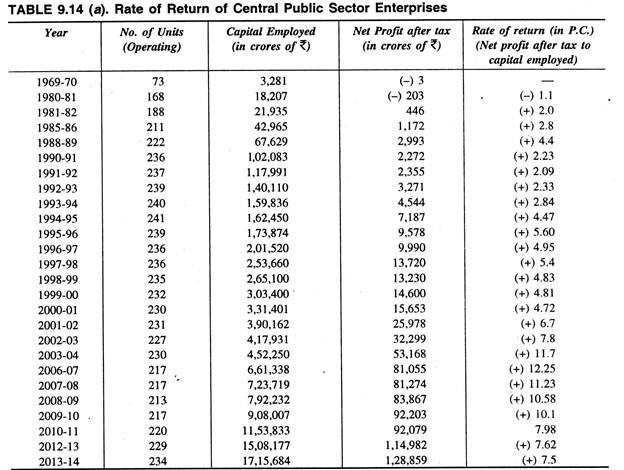

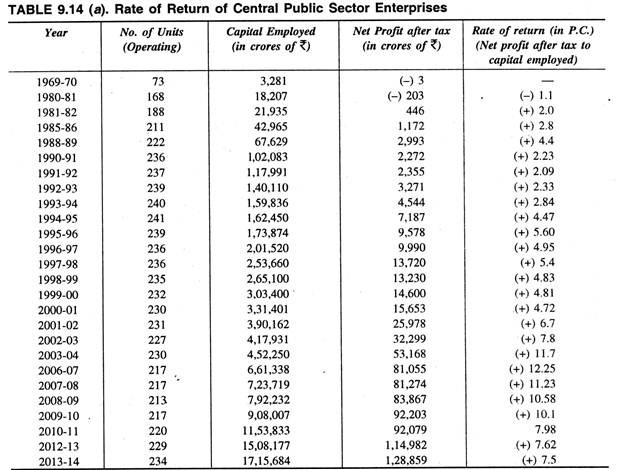

If we look back at the profitability of these public enterprises then in the initial period the picture was really gloomy. During the period 1966-67 to 1970-71, these public enterprises have earned a net loss to the tune of Rs 800 crore. The following table will show the rate of return of these public sector enterprises since 1969-70.

Table 9.14(a) reveals that the rate of return of the public sector enterprises i.e., net profit after tax to capital employed, which was almost nil during 1969-70 has gradually reached a negative rate to the extent of (-) 1.1 per cent during 1980-81 and then gradually increased to (+) 2.0 per cent during 1981-82 and to (+) 4.4 per cent in 1988-89 and then declined to 2.23 and 2.33 per cent in 1990-91 and 1992-93 respectively and again slightly improved to 4.81 per cent in 1999-00. Thus, inspite of having a huge investment in this sector the rate of return to this capital employed was all along very poor.

In 2003-04, the CPSEs have recorded a favourable position in its business. The net profit of Central Public Sector Enterprises (CPSEs) has registered a 64.6 per cent increase in 2003-04 over 2002-03. According to Public Enterprise Survey, 2003-04, there has been improvement in the overall performance of CPSEs. The capital employed of the public sector enterprises went up by 8.2 per cent, i.e., from Rs 4, 17,931 crore in 2002- 03 to Rs 4, 52,250 crore in 2003-04.

The net profit has increased to Rs 53,168 crore in 2003-04 from Rs 32,299 crore in 2002-03. The return to capital has also increased from 7.8 per cent in 2002-03 to 13.0 per cent in 2013-14. The return on equity share capital (Net profit to paid up capital ratio) was 24.58 per cent for 2001- 02.

The contribution to Central Exchequer by way of excise duty, customs duty, corporate tax, interest on Central Government loans, dividend and other duties and taxes went up from Rs 61,037 crore in 2000-01 to Rs 85,445 crore in 2003-04, marking an increase of 39.9 per cent.

Again the net profit after tax of CPSEs increased to Rs 81,121 crore in 2006-07 and then to Rs 1, 28,859 crore in 2013-14. Accordingly, the rate of return on capital employed which reached the level of 12.25 per cent in 2006-07 but the same rate further reached to 7.5 per cent in 2013-14.

As on March 31, 2014, there were 290 CPSEs in the country, of which 234 were in operation. Out of these 234 CPSEs, 71 units have been incurring losses continuously for the last three years.

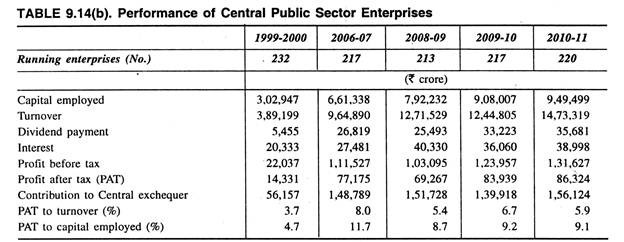

There have been considerable changes in the performances of Central Public Sector Enterprises (CPSEs) during the last 12 years which can be seen from Table 9.14(b).

Public sector of India has been experiencing massive expansion in its structure since independence. Starting with only 5 CPSEs in 1951 with a mere investment of Rs 29 crore, India is now having 290 CPSEs at the end of 2013-14 with a total investment of Rs 6,66,848 crore.

It is observed from Table 9, 14(b) that at the end of 2010-11, there 248 CPSEs out of which 220 were in operation. Total capital employed in those CPSEs increased considerably from Rs 3, 02,947 crore in 1999-2000 to Rs 9,49,499 crore in 2010-11, showing an increase more than 3 times.

During the same period, total turnover of CPSEs also increased from Rs 3, 89,199 crore to Rs 14, 73,319 crore showing an increase of about 3.78 times. The CPSEs have been contributing substantially to central government through payment of dividend, interest, corporate tax, excise duties etc.

Total contribution of CPSEs to Central Exchequer also increased from Rs 56,157 crore in 1999-2000 to Rs 1,56,124 crore showing an increase of about 2.78 times during this period and the same contribution further increased to Rs 2,20,161 crore in 2013-14. Again the profit after tax (PAT) of CPSEs also increased from Rs 14,331 crore in 1999-2000 to Rs 86,324 crore in 2010-11 showing an increase of about 6 times.

Again the ratio of PAT to turnover rose from 3.7 per cent in 1999-2000 to 5.9 per cent in 2010-11 but ratio of PAT to capital employed also increased from 4.7 per cent to 9.1 per cent during the same period.

Thus, the rate of return which remained all along very low earlier gradually started to show some improvement in recent years as a result of structural reforms.

7. Essay on the Problems of the Public Sector Enterprises in India:

The public enterprises in India are faced with the following major problems which are mainly responsible for this mounting loss of those loss incurring public sector enterprises in country.

A. Endowment Constraints:

Some of the public sector enterprises, particularly some of the loss-incurring enterprises are suffering from endowment constraints as the selection of sites of these enterprises were done on political considerations rather than on rational considerations.

B. Under-Utilisation of Capacity:

Under-utilisation of the production capacities are one of the common constraints from which almost all public sector enterprises are suffering. In 1986-87, out of the 175 public sector units 90 units had been able to utilise over 75 per cent of its capacities, 56 units achieved utilisation of capacities between 50 and 75 per cent and the rest 29 units could somehow managed to utilise under 50 per cent of its capacities.

This had been mainly due to the reasons such as long gestation periods, huge in-built capacities, ambitious scales of planning based on inadequate economic (particularly market) data, inadequate motivation, lack of initiatives and obsolescence of the product mix.

C. Absence of Rational Pricing:

Public sector enterprises in India are suffering from absence of rational pricing as the prices of their products are determined by such a price policy which has three considerations like: (a) profit as the basis of price fixation, (b) no-profit basis of public utility approach, and (c) import-parity price.

Thus, formal and informal regulations of prices by the Government in the interest of the economy and consumers, in general, and of price stabilisation are also responsible for huge losses incurred by some of these enterprises of our country. Moreover, subsidisation of the prices of some of the produce by these public enterprises had added a new dimension to the problems.

D. Technological Gap:

Some of the public sector enterprises in India are suffering from technological gap as these enterprises could not adopt up-to-date technologies in their production system leading to high unit cost and lower yield. Enterprises like I.I.S.C.O., E.C.L. etc. are still suffering from this constraint.

E. Government Interference:

Much government interference in the day to day activities of the public sector enterprises has reduced the degree of autonomy of the managements in respect of employment, pricing, purchase etc.

F. Heavy Social Costs:

Public sector enterprises are suffering from heavy social costs such as the outlays on townships and allied provision of amenities to its employees.

G. Operational and Managerial Inadequacies:

The public sector enterprises in India are also suffering from operational and managerial inadequacies and inefficiencies leading to huge wastages and leakages of funds in their day-to-day activities.

H. Evil Competition and Sabotage:

Between the public sector and private sector units within the same industry sometimes there exists evil competition which leads to sabotaging of public sector units at a large scale.

I. Marketing Constraint:

Some public sector units are even faced with marketing constraints where due to repetitive type of production mix they could not collect a good market for some of their products where the market is already captured by some big private industrial houses leading to a constant increase in inventories.

J. Surplus Manpower:

In some of the public sector units there is the problem of surplus manpower which is creating drainage of resources unnecessarily leading to increase in the unit cost of production. Political considerations have also contributed towards overstaffing of unskilled workers in these units.

K. External Factors:

Workers engaged in the public sector enterprises are lacking sincerity and devotion to their job leading to wastage of working hours which finally affects productive capacities of these enterprises. Moreover, external factors like too much trade unionism, union rivalries and labour troubles are also disrupting the smooth functioning of the production system of these public sector enterprises in the country.

Considering the problems of sickness faced by the Public enterprises, the Standing Conference on Public Enterprises (SCOPE) had recently constituted a committee to study various aspects of sickness of public enterprises.

In its recently submitted report (in December, 1995) on its analysis of PSU problems, the committee felt that too much interference by the Government in areas like autonomy and accountability, constitution of board of directors, continuity to top management and little discretionary powers to management for investment, employment, pricing and wages affected the PSU performance.

Bad financial planning was another cause of PSU sickness and many sick companies had over-borrowed. The report added here that “debt is a dangerous substitute for equity capital and interest on debt keep on accruing and has to be paid.”

The report of the SCOPE Committee further added that in many nationalised industries, management had been burdened with dummy assets like nationalisation accounts, fictitious inventory and unrealisable current assets which only deteriorated the balance sheet and did not provide any financial support to the companies.

The SCOPE Committee further regretted that the Government as a promoter, was charging one per cent fee from its own sick companies for providing guarantees to bank loans and that too for a limited period of one year at a time whereas private sector promoters were not charging any fee for such guarantee.

Various other problems such as allocation of resources, delays in filling up top-level posts, tight regulations and procedures for investment and restrictions on functional autonomy of the enterprises, e.g., in respect of labour and wage policy etc. have been creating serious constraints on the operational efficiency of public sector enterprises of the country.