After reading this essay you will learn about: 1. Definition of Micro, Small and Medium Enterprises 2. Present Position and Performance of Small Scale Industries or MSME Sector in India 3. Role 4. Case in India 5. Weaknesses 6. Remedial Measures 7. New Small-Sector Industrial Policy, 1991 and Other Details.

List of Essays on Micro, Small and Medium Enterprises (MSMEs) in India

Essay Contents:

- Essay on the Definition of Micro, Small and Medium Enterprises

- Essay on the Present Position and Performance of Small Scale Industries or MSME Sector in India

- Essay on the Role of MSME Industries in India

- Essay on the Case of Small Scale Industries in India

- Essay on the Weaknesses of Small Scale Industries in India

- Essay on the Remedial Measures to Remove the Weaknesses of Small Scale Industries

- Essay on the New Small-Sector Industrial Policy, 1991

- Essay on the Policy Measures for SSI Sector Undertaken during 2004-05

- Essay on the Policy Initiatives and Measures Undertaken for MSEs during 2006-07 and MSMED Act, 2006

- Essay on the Schemes to Boost MSME Sector

- Essay on the Twelfth Plan’s Initiatives for the Development of MSME Sector

1. Essay on the Definition of Micro, Small and Medium Enterprises (MSMEs):

In recent years, all micro, tiny, small and medium enterprises are clubbed in one broad group as Micro, Small and Medium Enterprises (MSMEs). After the enactment of Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the small and medium sector has been clearly defined as micro, small and medium enterprises with effect from 2nd October, 2006.

Moreover, separate investment limits have been prescribed for manufacturing and service enterprises.

The new definition so prescribed is as follows:

(A) Manufacturing Enterprises:

Manufacturing enterprises include:

(i) A micro enterprise, whose investment in plant and machinery does not exceed Rs 25 lakh;

(ii) A small enterprises, whose investment in plant and machinery is more than Rs 25 lakh but does not exceed Rs 5 crore; and

(iii) A medium enterprise, whole investment in plant and machinery is more than Rs 5 crore but does not exceed Rs 10 crore.

(B) Services Enterprises:

Service enterprises include:

(i) A micro enterprise, whose investment in equipment does not exceed Rs 10 lakh;

(ii) A small enterprise whose investment in equipment is more than Rs 10 lakh but does not exceed Rs 2 crore;

(iii) A medium enterprise, whose investment in equipment is more than Rs 2 crore and does not exceed Rs 5 crore.

Manufacturing enterprises of MSME category constitute 31.8 per cent of MSME sector and service enterprises account for the remaining 68.2 per cent of MSME sector. About 55.3 per cent of these MSME enterprises are located in rural areas. The MSME sector achieved consistent growth of more than 11 per cent every year till 2010-11, whereas in 2012-13 growth rate of this sector was 19 per cent and in 2013-14 nearly 14 per cent.

At present, there are about 3.61 crore number of MSMEs, which are contributing 37.5 per cent of the GDP of the country. MSMEs have a critical role in boosting industrial growth and ensuring the success of the ‘Make in India’ programme.

Small scale industries are now defined under the Micro, small and Medium Enterprises Development Act, 2006, which has specifically categorized small scale sector enterprises based on the value of investment in plant and manufacturing and investment in equipment for service sector.

At present, 20 items are strictly reserved for manufacture in the small scale sector, viz.:

(i) Pickles and chutneys;

(ii) Bread:

(iii) Mustard oil (except solvent extracted);

(iv) Ground nut oil (except solvent extracted);

(v) Wooden furniture and fixtures;

(vi) Exercise books and registers;

(vii) Wax candles;

(viii) Laundry soap;

(ix) Safety matches;

(x) Fireworks;

(xi) Agarbattis;

(xii) Glass bangles;

(xiii) Steel Almirah;

(xiv) Rolling shutters;

(xv) Steel chair—all types;

(xvi) Steel table—all other types;

(xvii) Steel furniture—all other types;

(xviii) Padlocks;

(xix) Stainless steel utensils; and

(xx) Domestic utensils—aluminium.

All undertakings other than small scale industries undertakings engaged in the manufacture of items reserved for manufacture in the small sector are required to obtain an industrial license and undertake an export obligation of 50 per cent of the annual production. The condition of licensing is, however, not applicable to those undertakings operating under 100 Export Oriented Undertakings Scheme, the Export Processing Zone (EPz) or the Special Economic Zone Scheme (SEZs).

2. Essay on the Present Position and Performance of Small Scale Industries or MSME Sector in India:

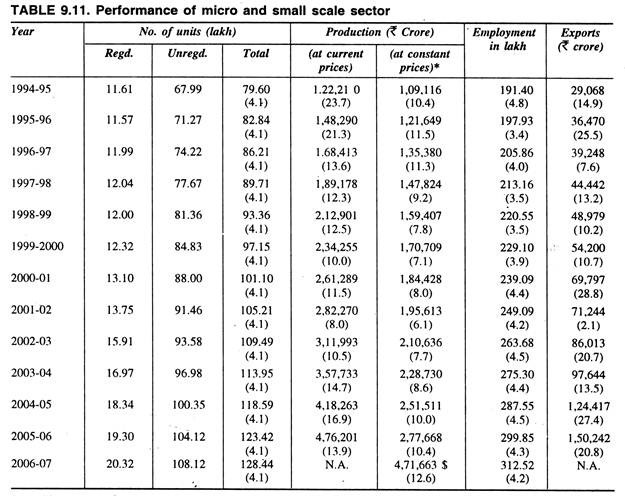

In a country like India, the position of small scale industry is quite worth mentioning. The number of small scale units has been increasing in a comprehensive manner in recent years, more particularly after the introduction of economic reforms. Table 9.11 shows the present position of SSI units in India.

The small scale industry sector continues to remain an important sector of the economy with a noteworthy contribution to GDP, industrial production, employment generation and exports. The performance of the small scale industry sector based on final results of the Third All India Census of SSIs, 2004 is given in Table 9.11.

It is observed from Table 9.11 that, there were all total 79.60 lakh SSI units in the country in 1994-95, out of which 11.61 lakh were registered units and 67.99 lakh were unregistered units.

Again total number of such SSI units in 2004-05 increased to 118.59 lakh, showing a growth of 4.1 per cent over the previous year, out of which 17.53 lakh were registered units and 101.06 lakh were unregistered units. It is estimated that the number of SSI units during 2006-07 has increased to 128.44 lakh registering a growth rate of 4.1 per cent over the previous year.

The value of production of SSI units in India at current prices has increased from Rs 2,98,886 crore in 1994-95 to Rs 4,18,263 crore in 2004-05 and then to Rs 4,76,209 crore in 2005-06, registering a growth rate of 16.9 per cent and 13.9 per cent respectively over the previous year. Again total value of production of SSI sector at constant prices has increased from Rs 2,66,054 crore in 1994-95 to Rs 2,51,511 crore in 2004-05 and then to Rs 2,77,668 crore in 2005-06, registering a growth rate of 10.0 per cent and 10.4 per cent respectively over the previous year.

Again total value of production of SSI sector calculated at 2001-02 prices increased to Rs 4,71,663 crore registering a growth rate of 12.6 per cent over that of previous year. Total number of persons employed in these SSI units has also increased from 146.56 lakh in 1994-95 to 271.36 lakh in 2004- 05 and then to 312.52 lakh in 2006-07, showing a growth of 4.1 per cent and 4.2 per cent respectively over the previous year.

In recent years, the importance of Micro, Small and Medium Enterprises (MSME) sector has increased considerably. The MSME sector now contributes 8 per cent to India’s Gross Domestic Product (GDP) and 45 per cent to manufactured output of the country. The sector also provides employment to over 8 crore people engaged in more than 8.6 crore MSME units, producing more than 6,000 products.

Again exports emanating from the SSI sector account for about 35 per cent of the total value of exports of the country. Total value of exports of SSI unit in India has increased from Rs 29,068 crore in 1994-95 to Rs 1, 50,242 crore in 2005-06 registering a growth of 20.8 per cent over the previous year.

Again, the total value of exports in US dollar terms from the SSI sector has increased from $ 8.07 billion in 1993-94 to $ 10.90 billion in 1995-96 and then to $ 13.13 billion in 2000-01.

Earlier, the share MSMEs in the country’s total exports was 40 per cent but now it has reduced to 36 per cent due to demand slowdown in western markets. But the contribution is likely to be upto 50 per cent by 2017.

RBI Estimates of the Performance of SSI/MSME Sector:

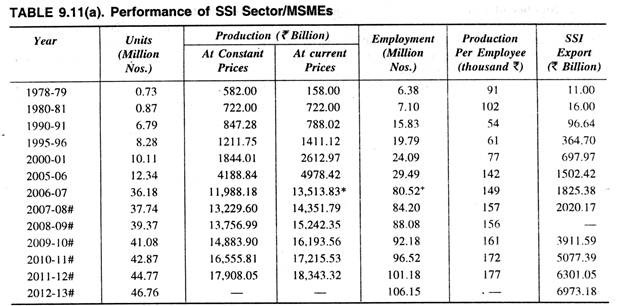

The Reserve Bank of India has also prepared the updated status on the performances of SSI and MSME sector of the country on the basis of the statistics available from Ministry of MSMEs, Government of India which can be seen from the table 9.11(a).

The latest estimate of the performance of the SSI/MSME sector is made by the Reserve Bank of India on the basis of Fourth All India Census of MSME, unregistered sector and on the basis of data available from Ministry of Micro, Small and Medium Enterprises; Government of India is shown in Table 19.11(a). It is observed from the table that total number of SSI units in 1978-79 was 0.73 million which further increased to 12.34 million in 2005-06.

After the enactment of the MSMED Act, 2006, all three tiers of enterprises, i.e. micro, small and medium are integrated within this group. Accordingly, total number of SSI/MSME units was estimated at 36.18 million, (projected) in 2006-07 which further increased to 44.77 million units in 2011-12 and then to 46.76 million units in 2012-13 (projected).

Again the value of production of SSI units in India at constant prices increased from Rs 582.0 Billion in 1978-79 to Rs 4,188.44 billion in 2005-06: But the value of production of entire MSME groups of enterprises increased from Rs 11,988.18 billion in 2006-07 to Rs 17,908.05 billion (projected) in 2011-12 showing in increase of 49.4 per cent over the six-year period and also registering a growth rate of 8.1 per cent over previous year.

Again the total value of production at current prices also increased from Rs 13,513.83 billion in 2006-07 to Rs 18,343.32 billion in 2011-12 showing an increase of 35.7 per cent over the six-year period and also registering a growth rate of 6.5 per cent over the previous year. Total number of persons employed in these SSI units also increased from 6.38 million in 1978- 79 to 29.49 million in 2005-06.

Again the total employment in all these MSME units also increased from 80.52 million in 2006-07 to 101.18 million in 2011-12 and then to 106.15 million in 2012-13 showing a growth of 4.8 per cent and 4.9 per cent respectively over the previous year. Again the production per employee in all these SSI units also increased from Rs 91 thousand in 1978-79 to Rs 142 thousand in 2005-06 and then to Rs 177 thousand in 2011-12.

Again, total value of exports of SSI units in India increased from Rs 11.00 Billion in 1978-79 to Rs 1502.42 Billion in 2005-06. Again, total value of exports of all MSME units increased from Rs 1825.38 Billion in 2006-07 to Rs 6973.18 Billion in 2012-13 registering a growth of 10.6 per cent over the previous year. Besides, exports emanating from the MSME units accounts for about 42.6 per cent of the total value of exports of the country in 2012-13.

Thus over last six decades after independence, the small scale industries or MSME sector has acquired a place of prominence in the economy of the country. It has contributed significantly to the growth of the gross domestic product (GDP), employment generation and exports.

The sector now broadly includes not only SSI units but also small scale service and business enterprises (SSSBEs) and is thus referred to as the small enterprises sector.

MSME or SSI sector is maintaining an important position on the industrial map of the country. Total value of production of SSI units accounts for nearly 45 per cent of the total value of industrial output of the country in general. The SSI sector being an labour-intensive project, can employ on an average 18 to 19 persons with an investment of Rs 1 lakh only.

Moreover, the MSME or SSI sector is also maintaining a good number of export oriented units (EOUs) producing goods for meeting demands coming from international market.

3. Essay on the Role of MSME Industries in India:

Small scale and cottage industries have been playing an extremely important role in Indian economy in terms of employment generation and growth. It is estimated that this sector has been contributing about 40 per cent of the gross value of output produced in the manufacturing sector and the generation of employment by the small scale sector is more than five times to that of large-scale sector.

The Second Plan rightly emphasised the role of small scale and village industries on the growth of; (i) employment generation, (b) equitable distribution of income, (c) mobilisation of capital, (d) mobilisation of entrepreneurial skill, and (e) regional dispersal of industries,

Following are some of the important roles played by small scale and cottage industries in India:

(i) Number of Units:

Total number of registered small scale units has been increasing rapidly from 16,000 in 1950 to 36,000 in 1961 and to 8.53 lakh units in 1985-86 and then finally to 20.32 lakh in 2006- 2007. Moreover, there were about 108.12 lakh unregistered small scale units in India. In 2006-2007 the total number of small scale units further increased to 128.4 lakh.

But as per the census of SSI units, 1987-88, about 30 to 40 per cent of these registered units might be non-functional. The second all-India census of registered small scale industrial units was conducted by Small Industries Development Organisation (SIDO) in 1987-88. This report shows that out of 9.87 lakh registered SSI units as on 31.3.88 included in the frame 3.05 lakh units (31 per cent were closed and another 57,000 units were not traceable).

Findings of the census also give added empirical support to the generally accepted hypothesis about the distinct characteristics of the SSI sector compared with those of the large and medium sector, namely lower capital base, lower capital/labour ratio, lower productivity of labour and higher productivity of capital and lower wage rates.

These small scale industries are also producing various types of commodities (over 5000 commodities) starting from simple consumer goods to the manufacture of sophisticated electronic goods. The reserved list of the small scale units has been increased from 177 in 1972 to 837 in 1983 and then declined to 35 in 2008.

In recent years, number of units engaged actively in the MSME sector has increased considerably and in 2012-13, total number of MSME units stands at 46.76 million.

(ii) Employment Generation:

Small scale industries are labour-intensive and thus are generating a huge number of employment opportunities. Total employment generated by these small scale industries has increased from 39.7 lakh in 1973-74 to 96.0 lakh in 1985-86. Estimated employment of the small scale sector has again increased from 129.8 lakh in 1991-92 to 312.5 lakh in 2006-2007, showing an increase of about 4.2 per cent over the previous year.

Recent study shows that MSME sector provides employment to over 4.67 crore people engaged in over 10.6 crore units in 2012-13.

(iii) Investment:

Investment in the small scale sector has been increasing at a faster rate. As per the statistics made available by SIDO, total amount of investment in the small scale units of India has increased significantly from Rs 2,233 crore in 1972-73 to Rs 4,431 crore in 1978-79 and then to Rs 9,585 crore in 1985- 86.

Thus, the investment has increased by 116 per cent during the last 7 years. Fixed investment per employee which was Rs 6.4 thousand in 1972 as per SSI census gradually rose to Rs 65.71 thousand in 1987-88 as per the results of Annual Survey of Industries (ASI).

(iv) Output:

Total production of the small scale units has increased from Rs 7,200 crore in 1973-74 to Rs 57,100 crore in 1985-86. The value of output of the SSI sector in 2006-2007 is estimated at Rs 4, 71,663 crore showing an increase of 12.6 per cent over the output of Rs 4, 18,884 crore in 2005-06.

In 2011-12, total value of production at constant prices produced by all MSME units of the country stood at Rs 17,908 billion, registering a growth rate of 8.1 per cent over the previous year.

In 2012-13, the entire MSME sector contributes 8 per cent to India’s GDP and 45 per cent to manufactured output.

(v) Contribution to Exports:

The contribution of SSI sector towards export has been increasing at a faster rate. The value of exports of the products produced by the small scale sector has increased from Rs 393 crore in 1973-74 to Rs 9,100 crore in 1990-91 and then to Rs 1,50,242 crore in 2005-2006.

Again in dollar terms, the value of exports from SSI sector has also increased from $ 8.87 billion in 1993-94 to $ 13.13 billion in 2000-01. The share of export from small scale sector in the total exports has increased from 9.6 per cent in 1971-72 to 35 per cent in 2000-2001.

In 2012-13, the share MSME units in country’s total exports stands at 42.6 per cent which is likely to increase upto 50 per cent of the total exports of the country by the end of Twelfth Plan.

(vi) Equitable Distribution of Income:

Small scale and cottage industries has been resulting a more equitable distribution of national income and wealth. This is mainly due to the fact that the ownership of small scale industries is quite widespread as compared to large scale industries and small scale sector is having a higher employment potential than that of large scale sector.

(vii) Mobilisation of Capital and Entrepreneurial Skill:

Small scale industries can mobilise a good amount of savings and entrepreneurial skill from rural and semi-urban areas remained untouched from the clutches of large scale sector. Thus a huge amount of latent resourced are being mobilised by the SSI sector for the industrial development of the country.

(viii) Regional Dispersal of Industries:

Small scale industries are playing an important role in dispersing the industrial units of the country in the various parts of the country. As the large scale industries are mostly located in some states like Maharashtra, West Bengal, Gujarat, Tamil Nadu, thus dispersal of SSI units throughout the country can achieve a balanced pattern of industrial development in the country.

(ix) Better Industrial Relations:

The small scale industries are maintaining better industrial relations between employers and employees and thus can lessen the frequency of industrial disputes. But the large-scale industries are facing the problems of strikes and lockouts and hence good industrial relations in these industries are very difficult to maintain. Thus the loss of production and man days are comparatively less in small scale sector.

It is due to the above mentioned factors the growth rate of small scale industrial sector has remained faster in terms of its number, employment and output.

Thus, in real terms the growth rate of the SSI output during 1992-93 is estimated to be about 5.6 per cent when compared with only 1.8 per cent growth of the overall industrial production. In 2006-2007, the growth rate of the SSI sector is likely to be more than 12.6 per cent.

Research studies indicate that the SSI sector accounts for 40 per cent of the value added by the entire manufacturing sector, 6.9 per cent of the net domestic product and more than 35 per cent of the total volume of exports of the country.

4. Essay on the Case of Small Scale Industries in India:

There is a strong case for the development of small scale industries in a country like India. Thus, there are numerous arguments in favour of small scale industries in the country.

The industrial policy resolution, 1956 has put forward four arguments in favour of small scale industries and these arguments are:

(a) Employment argument,

(b) Equality argument for even distribution of income and wealth,

(c) The latent resources argument for tapping hoarded and unutilised wealth and

(d) The decentralisation argument for balanced regional development.

The other argument in favour of small scale units are that these industries are making provision for self-employment and capital formation and they are skill light, import light and quick yielding. Besides, these small industries are also supporting large scale industries, overcoming territorial immobility reducing pressure on land, relieving congestion in urban areas and sustaining green revolution by developing agro- based industries in the country.

5. Essay on the Weaknesses of the Small Scale Industries in India:

In spite of having huge potentialities, the small scale industries in India could not progress satisfactorily as these industries are suffering from various weaknesses.

The major weaknesses of the small scale industries are:

(a) Inefficient human factor,

(b) Faulty and irregular supply of raw materials,

(c) Lack of machinery and equipment,

(d) Absence of credit facilities,

(e) Absence of organised marketing facility,

(f) Competition from large scale units and imported articles,

(g) Old and orthodox designs,

(h) High degree of obsolescence,

(i) Substantial under- utilisation of capacity varying between 47 to 58 per cent,

(j) Huge number of bogus concerns,

(k) Unsuitable location etc.

Due to all these weaknesses the small scale industries could not develop to its full potential.

The Seventh Plan has lightly observed that “All these constraints have resulted in a skewed cost structure placing this sector at disadvantage vis-a-vis the large industries both in the domestic and export markets.”

6. Essay on the Remedial Measures to Remove the Weaknesses of Small Scale Industries:

Small scale industries are occupying a very important place in the industrial structure of the country. Thus, suitable steps should be taken to remove all those weaknesses from which these industries suffer.

The remedial measures are:

(a) Conducting detailed surveys of the existing small industries and drawing productive programmes for them;

(b) Improvement in techniques and adoption of modern technology in these SSI units;

(c) Imparting proper education and training to workers engaged in small scale units;

(d) Regular supply of inputs at reasonable rates;

(e) Adequate credit arrangement;

(f) Provision for cheap and regular supply of electricity;

(g) Effective marketing managements like sales depot and exhibitions;

(h) Conducting research on the techniques of production;

(i) Maintaining standards and quality of the output produced by SSI units;

(j) Temporary protection through reservation of spheres of small scale industries;

(k) Establishing separate suitable machinery with large powers and initiative to tackle different typical problems of small scale industries of the country.

Thus, if all these steps are taken in proper time and spirit the small scale sector will be able to utilise huge development potential available in the country and the SSI sector will prove itself as one of the most dynamic and vibrant sector of the economy of the country.

In recent years, several policy initiatives and procedural simplification have been undertaken by the government to support the small scale sector and enhance its competitive strength. The measures encompass areas like greater infrastructural support, more and easier availability of credit, lower rates of duty, technology upgradation, building entrepreneurial talent, quality improvement, export incentives, employment generation etc.

Upgradation of Investment Limits of SSI in 1996-97 and Thereafter:

In 1996-97, the Government of India in its policy of industrial reforms has enhanced the investment ceilings in plant and machinery for small scale industries (SSI) and ancillary units from Rs 60 lakh and Rs 75 lakh respectively to Rs 3 crore and that for the tiny sector has also been raised from Rs 5 lakh to Rs 25 lakh. Thus, this investment ceiling of SSI unit would also apply to ancillary and export oriented units for which no separate limit has been prescribed.

The Abid Hussain Committee on Small Industries had suggested the enhancement of the ceilings to modernise the units and to make these units competitive. The investment limit was raised mostly to off-set the erosion in the value of the rupee on account of inflation, devaluation/ realignment of exchange rates vis-a-vis foreign currency mid erosion in the value of rupee due to increase in the international price of capital goods.

The limit was raised to take cognizance of the tariff structure and to enable the small scale units to meet the growing needs of technology upgradation and modernisation to remain competitive and take care of additional investment arising out of introduction of anti-pollution measures.

Selective enhancement of investment in plant and machinery from Rs 1 crore to Rs 5 crore was carried out in respect of 13 items in stationary sector and 10 items of drugs and pharmaceuticals sector from June 5, 2003 and also for 7 items of sports goods reserved for manufacture in the small scale sector from October, 2004 in order facilitate technology upgradation and enhancing competitiveness. Moreover, Union Budget, 2005-06 raised the ceiling of SSI exemption on turnover from the existing Rs 3.0 crore to Rs 4.0 crore per year.

Moreover, the Union Budget 2007-08 has also proposed to raise the general exemption limit of Small Scale Industrial units from Rs 1.0 crore to Rs 1.5 crore.

It is expected that the recent increase in investment limit of small scale industries (SSI) sector could result in more opportunities for employment and exports.

New Measures:

Several new measures have been adopted for improving the efficiency and performance of the small scale units by the Government of India in recent years.

These include:

(i) Provision of excise concessions available for both registered and unregistered units depending on turnover upto Rs 300 lakh;

(ii) Reservation of products for exclusive manufacture (35 products at present);

(iii) Enhancement of investment ceilings to Rs 3 crore for SSI units;

(iv) Infrastructural support to Entrepreneurship Development Institutes (EDI) to augment their training capacities;

(v) Adoption of joint programme by SBI and SIDBI for modernisation and technology upgradation of industry cluster;

(vi) Enhanced technology support for modernisation and quality upgradation through opening of five new tool rooms with Danish and German assistance;

(vii) Launching of Technology Development and Modernisation Fund (TDMF) scheme for modernisation and to provide improved and updated technology to export oriented units;

(viii) Provision of infrastructural support in integrated manner through Integrated Infrastructure Development (IID) scheme;

(ix) Introducing seven point action plan for improving the flow of credit to SSI sector in 1995-96;

(x) Simplification of procedural formalities by banks for SSI entrepreneurs;

(xi) Enhancing entrepreneurship development programmes by involving voluntary agencies,

(xii) Strengthening special employment generation programmes through PMRY schemes, and

(xiii) Enhancing the information and data base of the small scale industrial sector.

All these new measures introduced in post-reform era benefitted the entire SSI sector which employed over 1.5 crore people and produced around 50 per cent of the total output produced in the manufacturing sector of the country.

The small scale industry with its inherent dynamism needs to be given vital inputs to boost its performance. The promotion of small scale units ensured greater participation and wider diversification of the production process and ensured dispersal throughout the country.

7. Essay on the New Small-Sector Industrial Policy, 1991:

On August 6, 1991, the Government of India announced its new small sector industrial policy entitled ‘Policy Measures for promoting and strengthening small, Tiny and Village Enterprises.’ The main objective of this new policy is to inject higher degree of vitality and growth impetus to this sector in order to attain a higher growth rate in respect of its output, employment and exports.

The following are some of the salient features of the new policy:

1. De-regulation, de-bureaucratisation and simplification of rules, regulation and procedures in connection with the establishment and maintenance of these small scale units.

2. Enhancement of the investment limit in fixed capital asset of “tiny” enterprises from Rs 2 lakh to Rs 5 lakh, irrespective of the location of the unit.

3. Recognising industry related services and business enterprises within small scale industries, irrespective of their location with investment upto Rs 5 lakh.

4. Arranging adequate and regular flow of credit on a normative basis and to improve the quality of its delivery for smooth and viable operation of the small scale sector.

5. Establishing a special monitoring agency in order to look after the genuine credit needs of the small-scale industrial sector.

6. Arranging a suitable legislation to ensure prompt payment of small industries bills.

7. Introducing a scheme of integrated Infrastructural Development for small scale industries.

8. Setting up of a Technology Development Cell (IDC) in the Small Industries Development organisation (SMA) for providing technology inputs for improving productivity and competitiveness of the products produced by the small sector.

9. Ensuring market promotion of the products produced by small sector through co-operatives, public institution and other specialised professional or marketing agencies and consortia approach.

10. Establishing one Development Centre: Establishing Export Development Centre in Small Industries Development Organisation (SIDO).

11. Introduction of a limited partnership Act to limit the financial liability of new and non-active partners/entrepreneurs to allow foreign companies upto 24 per cent.

Steps Taken by the Government:

The Government has taken the following steps for the promotion of small-scale industries pursuant to the policy measures announced on 6 August, 1991:

(i) Restriction on registering new SSI units for the manufacture of certain products was disbanded.

(ii) Removal of credit bottlenecks of this sector. The eligibility limit of projects under National Equity Fund Scheme has been doubled from Rs 5 lakh to Rs 10 lakh.

(iii) The single window scheme was extended to be operated by schedule banks also in addition to State Financial Institutions.

(iv) An ordinance was promulgated on 23rd September, 1992 making payment of interest obligatory on delayed payments to small scale and ancillary industrial undertakings. It has been re-promulgated in January 1993.

Various procedural simplifications including new registration forms were also introduced, to ensure prompt payment to small scale units and a new legislation, viz. Interest on the Delayed Payments Act, 1993 was enacted by Parliament. A scheme has been formulated to train unemployed non-technical graduates so as to augment the availability of managers at affordable rates for the SSI sector and reduce educated unemployment.

Special Package of Measures and Incentives for SSI:

The Central Government appointed the Nayak Committee to examine the problems of credit, sickness and other related issues in the SSI sector. The committee submitted its Report in September, 1992. The Reserve Bank of India vides their circulars dated April 17, 1993 and July 3, 1993 announced a special package of measures to ensure adequate and timely credit to SSI sector.

The salient features of this package are:

(a) Banks should give preference to village industries, tiny industries and other small scale units in that order, while meeting the credit requirement of the small scale sector;

(b) The banks should step up the credit flow to meet the legitimate requirements of the SSI sector in full during the Eighth Five Year Plan;

(c) An effective grievance redressal machinery within each bank which can be approached by the SSI in case of difficulties would be set up; and

(d) Banks should adopt the single window clearance scheme of SIDBI for meeting the credit requirements of small scale units.

Thus, in order to help the small scale industry sector, the Government took some initiatives during 1993- 94 which include, introduction of a 24 per cent equity participation, interest on delayed payment, abolition of the restricted list in the small scale sector and simplification of registration procedures.

The small scale sector contributes about 40 per cent to the gross turnover in the manufacturing sector and nearly 35 per cent of total exports. In order to enhance the competitive strength of the small scale sector, several policy initiatives have been undertaken.

These measures included:

(i) A new scheme of Integrated Infrastructural Development was launched recently to strengthen infrastructural facilities in 50 centres in rural and backward areas.

(ii) The concessional rate of excise duty available for units with a turnover of Rs 30 lakh to 75 lakh per annum was extended to the non-registered sector also.

(iii) A Quality Certification Scheme was launched in 1994 to improve the quality standards of SSI products which are to be by awareness programmes and financial support to acquire ISO 9000 or similar International quality standards.

Modifications were effected in the ‘Single Window Scheme’ operated by SIDBI. The project outlay under the scheme was raised from Rs 30 lakh to Rs 50 lakh as a whole, removing sub-limits for working capital and term loan components.

Moreover, the government has constituted a high power advisory committee on reservation of items for exclusive production under the small scale sector. A committee has also been set up for checking the entry of large and medium scale units into the areas reserved for small scale sector. The government has also formulated a scheme, to train small entrepreneurs and managerial assistants to improve the supply of managerial cadre to the sector.

In recent times, the centre is also keen on formulating a policy for the tiny industry sector, which constitutes about 90 per cent of the small-scale industries in the country, for their faster growth and development, particularly in backward areas.

The tiny industries sector, the majority among the SSI units, was at present passing through a bad phase which needed to be improved to keep pace with economic reforms. The Government has also announced the setting up of an expert committee to look into the problems and difficulties of SSI units in the country and their solution.

In the post-liberalisation scenario, the small industries sector-has to face global competition and, thus, inherent strengths ought to be suitably moulded to adapt to the changed circumstances through upgradation of technology and by forging closer ties between domestic and foreign enterprises.

Appraisal:

It is for the first time that a separate policy has been announced. It is important to note that the policy has announced the continuation of the reservation policy for the SSI sector.

J.C. Sandesera observed that the four measures of the new policy are really ‘Path breaking’ and the measures are well directed to minimise the problems of this sector.

These four measures include:

(a) Changes in the definition of tiny units,

(b) Separate package for the promotion of tiny enterprises,

(c) Providing for equity participation by other industrial units in the small scale units not exceeding 24 per cent of the total shareholding, and

(d) Introduction of a new legal form of organisation of business, known as restricted or limited partnership.

But this policy failed to redress the serious problems of large number of sick units in the small sector.

The new policy has legitimised the sub-contracting operation of big business by the large business houses and foreign firms to have an ownership stake.

The new policy has done away with the locational criterion or defining the tiny and service sector enterprises. Thus, such enterprises can now be set up anywhere in the country. The reversal of the earlier policy in this direction may lead to greater concentration of industrial units in cities and metropolitan areas; with all the resultant evils of conglomeration.

The proposal of the new policy to allow equity participation by other industrial undertaking including foreign companies is intended to help build up linkage between the SSI and LMSI (large and medium) sectors. But this may lead to an intrusion to SSI sector by the large sector.

Indian Council of Small Industries (ICSI) and Indian Federation of Tiny Enterprises (IFTE) call this opening up of the SSI sector a backdoor entry of large industries into the area of the SSI sector. Furthermore, the entry of large industrial houses with their great financial clout into the field earlier reserved is likely to deal a severe blow to the SSI investors.

The new policy has completely stopped the concessional finance for the SSI sector. The priority sector status is also likely to be withdrawn.

Fund is a major constraint for the SSI sector. It is the timely and adequate credit that is very much needed by the sector. The new policy also proposed to raise the eligibility limit of investment upto Rs10 lakh for National Equity Fund and upto Rs 20 lakh for single window schemes. Accordingly, more SSI units will be able to get financial assistance under these two schemes.

Other measure like introduction of factoring service through commercial banks, enactment of legislation of reducing the delay in payment of bills of the SSI units etc. are likely to benefit the SSI units etc. It will however depend on quick implementation of the proposed measures.

Thus, in this context it can be observed that it is not the announcement of policy alone which is important but it is the implementation of the policy which is more important.

8. Essay on the Policy Measures for SSI Sector Undertaken during 2004-05:

Major policy measures undertaken during 2004-05 for the SSI sector were as follows:

1. The National Commission on Enterprises in the Unorganized/Informal Sector was set up in September 2004. The Commission will, inter-alia, recommend measures considered necessary for improvement in the productivity of these enterprises, generation of large scale employment opportunities on a sustainable basis, linkage of the sector to institutional framework in areas like credit, raw material supply, infrastructure, technology upgradation, marketing facilities and skill development.

2. 193 items reserved for exclusive manufacture in the SSI sector were de-reserved in March 2005. The total number of reserved items now stands at 506.

3. To facilitate technology upgradation and enhancing competitiveness, the investment limit (in plant and machinery) has been raised in October 2004, from Rs 1 crore to Rs 5 crore, in respect of 7 items of sports goods, reserved for manufacture in the small scale sector.

4. The Small and Medium Enterprises (SME) Fund of Rs 10,000 crore was operationalised by the SIDBI since April 2004. Eighty per cent of the lending from this fund will be for SSI units, at interest rate of 2 per cent below the prevailing PLR of the SIDBI.

5. The Reserve Bank of India enhanced the composite loan limit for the SSI sector to Rs 1 crore from Rs 50 lakh.

6. With a view to integrate small and medium enterprises, facilitating their growth and enhancing their competitiveness (including measure for freeing the sector from “Inspector Raj”), a suitable legislation is being finalised.

7. A new “Promotional Package for small enterprises” is being formulated. This would include measures to provide adequate credit, incentives for technology upgradation, infrastructural and marketing facilities, etc.

9. Essay on the Policy Initiatives and Measures Undertaken for MSEs during 2006-07 and MSMED Act, 2006:

The micro and small enterprises (MSEs) are playing an important role in Indian economy, contributing around 39 per cent of country’s manufacturing output and 34 per cent of its exports during 2004-05. These enterprises provide employment to around 29.5 million people in both the rural and urban areas of the country.

The process of economic liberalisation and market reforms exposed the Indian MSEs to increasing levels of domestic and global competition and has also opened up attractive possibilities of access to larger markets and also stronger and deeper linkages of MSEs with larger enterprises.

Under this changed environments, the MSEs should achieve sustained growth by enhancing technological capabilities so as to improve the quality of products and services to global standards and also seeking ways of innovation.

In 2006-07, the Government has undertaken initiatives and measures to enable in MSEs enhance their competitive strength, address challenges of competition and also to avail the benefit of global market.

The following are some of these measures:

1. MSMED Act, 2006:

The Government of India enacted the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 which provides the first ever legal framework for recognition of the concept “enterprise” (comprising both manufacturing and services) and integrating the three tiers of these enterprises, viz., micro, small and medium. Under this Act, enterprises have been categorised broadly into those engaged in (i) manufacturing and (ii) providing/rendering of services and that too classified into micro, small and medium enterprises.

For manufacturing enterprises, the investment limit of Micro enterprises is fixed at Rs 25 lakh, small enterprises above Rs 25 lakh to Rs 5 crore, Medium enterprises above Rs 5 crore to Rs 10 crore. For service enterprises the investment limit is fixed at for Micro enterprises—upto Rs 10 lakh, small enterprises— above Rs 10 lakh to Rs 2 crore and Medium enterprises—above Rs 2 crore to Rs 5 crore.

The Act provides for a statutory consultative mechanism at the national level with wide representation of all sections of stakeholders, particularly the three classes of enterprise and with a wide range of advisory functions and an Advisory Committee in found to assist the Board and the Centre/State Governments.

The other features of Act include:

(i) Establishment of specific funds, for the promotion, development and enhancement of competitiveness of these enterprises;

(ii) Notification of schemes/programmes for the purpose;

(iii) Progressive credit policies and practices,

(iv) Preference in Government procurements to products and services of the micro and small enterprises;

(v) Introducing most effective mechanisms for mitigating the problems of delayed payments to micro and small enterprises and

(vi) Simplification of the process of closure of business by all three categories of enterprise.

2. Amendment to KVIC Act:

The government has amended the Khadi and Village Industries Commission Act, 1956 introducing several new features to facilitate professionalism in the operations of the Commission as well as field level formal and structured consultations with all segments of stakeholders. Accordingly the commission has been constituted.

3. Approval of Package:

A package for promotion of Micro and Small enterprises has been approved recently to address most of the concerns in the areas such as credit, cluster-based development, infrastructure, technology and marketing. Besides, capacity building of MSME Associations and support of Women entrepreneurs are the other important features of this package.

4. Setting up EGOM:

An Empowered Group of Ministers (EGoM) under the Chairmanship of the External Affairs Minister has been set up to lay down a comprehensive policy for cluster development and to oversee its implementation.

5. Introducing CGTSI:

Under the Credit Guarantee Scheme, life insurance cover for chief promoters of units provided guarantee cover by the Credit Guarantee Fund Trust for Small Industries (CGTSI) has been introduced. Further, the one-time guarantee fee under the scheme was reduced from 2.5 per cent to 1.5 per cent with effect from April 1, 2006.

6. De-reservation:

After due consultation with the stakeholders, 180 items reserved for exclusive manufacture in micro and small enterprises have been de-reserved on May 10, 2006 and 87 such items were de-reserved on January 22, 2007.

Major Initiatives taken by the Government:

Recently, the Government has taken some major initiatives to revitalize MSME sector.

These are:

(i) Implementation of Micro, Small and Medium Enterprises Development (MSMED) Act, 2006.

(ii) A “Package for Promotion of Micro and Small Enterprises” was announced in February 2007. This includes measures addressing concerns of credit, fiscal support cluster-based development, infrastructure, technology and marketing. Capacity building of MSME Associations and support to women entrepreneurs are the other important features of this package.

(iii) To make the Credit Guarantee Scheme more attractive, the following modifications have been made: (a) enhancing eligible loan limit from Rs 25 lakh to Rs 50 lakh; (b) raising the extent of guarantee cover from 75 per cent to 80 per cent for (i) micro enterprises for loans upto Rs 5 lakh, (ii) MSE operated or owned by women and (iii) all loans in the North Eastern Region; and (c) reducing one time guarantee fee from 1.5 per cent to 0.75 per cent for all loans in the North Eastern Region.

(iv) The phased deletion of products from the list of items reserved for exclusive manufacture by micro and small enterprises in being continued 125 items were de-reserved on March 13, 2007 reducing the number of items reserved for exclusive manufacture in micro and small enterprises sector to 114.0. Further, 79 items were de-reserved through a notification dated February 5, 2008.

Progress of Micro, Small and Medium Enterprises (MSMEs) Sectors:

Presently, micro, small and medium enterprises (MSMEs) are playing an important role in Indian economy. MSMEs are contributing about 8 per cent of the GDP of the country, about 45 per cent of manufactured output and nearly 40 per cent of total exports. This, coupled with a high labour to capital ratio, high growth and high dispersion makes them crucial for achieving the objective of inclusive growth.

As per the Results of the 4th All India census of MSMEs released on November 19, 2010, there were about 30.0 million MSMEs in the country, which provided employment to about 60 million persons of which 28 per cent were in the manufacturing sector and 72 per cent in the service sector. This is the first census after the enactment of the MSMED Act 2006 and includes for the first time medium enterprises.

One important aspect of this MSME sector is that it mobilizes major portion of its capital from the lower middle class sections of the society in order to invest the same amount in productive economic activities. In spite of all efforts, the MSME sector is facing a tough situation as a large number of 4, 80,946 units were closed down over the five year period preceding 2006 and another group of 77,723 MSME units were declared sick. The census report also highlighted that obtaining adequate and timely credit, especially work-capital loan is considered as the major problem in the path of MSME sector.

Again, the India Micro, Small and Medium Enterprises Report, 2014 prepared by RM. Mathew, director of the Mi, based Institute Of Small Enterprises and Development stated that the inadequate flow of credit to the MSMEs is problem and also an opportunity for the banks to expand its credit network.

It is observed from the report that three-fourth of MSME units of India do not have any access to institutional finance and times has come for banks to enter long term financing agreements with these units in a vigorous manner.

As per Reserve Bank of India data, bank lending to MSMEs was only 7 5.4 trillion as on January, 2013.

In order to promote the MSME sector, the Ministry of MSME with its MSMED Act, 2006 has set up different committees and made different recommendations for introducing a smooth credit delivery system.

10. Essay on the Schemes to Boost MSME Sector:

Being an important component of industrial sector of the country, the MSME sector covers both the registered and informal sectors. The classification of micro, small and medium enterprises presently is based on the criterion of investment in plant and machinery by each enterprise.

Detailed information for the registered MSMEs on the various economic variables such as employment investment, products, gross output, and exports is available based on the Fourth Census of MSME (2006-07).

The size of the registered MSMEs was estimated to be about 15.84 lakh units with sub-sector wise composition in the proportion of 94.9 per cent micro enterprises, 4.89 per cent small and 0.17 per cent medium enterprises. The total registered MSME sector comprised of 67.1 per cent manufacturing enterprises and 32.9 per cent services enterprises.

About 15 per cent of these registered enterprises were located in rural areas. More detailed information based on the Fourth Census on the unorganized sector units, constituting about 94 per cent of the entire MSME sector is awaited.

In the recent past the Prime Minister’s Task Force on MSMEs and the Twelfth Plan Working Group on MSMEs have discussed issues related to the MSME sector. The Twelfth Five Year Plan policy framework is guided by the recommendations of these key committees.

The Plan covers various aspects of the MSME sector and its key recommendations fall under six broad verticals, viz.:

(i) Finance and credit

(ii) Technology

(iii) Infrastructure

(iv) Marketing and procurement

(v) Skill development and training, and

(vi) Institutional structure.

The Plan has a separate set of recommendations for the Khadi and village industries and the coir sector.

In order to boost the MSME sector, several schemes are under operation including the following ones:

1. Procurement Policy:

The government has notified a Public Procurement Policy for Goods Produced and Services rendered by Micro and Small Enterprises (MSE) order, 2012 effective from 1st April, 2012. The policy mandates that all the central ministries/departments/central public sector undertakings (CPSUs) shall procure a minimum of 20 per cent of their annual value of goods/services required by them from MSEs. Further, policy has earmarked a sub-target of 4 per cent procurement out of this 20 per cent from MSEs owned by scheduled caste/scheduled tribe (SC/ST) entrepreneurs.

2. MSE-Cluster Development Programme (MSE-CDP):

The Ministry of MSME has adopted a cluster approach for holistic development of MSE in a cost effective manner. To build capacity of MSMEs for common supportive actions, soft interventions are undertaken in the existing clusters/ new industrial areas/estates or existing industrial areas/estates.

To ensure transparency and speedy implementation of the MSE-CDP, office of the Development Commissioner, MSME has started an online application system from 1 April 2012. Hard interventions are taken up to create/upgrade infrastructure facilities and setting up of common facility centres in new/existing industrial estates/ clusters.

3. Credit Guarantee Scheme:

The Government is implementing the Credit Guarantee Fund Scheme for MSEs with the objective of facilitating flow of credit to the MSEs, particularly to micro enterprises by providing guarantee cover for loans upto Rs 100 lakh without collateral/third party guarantees.

For making the scheme more attractive to both lenders as well as borrowers, several modifications have been undertaken which, inter alia, include:

(a) Enhancement in the loan limit to Rs 100 lakh;

(b) Enhancement of guarantee cover from 75 per cent to 85 per cent for loans up to Rs 5 lakh;

(c) Enhancement of guarantee cover from 75 per cent to 80 per cent for MSEs owned/operated by women and for loans in north eastern region (NER);

(d) Reduction in one-time guarantee fee from 1.5 per cent to 1 per cent and annual service charges from 0.75 per cent to 0.5 per cent for loans upto Rs 5 lakh and

(e) Reduction in one-time guarantee fee for NER from 1.5 per cent to 75 per cent.

4. Credit Linked Capital Subsidy:

Scheme for Micro and Small Enterprises (CLCSS) for MSEs. The scheme aims at facilitating technology up-gradation of MSEs by providing 15 per cent capital subsidy (limited to maximum 2-15 lakh) for purchase of plant and machinery. Maximum limit of eligible loan for calculation of subsidy under the scheme is Rs 100 lakh. Presently, 48 well established and improved technologies /sub-sectors have been approved under the scheme.

The CLCSS is implemented through 11 nodal banks/agencies including the Small Industries Development Bank of India (SIDBI), National Bank’ for Agriculture and Rural Development (NABARD) and Tamil Nadu Industrial Investment Corporation (TICC), Chennai (TIIC) and National Small Industries Development Corporation (NSIC) Ltd.

In order to boost the MSME sector, several other schemes are made operational for the establishment of new MSMEs and growth and development of existing ones.

These include:

(i) Technology Centre Systems Programme;

(ii) India Inclusive Innovation Fund;

(iii) Prime Minister’s Employment Generation Programme;

(iv) Scheme for Extension of non-tax benefits to MSMEs for three years;

(v) Performance and Credit Rating Scheme;

(vi) Assistance to Training Institutions; and

(vii) Scheme of Fund for Regeneration of Traditional Industries.

11. Essay on the Twelfth Plan’s Initiatives for the Development of MSME Sector:

Under the Twelfth Five Year Plan, the government at the centre wants to set up around 5.0 lakh small industrial enterprises with an aim to create employment avenues for nearly 40 lakh people of the country.

Moreover, the share of Micro, Small and Medium Enterprises (MSME) in India’s total exports is expected to increase upto 50 per cent of India’s total exports during the Twelfth Plan is compared to 36 per cent contribution to country’s total exports preventing in 2012-13.

The increase in contribution to exports is expected on account growing demand for MSME products from the western and emerging markets.

Under the Twelfth Plan, the government has decided to establish these new MSME units under the Prime Minister’s Employment Generation Programme (PMEGP) for which a sum of Rs 8,050 crore has been earmarked. PMEGP is a flagship scheme of the UPA government.

Ever since its inception in 2008, more than 2.34 lakh new MSME entrepreneurs have been assisted under it and 21.16 lakh employment opportunities created across the country. For assisting these enterprises, margin money (subsidy) to the tune of Rs 5,167 crore have been released by the government.

The programme a credit linked subsidy programme, aimed at generating self-employment opportunities as well as wage employment through establishment of micro enterprises in the non-farm sector, has been implemented by the MSME Ministry. The MSME Ministry has now targeted over 100 new enterprises per district every year under the PMEGP in all the 650 districts of the country.

The government has accorded top priority to the MSME sector. Consequently, the fund allocation to the MSME Ministry has been enhanced to over Rs 24,124 crore in the Twelfth Plan as compared to Rs 11,000 crore allocated during the Eleventh Plan.

MSME sector is of vital importance to the national economy. The government’s initiatives can be successful only with the participation of the private sector and civil society. Strong performance in the MSME sector is necessary for the country to achieve rapid and inclusive growth. It is now a matter of satisfaction that the MSME sector of the country has grown at a healthy rate of 10 per cent in recent years.

Moreover, the MSME Development Act, passed in 2006, was one of the important recent initiatives in this direction. Subsequently, the country has been implementing the National Manufacturing Competitiveness Programme (NMCP), which is a blueprint for increasing competitiveness of the sector.

The government also implemented the major recommendations of a task force set up in 2010 in order to suggest steps to strengthen the sector. Moreover, the public procurement policy announced in favour of MSME sector in 2012 would help in improving the market access and competitiveness of micro and small enterprises.

Besides, in order ensure better flow of credit to MSME units by minimising risk perception of banks/ financial institutions in lending without collateral security, the government is implementing the Credit Guarantee Scheme.

The scheme provides guarantee cover upto 85 per cent on collateral security free credit facility which is extended by lending institutions to new and existing units for advancing loan upto Rs 100 lakh. Till April 2013, more than 11 lakh proposals have been approved under the scheme providing guarantee cover for total sanctioned loan amount of Rs 54,322 crore.