After reading this essay you will learn about:- 1. Meaning of Depreciation 2. Types of Depreciation 3. Methods for Calculation.

Essay # 1. Meaning of Depreciation:

Whenever any machine or equipment performs useful work, its wear and tear is bound to occur. This can be minimised up to some extent by proper care and maintenance but cannot be totally prevented. Its efficiency also reduces with the lapse of time and at one time it becomes uneconomical to be used further and needs replacement by another new unit.

Therefore, we can say efficiency and value of machine or asset constantly reduces with the lapse of time during use, which is known as “Depreciation”.

So some money must be set aside yearly from the profits, so that when that equipment becomes uneconomical, it can be replaced by the new one. Therefore, the initial cost of machine plus installation charges + repair charges— scrap value is charged against overheads and spread over the machine’s useful life.

For this purpose, depreciation account for the complete plant or individual equipment is opened in the Company’s Books and is known as Depreciation Fund or “Sinking Fund”. This amount is deducted yearly from the profits and kept separate to have sufficient money for replacement at the end of useful life.

Essay # 2. Types of Depreciation:

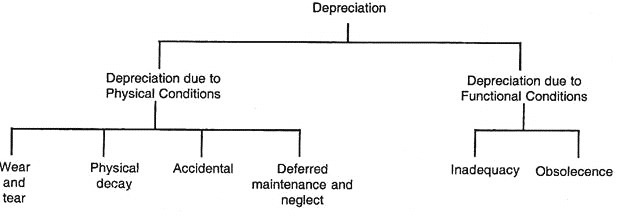

For further understanding depreciation can be classified as under:

Now, each type of depreciation is explained in short below:

(a) Depreciation due to Wear and Tear:

Everybody knows that when any machinery performs work, wear and tear of certain components takes place, although sufficient precautions are taken, e.g. proper lubricating and cooling is done, which minimise wear and tear but it cannot be totally prevented. Hence the cost of replacement because of this cause, is the value of depreciation due to wear and tear.

(b) Depreciation due to “Physical decay”:

There are certain items in a factory, such as insulation of materials, furnitures, electric cables, buildings, chemicals, vessels etc., which get decay, because of climatic and atmospheric effect, with the result the value of these articles goes on reducing with the lapse of time.

Although every effort is made by the owner to keep them in serviceable condition even then because of climatic and atmospheric effect, there will be reduction in their costs. This reduction in cost is depreciation due to physical decay.

(c) “Accidental” Depreciation:

Although, the machine might have installed even few days back and sufficient care is taken to prevent accident, even then, accident may occur due to some wrong operation, or some loose component or some other cause which may result in a heavy damages. The depreciation in a machine caused due to this reason is called accidental depreciation.

Now-a-days, to cover this risk most of the owners get their equipment insured with the insurance companies. For this, owners have to pay certain premium yearly. The amount of premium depends upon the estimated cost and life of equipment.

(d) Depreciation due to “Deferred Maintenance and Neglect”:

Every manufacturer supplies certain instructions for the smooth and efficient running of an equipment.

For example, in the case of a vehicle, a manufacturer gave the following instructions:

(i) Lubricating oil of particular grade should be used in engine.

(ii) Oil should be drained and new oil should be refilled after first 1000 km running, and then every 5000 km.

(iii) All the bolts and nuts should be re-tightened after 5000 km running.

(iv) Decarbonising after 30000 km running and so on.

If these instructions are not followed because of neglect, and proper maintenance is not done as recommended by manufacturer, then the life of the vehicle may be reduced and depreciation in value because of this, is called depreciation due to deferred maintenance and neglect.

(e) Inadequacy:

This is the form of functional depreciation. Inadequacy means reduction in efficiency of an asset. This may result even if any equipment is servicing under proper precautions and sufficient maintenance is provided, there is fall in efficiency with the lapse of time.

Secondly, suppose after 2-3 years of running, the demand of products manufactured by certain plant is increased. But the plant cannot cope with the increased demand. This needs additional money either to replace with the bigger size machinery or installation of more similar size plants. This is, what is called depreciation due to inadequacy.

(f) Depreciation by Obsolescence:

Now-a-days because of rapid scientific advancement, there are frequent changes. If a new machine comes in the market which is more efficient because of new invention or better design than the existing one, manufacturing same type of products by the new one are much cheaper and better than the existing one, then the existing machinery has to be replaced to withstand market competition. This is called depreciation by obsolescence.

Essay # 3. Methods of Calculating Depreciation:

Various methods of calculating depreciation are explained below with the help of solved problems for clear understanding explained below:

1. Straight Line Method.

2. Diminishing Balance Method.

3. Sinking Fund Method.

4. Annuity Charging Method.

5. The Insurance Policy Method.

6. The Revaluation or Regular Valuation Method.

7. Machine Hour Basis Method.

8. The Sum of the Year’s Digits Method.

1. Straight Line Method:

This method assumes that the loss of value of machine is directly proportional to its age. It means one should deduct the scrap value from the original value and divide the remaining value by the number of useful life.

Let C be the initial cost of a machine S be the scrap value.

N be the number of years of life of machine.

and D be the depreciation amount per year.

Then D = Rs. C – S/N

This method of calculating depreciation fund is also known as “Fixed Installment” method, because every year same (fixed) amount is deducted and no consideration is made about the maintenance and repair charges, which gradually increases as the machine is getting old.

This will be clear by the following numerical problem:

Problem 1:

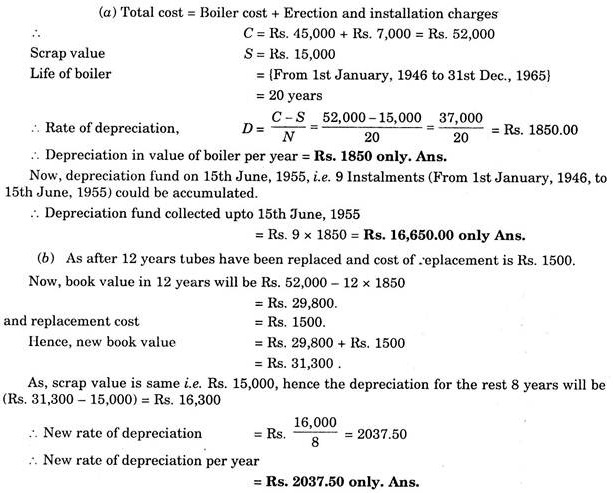

(a) A boiler was purchased for Rs.45,000 on 1st January, 1946, the erection and installation work cost Rs.7000. The boiler was replaced by a new one on 31st Dec. 1965. If the Scrap Value was estimated as Rs.15,000; what should be the rate of depreciation and depreciation fund on 15th June, 1955?

(b) If after 12 years of running some boiler tubes are replaced and the replacement cost is Rs.1500, what will be the new rate of depreciation?

Solution:

2. Diminishing Balance Method:

This is also called “Reducing Balance” Method. The diminishing value of machine is much greater in the early years. It depreciates rapidly in the early years and later on slowly.

Therefore, it is better to depreciate much during the early years, when the repair and renewals are not costly.

So under this method, the book value of the machine goes on decreasing as its existence continues. A certain percentage of the current book value is taken as depreciation. Therefore, this is also called “Percentage on Book Value” method.

In this, let x be the fixed percentage taken to calculate the yearly depreciation on the book value

Then x = 1 – (S/C)1/N

where, C = Initial cost, S = Scrap value, N = No. of years of life.

It will be more clear by the following solved problem:

Problem 2:

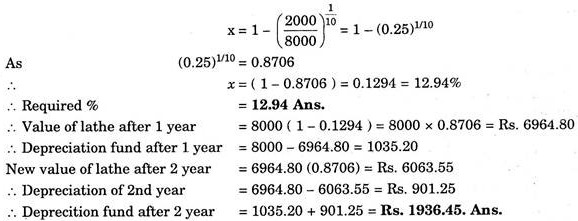

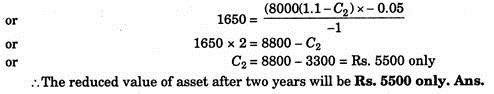

A lathe is purchased for Rs.8,000 and the assumed life is 10 years and scrap value is Rs.2,000. If the depreciation is charged by Diminishing Balance method, calculate the percentage by which value of the lathe is reducing every year and depreciation fund after 2 years.

Solution:

Here C = 8,000, S = 2,000 and N = 10.

We know that x = 1 – (S/C)1/N

Substituting the given values in the above formula

3. Sinking Fund Method:

In this method a depreciation fund equal to the actual loss in the value of the asset or machine is estimated, taking into account, the interest on the so accumulated fund. The rate of depreciation will be constant throughout the life of machine.

Let

D = Rate of depreciation per year

R = Rate of interest on accumulated fund in fraction number.

C = Total cost of machine.

S = Scrap value.

N = No. of years of life of machine.

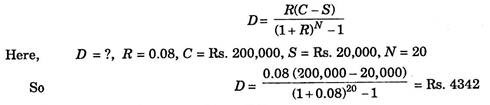

D = R(C – S)/(1 + R)N – 1

This will be clear by the following solved problem.

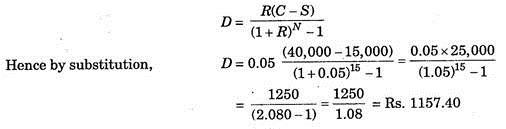

Problem 3:

A machine is purchased for Rs.40,000. The estimated life of machine is 15 years and scrap value Rs.15,000. If the rate of interest on the depreciation fund is charged at 5%, calculate the rate of depreciation by sinking fund method.

Solution:

The required formula is:

Hence, required depreciation is Rs.1157.40 per year. Ans.

Problem 4:

An industrial plant with initial value of Rs.200,000, and the salvage value of Rs.20,000 at the end of 20 years but is sold for Rs.145,000 at the end of 10 years. What is the profit or loss if sinking fund depreciation method at 8% compound annually was adopted?

That is the rate of depreciation = 4342 per year.

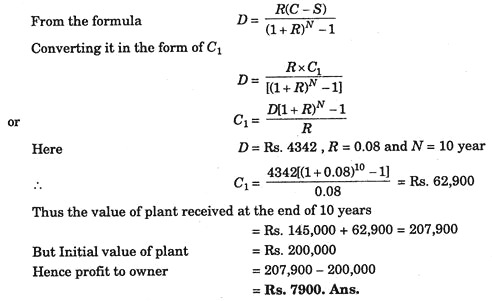

But as per the question he sold the plant for Rs.145,000 at the end of 10 years. Thus, we are required to calculate the value of plant at the end of 10 years.

Which can be obtained as under:

The depreciation amount will be collected each year for 10 years. On which 8% compound interest will be earned. So the amount of depreciation plus compound interest collected in 10 years = Rs.62,900.

This can be calculated as follows:

Let C1 is the amount collected for 10 years as depreciation fund along with 8% compound interest.

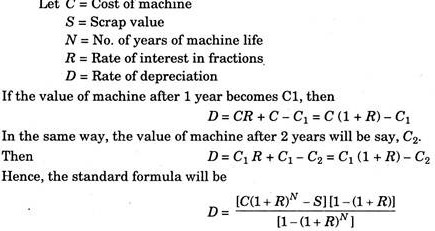

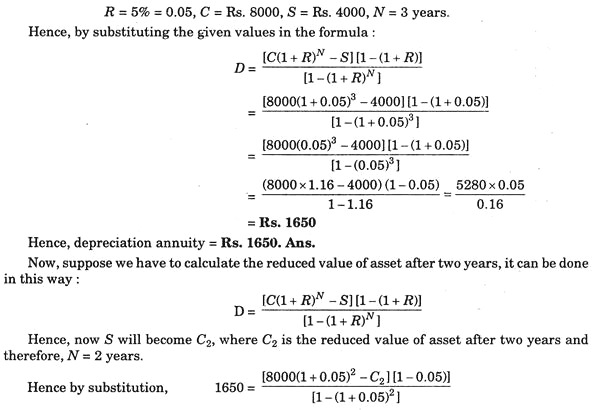

4. The Annuity Charging Method:

In this, interest is charged on the cost of machine or assets every year on the book value, but the rate of depreciation is constant every year.

Hence by substituting the different values in the above formula the rate of depreciation can be calculated.

It will be more clear by following problem:

Problem 5:

Find the depreciation annuity by the annuity charging method after 3 years, when the cost of machine is Rs.8000 and scrap value Rs.4000. Rate of interest is 5%.

Solution:

5. The Insurance Policy Method:

This method covers the risk, if the machine becomes unserviceable before its estimated life.

In this method the machine is insured with the Insurance Company and premiums are paid on the Insurance Policy. When the policy matures, the company provides sufficient sum to replace the machine.

6. Revaluation or Regular Valuation Method:

This is not a standard method. In this, every year the value of machine is revaluated and the difference between the book value and revalued value is charged as a depreciation fund.

7. Machine-Hour Basis Method:

In this method, rate of depreciation is calculated, considering the total number of hours a machine runs in a year and therefore a work hour chart of every machine is maintained to know the total number of hours the machine runs in a year.

This will be clear by the following problem;

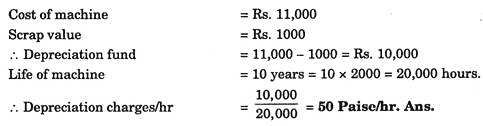

Problem 6:

What are Depreciation Charges?

A machine is costing Rs.11,000 and expected to run for 10 years at the end of which its scrap value is likely to be Rs.1000. Machine is expected to run 2000 hours/year on the average. Estimate the depreciation charges per hour for the machine.

Solution:

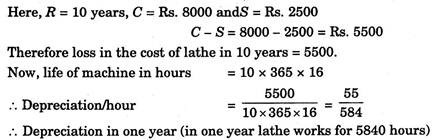

Problem 7:

The estimated life of a lathe is 10 years and it works 16 hours a day. The initial cost of lathe is Rs.8000 and scrap value after 10 years is Rs.2500. If the machine works for 5840 hours in a year, calculate the rate of depreciation charged annually under machine hour basis method.

Solution:

8. The Sum of the Year’s Digits Method:

As the new equipment is installed, the reduction in value will be greater initially and it will go on decreasing gradually. This fact is taken into account and therefore greater amount of depreciation is made during the early years of life and it goes on reducing as the life of equipment decreases. Therefore, for calculating depreciation, the net amount (Total cost – Scrap value) is spread over whole life in a decreasing proportion.

It will be more clear by the following problem:

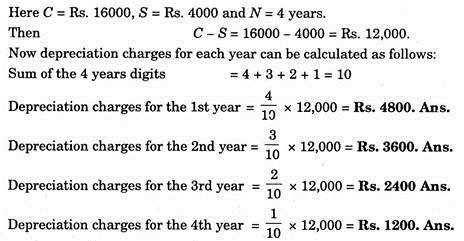

Problem 8:

The cost of a machine is Rs.16,000 and its scrap value Rs.4000. Determine depreciation charges for each year, if the estimated life of machine is 4 years. Use “sum of the year’s digits” method.

Solution:

Therefore, from above it is clear that higher depreciation charges are made during the early years and it is the advantage of this method.

Problem 9:

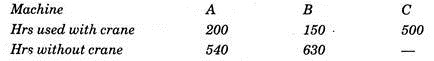

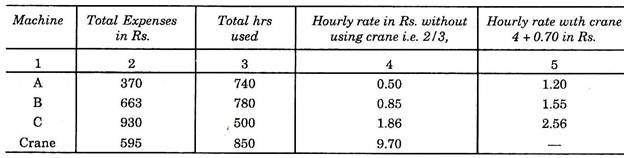

Expenses for the following three machines have been allocated as under:

One overhead crane have also used for bringing the materials to these machines.

The utilisation of these 3 machines and the crane is as follows:

If expenses on crane are Rs. 595, calculate machine hour rate for each machine and crane and rate for machines when used with crane.

Solution:

Problem 10:

A company have been set up for the manufacture of a specially designed pump approved by the government. The company has a capacity of producing 50,000 units per year. Government placed an order of only 10,000 units and, the company failed to get any other order from other sources. The company charged the entire depreciation of the year over 10,000 units. But the government objected to it. Give your opinion on this point of dispute.

Please also give your opinion about the rate of depreciation if government places an order of 80,000 units for manufacturing in one year.

Solution:

The act of the company for charging the depreciation of the whole year on 10.000 units instead on 50,000 units is not justified, because the government did not take any guarantee for placing the order for full capacity of 50,000 units.

In these circumstances, the government is not liable to pay depreciation for full year. If Rs.100,000 is the depreciation for full year, the depreciation for each unit is (100,000/50,000) = Rs. 2.00. Thus the government must pay Rs.2 × 10,000 = Rs.20,000 and rest Rs.80,000 is treated as a case of indirect expenses due to idleness of factory.

Similarly, if the government places an order of 80,000 units and the same is executed in the same one year then also depreciation at the rate of Rs. 2.00 per unit should be charged. Since this is a good luck of the company and also good efforts made by them to produce more than the capacity, the company has full right to get more amount on account of depreciation.