Essay on International Trade in India!

In the simplest of definitions the international trade can be defined as the mutually profitable exchange of goods and services between the people of different countries residing in different geographical locations.

The international trade is the net sum of the export trade of the interacting countries. The term “Foreign trade” is different from international trade it refers to a country’s net sum of imports and exports.

The availability of elements of production is not uniform world over, one country might possess excess of such elements and some in deficit, the production in one country might be better than the others resulting in better production efficiencies.

This condition of excess/deficient productive/nonproductive modern/obsolete etc., is a situation conductive to the flow of goods and services from one country to another and this is what we call the international trade. Another factor, which propels the movement of goods and services between countries, is the specialization factor.

One country might be efficient in producing one type of item and another country efficient in producing another type of item. Both need these items, so logical conclusion would they exchange the goods to gain from the expertise of each other rather than to produce everything that one needs.

The international trade gains importance from the situation when domestic production and sales outgrows the potential of the market in terms of the size, growth rate and profitability. The domestic and the overseas markets together develop into pulsating bipolar arrangements in which both are a dynamic stage of equilibrium.

Each tries to stabilize the other. The global trader operating at such a level has to live with ever changing economic and political situations in the countries. The political situation is very important for the trader because this will form the foundation for solid smooth business conditions under which the various trade activities will flourish.

The other factors that affect international trade and must be understood clearly by a trader are the economic and industrial policies followed by the sovereign countries, proprietary laws and the legal system, currency position and parity rates, investment and repatriation laws, tax system, exchange control regulations.

All countries strive to export more than import for generating trade surplus. This is not an easy task; they have to produce goods and services for the world market. For this purpose there are two things that must be addressed by the countries, firstly whether what they produce is worth for the global market(s) and secondly they must analyze the competitiveness of their goods/services to withstand the global competition.

The factors that determine whether the goods are worth for the international market are:

(i) Cost of production,

(ii) Technical level specific to the market, and

(iii) Cost of distribution.

The factors that determine the global competitiveness of the products are:

(a) The skillfulness and qualitative standards of the labour.

(b) The technological depth level supported by intensive R&D.

(c) Wage level differential.

(d) Overall productivity level of the organizations.

(e) Resourcefulness and diversity.

The above factors also play an important role for bringing in the various levels of efficiencies. If the country possesses higher level of qualitative labour supported by intensive R&D the country would tend to be a net exporter.

The wage level difference and productivity also tend to influence the export worthiness of a country. Lastly the resourcefulness and diversity in the sphere of material management also play vital role in deciding the overall competitiveness of a nation in the international market.

The countries that are engaged in the export fronts are basically of two types. Firstly are those countries where product innovation is the prime concern of the industry for survival in the domestic sector. The other types of countries are those where production is the prime concern of the industry for survival in the domestic market.

The two most striking examples of such countries are the United States for product innovation and Japan for production innovation though both countries do have higher level of innovation and production but the point is the tendency and approach.

What we are concerned is the influence of these factors on the flow of goods and services between countries. This flow varies from region to region and also whether it involves developed, developing or lesser-developed countries.

The traders who are instrumental of this flow of goods and services are engaged in this business practice for the same reason as any business person would be, that is to generate profits. The international trade not only provides profits through sales but also employment and gives impetus to large-scale and rationalized production economies.

This gives an opportunity to the buyers and the sellers to transact deals at attractive terms beneficial to both of them. The seller makes profits through volume sales and the buyers make profits through competitive prices and attractive conditions.

The international buyer can have access to many competitive sources of raw materials/processed goods and components and the international seller can have the advantage of diversified markets.

The major part of the international trade is conducted by private sector that is very sensitive to the said factors, for them it is the question of survival on structured pattern of business.

Traditionally the international development and expansion of the trade follows certain norms, which are more for the protection of domestic industry than the industry over the national borders. So each country has its set norms for the conduct of overseas trade. The set of rules for the outgoing trade are the ones that give impetus to the domestic market.

The foreign trade is conducted either to earn the hard currency needed for the development of the domestic economy or complement the domestic market by providing an alternative in order to keep the production economies in check. Whatever be the reason the fact is that countries try their best to enter the world markets and share and compete in the domestic and overseas markets.

The goods and services that you provide must have roots in the market. In other words the origin has to be in the needs of the ultimate end user. The goods have to be user oriented. The user’s needs need to be backward integrated to give shape to what is produced ultimately.

When we are talking about the global markets it important that the item that we make must have the need in the world market segment or we produce the items for the market and in standards that are acceptable in that particular market.

If we are able to do this then the beginning is laid down for us to become a world market player. This is the first step in international trade and you as the future managers, have to understand this prerequisite in the world arena, the products, the services that you select for the world market must be those that have maximum acceptability in the world markets, International trade is done in the commodities that have to meet the needs of a varied and wide spectrum of acceptability and adaptability.

The products are either finished ones or the unfinished ones. The unfinished or semi processed or finished ones are those which can stand alone as an individual identity but the finished ones are those which cannot stand alone but require processing to be labeled as finished products. Global trade is done in both the items.

In developed countries the export emphasis is on the finished products /processes and import emphasis on the raw materials. The situation of the developed countries is just the reverse of the developed countries

Why must we Trade?

There could be many reasons as to why we import or export but the most common and historic reason, for a long time, was associated with the unavailability and shortages that compelled the nations to seek out-side suppliers to meet the domestic demands and/or to offload the domestic surpluses in production capacities or the products.

These were unidirectional actions where other parties had little role to play. This was also the time when global trading organizations made the maximum use of the situation to expand their reach and business.

But those days have gone, now a days the most common questions that helps us to make a decision whether to import or to export, are cost of production, quality, distribution logistics, with correlated deferential qualities of individuals and nations in a demand and supply cycle.

Our differential qualities play a vital role in internationalizing the trade. We all have some plus points and some, may be many, negative points but it is the plus side which matters most. Similarly for most of the people, societies and even nations, some are good to make one thing and there are some others who are good to make other things.

This is the gist of what moves the world trade or in other words the prime mover of world trade is this differential quality of individuals and nations. Each country is bestowed with differing relative factors of production, consumption and services.

The differences in relative shortages or abundance in the form of land, labour, technology, management and capital determines the production possibilities for a given price in the domestic market.

The land and labour are no doubt important but not deciding ones. Abundance of these factors might prompt the spread of such industries, which mostly depend on them like the agriculture, but the technology and managerial talents are the other two factors, which greatly influence the ability and capability of countries to be proficient in one or the other.

These two factors act as deriving force for building up the capital. No doubt the first two factors too can build up capital but their propensity is far lesser as compared to the later ones.

Expansion and acquisition are the two most common human traits and that also account for driving forces behind international trade. Importing goods and services from other sources/countries at competitive prices and favourable terms increases our purchasing and manipulative power. It not only increases the profitability but also expands and increases our income.

The cumulative effect is the overall growth in national economy and welfare. This effect is not limited to the importing country only, the exporting country also benefits in the sense that there is higher level of production, better employment and their economy also fares well.

They too have the exchange or the financial powers to sustain imports and services from others. This is a vicious cycle one feeds on the other and so on.

There are a number of theories to explain as to why nations indulge in international trade, like Mercantilist, Absolute advantage, Comparative advantage, and the factor endowment theories. There are many other theories as well but for our present study let us concentrate on the said theories.

Each theory has its plus and minus points, and has the tendency for being situational. As we move from the Mercantilist towards the Factor Endowments, the complexity of interpretation and application increases. These theories were made after the action has taken place or a sort of postmortem analysis of a given time and situation.

That is perhaps the reason as the time and situations changed new and newer theories came to light. The new millennium is said to be the era of Internet and e-commerce, as we progress in this era new theories are bound to come up. In the meantime let us have a look at the theories existing at the end of the century.

The Mercantilist theory was based on the assumption that a country would benefit from export trade because it would increase its wealth and increase its level of power and domination in a given area. In its raw form it sounds good and many nations still followed it.

They considered exports as the means for accumulating the hard currencies and thus framed the export oriented growth policies. But there are lots of limitations to this theory, for a short run it may succeed, but on the long run it starts to falter. “Import” is an integral part of the international business no one would feel comfortable if he has only to “receive” and not to “give”.

A country cannot survive if it only exports or if it only imports. Both the actions have to be balanced. The developing countries passed through a very difficult phase in their economic development when the imports far exceeded the exports.

But those countries which laid emphasis on import of technology and means of production, very soon brought the situation under control, but those who could not; brought their nations closer to financial disaster.

The next theory of Absolute advantage is based on the assumption that one country specializes in the production of one item whereas another country specializes in another item, and that both the items are essentially required by each country. This theory easily explains the market differentiation between the developed and developing nations.

Take the case of clothing, India specialize in polishing of rough diamonds but has no diamonds. South Africa has diamond mines but not enough facilities for polishing. They both work together as best partners.

This is a perfect example of how the property of absolute advantage can be used for mutual benefit by nations. But the application of the theory becomes more and more difficult when there are a number of countries or suppliers or manufacturers having similar level of advantages.

For such situations another theory comes to the forefront it is called the “comparative advantage”. Using this theory, we get answer to our main question “Why nations trade”—to export items with high absolute advantage, and import items with low absolute advantage. What is the benefit? For a fixed unit-time factor the country generates more money value.

The Comparative advantage is one step ahead of the absolute advantage. In this case even when a country has absolute advantage in all of its requirements, but it may differ in terms of relative costs as compared to others.

This relative costs differ from country to country, thus a country with absolute advantage in all its requirements, may find it cheaper to buy some of the goods from others where the relative costs are comparatively lower and use this price differential for other uses.

This works for both the sides and is functional only when there is exchange of goods and services. In this case the relative costs are considered but not the availability of the materials utilized in production.

The next theory (Heckscher-Ohlin) takes these points into consideration. Using this theory, we get answer to our main question “Why nations trade” —to export items where relative costs are low in the home country but high in other country, and import items where relative costs are high in other countries but low in home country or export items with low relative cost and import items with high relative costs.

What is the benefit? For a fixed unit-time factor the country generates more money value.

In the Factor Endowment theory, the factors of production are taken into consideration. These are the materials/services required for production. It might be possible that countries have the availability of all the materials, but some may have them in abundance and some in small quantities.

According to this theory, a country should export those goods for which the raw materials are available in abundance with in the country, and import such goods for which the raw materials are not available in abundance.

This theory advocates heavy value addition and capital intensive exports from the developed countries, and import of labour intensive and comparative low value addition goods from the developing countries. The assumption is that developed countries have abundance of hi-technology items and are rich in capital, whereas developing countries are low in technology but very rich in labour content of production.

Using this theory, we get answer to our main question “Why nations trade”—to export hi-tech and capital intensive with highest value addition, and to import low-tech and labour intensive items with low value addition. What is the benefit? For a fixed unit-time factor the country generates more money value.

The latest addition to the traditional trade theories is “Strategic Trade” theory.

It is based on logical interpretation and association of the following indicators:

(i) Economy of scale,

(ii) Product and market differentiation,

(iii) Level of competition,

(iv) Entry and Exit cost, and

(v) R&D.

The unit price is directly related to the cost of production. Cost of production tends to decrease when large numbers of similar cyclic operations are undertaken through standardization and logical sequencing of operations.

The factors which help in cost cutting are standardization of inputs, the common cost heads, decreased labour content, increased machine interaction (robotic), inventory control (on dot supply and inventory cost shifting to suppliers instead of manufacturers), and packaging and forwarding.

The product and market differentiation leads to higher turnover of trade. For example in the readymade-ups there are three levels of differentiation (for men, for women, for kids). Again for each segment there is further differentiation (casual wear, formal wear, evening wear, and sportswear).

The market differentiation occurs on geographical location, income division, and demographic breakup. There is further differentiation that is associated with material, manufacturer, and the organization that clubbed together would lead to branding.

Level of competition acts as the tonic of the market movement in favour of the ultimate consumer at the global scale. It is also a cyclic phenomenon that leads to adjustments and relocations for keeping and sustaining the profitability.

This was the primary reason for the consumer .goods and consumer durable goods manufacturers to spread out in the world markets using various routes like assembly, part production and part import, full production, licensing, joint ventures, takeovers and mergers.

Entry and exit costs are not new, but they have powerful impact on the market, manufacturers, consumers, and competitors. The Japanese Global Trading Organizations expanded business in the sixties, seventies and eighties by setting up offices in almost all the trading nations and cities of the world, linking each other for spontaneous actions and responses.

They figured as the top ten organizations in the Fortune 500 list. The tools they used for global expansion were information and communication.

The entry of Internet and e-mailing suddenly shook them at the roots and their empire started to fall. Mid nineties was the time of decision making “stay put or exit”. Many trading firms took the exit route but some stayed on knowing the difficulties and costs of re-entry, they suffered recurring losses but they kept on by trimming the operations and manpower.

By end of nineties they started to surge again on the world markets using the very tools that first destroyed their empire but in the new millennium it provided and opened up new horizons for them.

Research & Development (R&D) is perhaps one of the strongest link in the state of the economy in the developed world and weakest link in the developing and least developed countries/economies. This factor had been neglected in earlier theories but the modern theories of global trade take it into account while predicting the market movement whether related to production or consumption.

R&D is an indicator of future direction of the technology or innovation. The organizations, which plan 5 or 10 years ahead of their market/product cycle benefit most by gearing up for the future market movements and are the first to harvest the market to maximize on the profit and move forward leaving market for imitators.

Let us consider just for discussion’s sake the domestic industry vs the imports. Couple of years back it was thought as impractical to open up one’s domestic market to overseas. It was feared that with the advent of overseas MNCs the domestic production would be hard hit leading to widespread unemployment and closures.

To some extent this was true at that point of time when GATT was in formation and WTO had not emerged. After WTO these points do not hold any ground. Though it is a debatable point but the emergence of WTO has definitely enlarged the potential of global trade in goods and services by opening up new markets and making accessibility easier for both the developed countries and the developing countries.

It is a matter of comparative statement as to who has gained advantage of the situation. The fact remains that opportunities are there on equal basis and it is up to the individual countries to exploit the situation to their best advantage by tuning up their trade related laws and policies in conformity with the global requirements.

If we look back to those countries which had colonial rule and emerged as independent countries especially after the World War II, the foremost job ahead of them was to build up the infrastructure and basic industries, to augment their agriculture, spread the transport network, build up the education and healthcare etc.

In nutshell their main job was to put their house in order and then look outward to the others in search of markets for their products and for new technologies for their domestic producers. Gradually these transformed themselves into a new category called the developing nations.

These nations on the one hand provided markets for the developed countries for their technology and capital goods but in return they provided the industrial nations with the raw materials required by the industries of such developed nations.

Gradually newly emerging nations shifted their emphasis from the raw material supplying nations to that of value added raw material and components suppliers. This transition helped the emerging nations not only to upgrade their industrial base but also to build up foreign exchange reserves to pay for the goods and services that they imported from the developed nations.

The factors on which the newly emerging nations capitalized was the availability of natural resources and low cost labour as against the developed countries which lacked in these two factors in their markets.

But not all the newly emerging countries were rich in these two resources; some had only the low cost labour and ingenuity of others to make an impact provided the suitable environments were created for them.

These environments were in the form of capital management and production technologies, all were provided by the developed countries since they saw the opportunity and future for doing so.

What they got in return was market which not only absorbed their product and technologies but also provided them with raw material, components, sub-assemblies and even complete products at a much lower costs as compared to what it would cost if the same were to be produced in their home countries.

The examples of Hong Kong, Taiwan, Korea, Mexico, Brazil etc. are just a few to mention. These so-called Asian and South American tigers and many others propelled the world trade to boom. The mutual cooperation transformed the world as never before seen in any era.

Technology has a multiplier effect on the generation of capital in the sense that it can be duplicated and has a life cycle. This life cycle is product and production oriented. It has phases and not necessarily these phases are universal in application.

This differentiation is exploited by the nations by selectively inducting it to different markets depending on the capacity of that market at that point of time to absorb which and when. Thus the prime movers of international trade are the price advantage relating to the underlying factors of land labour technology managerial talent and capital, together they decide economies of product and production.

The developmental phases associated with the national economies also play important role. The developmental pace world over was not uniform, some developed faster, and some at a slower pace and this pace helped in the classification of the nations and identifying their priorities.

These countries show very distinct feature, which is detrimental in the flow of technology and services. Their needs and aspirations are different and help us to classify them in to different levels. Countries at each level show similarities in the trading activities and potentials thereof.

According to general classification there are three levels of development—the developed, developing and under developed or least developed countries. As a thumb rule the developed countries concentrate in the Northern Hemisphere and the developing and underdeveloped countries throng the Southern Hemisphere.

The northerners are the inventors and the southerners are the imitators. This is just but a generalization and not a rule. The developed countries are those where industrialization movement started and where most of the basic inventions also took place.

They walked a long distance to reach the present level of economic and industrial strengths. Most of them though had social turmoil and regional conflicts but very few had suffered the colonialization and deprivation of independence.

The long history of independence had helped them to concentrate on the economic and scientific activities. This is in contrast to the developing and underdeveloped countries. Majority of them had suffered the foreign rules and colonialization, which was mainly due to their mineral and agricultural resources.

The era when industrialization was sweeping the world they were under chains. At present there is hardly any colonial rule in the world. But the wedge between them has widened appreciably. Each block of countries now has noticeable pattern of trade.

The division of the world market between developed, developing, and least developed groups gives rise to market differentiation with a tendency for upward movement in the form of shifting markets.

The world as we know is divided in three distinct sectors each comprising of a group of countries with similarities in economic and industrial activities—the developed countries, the developing countries, and the lesser-developed countries. Each one represents a broader package of opportunities and potentials.

Each has something to give and something to receive. This mutual exchange of goods and services between the three types of countries show a noticeable trade pattern, which has tendencies to shift bottom upward.

The developed countries took years to reach the present position of industrial economic supremacy. This achievement was not without sacrifices. These were in the form of movement of labour from low cost to high cost, which created a deficient situation at home.

So these developed countries shifted their production from their land to the lands of underdeveloped or developing countries where labour element was still low and in technology they were still years behind.

Another indirect benefit that they got was to shift the pollution-creating sector of the industry in to these countries. Some of which, were aware of this problem and took corrective steps in the early stages. There were still some countries that took no action at all and continued to operate the polluting industries.

Thus polluting their land, water and air which again created an opportunity for the developed countries. At first they earned by letting the developing and underdeveloped countries get polluted and then they again earned to start advising and cleaning the pollution created by industries serving their interests.

In this paradoxical situation no one is to be blamed. The industrial world at first suffered to achieve what they have now, likewise the emerging nations must also undergo to some extent, same pains, in order to reach the levels of the world of the developed nations.

An example for this could be found in the migration of the casting and forging industries, which are highly polluting industries, but the developed countries are either shifting the foundries to developing countries, or are sourcing the components from them.

This no doubt is helpful to the developing nations and as I said earlier the developing countries have to pay a price to reach the level of the developed nations. The shifting and relocation of the production and distribution are the external factors that affect the economic development of a country, there is much to be done internally by the country for fast track, medium or slow track development.

How a country develops is totally up to the policy makers of the nation. The economic development and expansion of international trade depends on the resources availability (monetary, manpower, and materials) and the national policy priorities and direction (export orientation of the Exim policy and infrastructure framework.

The main attraction of the international trade is the marketability of the value- added products, higher the value addition better are the returns). That is perhaps one of the reasons why certain countries develop much faster as compared to others.

The syndromes of value additions also segregate the economies into least developed, developing and developed sectors. Each sector has set pattern of products and services that it can offer for the export market.

And countries seldom remain in one sector for a long time, they pass through a transitional phase of development. In this transitional phase there is a shift in product and market mix. The shift or tendency for it is always present in the system, it is up to the government to choose the right gear for optimum results.

Before we proceed any further let us understand the “value addition” in context of global trade. To start with let us take one MT of iron ore lime and coal (raw materials).

The various value additions and resulting costs are indicated below:

(i) Raw materials per ton: US$50

(ii) Iron pellets per ton: US $ 90

(iii)Pig iron per ton: US$150

(iv) Steel structural products per ton: US$300

(v) Stainless steel per ton US $ 1800

(vi) Wrist watch casings 10,000 nos 100 gm each @ US $ 10/piece: US $ 100,000

(vii)Wrist watches (80% metal 20% plastic) @ 100 US$ each (8000 * 100): US $ 800,000

In this example there are four types of products involved from raw materials or resource based products (i, ii and iii), low technology based products (iv and v) medium technology based products (vi) and high technology based products (vii). Each ton of the above five products gives different value in the international market.

For physical movement, items i, ii and iii require heavy infrastructure (road, rail, and ocean), but iv and v require lesser and the last one no vi requires least. But the involvement of technology and capital increases with each step (i to vi).

This also differentiates the markets and countries. If a country wants to develop its international trade at a faster rate than it has to lay emphasis on technology based products and not resource based products.

The transitional phase of economic development especially of the developing nations presents an interesting case study, the transitional indicators of an economy are based on the value addition factors to the manufactured goods for exports. In the above example we have taken one item (steel) and discussed the downstream products with value addition at each stage.

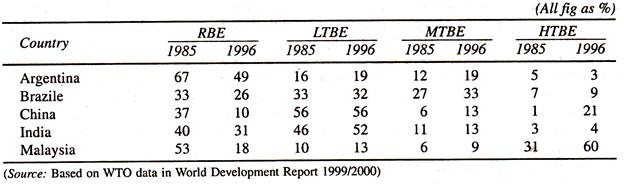

Let us now generalize out statement to define the four categories of products with increasing complexity and market value and then study five sample developing countries (Argentina, India, Malaysia, China, and Brazil) how they developed their economy over a period of 11 years (1985 to 1996).

(i) Resource Based Exports (RBE): Example: Semi finished raw materials/products.

(ii) Low Technology Based Exports (LTBE) Example: Low labour skill based manufactured goods: Textiles, garments, foot wear etc.

(iii) Medium Technology Based Exports (MTBE). Examples: Mass production based manufactured products that require some degree of design concept like; automobiles, chemicals, industrial machinery, consumer goods etc.

(iv) High Technology Base Exports (HTBE): The manufactured goods that require high degree of precision and technical skills supported by intensive research and development activities like: aircraft and precision components/products, fine chemicals, drugs and pharmaceuticals, semiconductors and integrated electronic circuits, computer hardware/software designs and structures, telecommunication and communication satellites etc.

The value addition increases from RBE towards HTBE. (HTBE>MTBE>LTBE>RBE). If we analyze the export pattern of the developed nations we will find maximum exports falling under HTBE and those of least developed nations falling under RBE.

The developing and least developed countries that took the quickest path for development shifted emphasis from RBE towards HTBE or in-between depending on their capacity in terms of capital and manpower availability.

According to the published data of the United Nations on Trade and Development an interesting observation is made when the comparative development of selected developing-economies are made. In the following table the transition of economies of five developing nations is compared from what it was in 1985 and what it became in 1996.

Chinese economy has dominated the world scene for a long time as the fastest growing economy in the developing world. The above table gives us the reason for that transition. In 1985 the RBE were 37%, which decreased to 10 % in 1996.

The LTBE remained the same since this segment constituted their traditional art and craft sector. The MTBE increased from 6 to 13 % and that of HTBE from 1 to 21 %. The situation of Malaysia is almost similar to that of China followed up by Brazil.

Argentina had mixed development, the RBE declined from 67% to 49% but LTBE increased from 16 to 19%, similar is the situation for MTBE, but for the HTBE it registered decline from 5 to 3%. In general all these countries registered a sharp to medium shift in the RBE segment.

But the situation of India is different, on all the four counts the shift has been low or marginally high, which speaks volume of the state of exports from this country. If we have to increase our exports to world class and levels we have to do lots of value addition and target on HTBE and MTBE.