Are you looking for an essay on the ‘Reserve Bank of India’? Find paragraphs, long and short essays on the ‘Reserve Bank of India’ especially written for school and college students.

Essay on the Reserve Bank of India

Essay Contents:

- Essay on the Brief History before Establishment of Reserve Bank of India

- Essay on the Establishment of the Reserve Bank of India

- Essay on the Nationalisation of Reserve Bank

- Essay on the Objectives of Reserve Bank of India

- Essay on the Management and Organisation of Reserve Bank

- Essay on the Legal Framework of Reserve Bank of India

- Essay on the Functions of Reserve Bank of India

- Essay on the Prohibitions for Reserve Bank

- Essay on the Credit Control Policy of Reserve Bank of India

- Essay on the Evaluation of the Working of Reserve Bank

Essay # 1. Brief History before Establishment of the Reserve Bank of India:

The assumption of the foundation of a Central bank of India had been going on for a long time. But the Credit of a successful attempt goes to Warren Hestlings, the governor of Bengal. He recommended for the first time for the foundation of Central Bank in Bengal and Bihar in January, 1773.

Many more attempts took place with the passing of time. There include the names of Robert Richard and John Menard Kenz, the members of the Bombay, Government. After a long interval the chamberlane commission, recommended for the foundation of a central bank in 1913, but it could not be properly considered due to the starting of World War I.

The year 1921 is very important in the history of Reserve Bank of India. To meet the lacking of a central bank of India, the Government of India set up Imperial Bank of India by merging of the three Presidency Banks. But Imperial bank was not getting successful completely as the central bank. Before the foundation of Reserve Bank, the government of India performed the task of regulating money and Imperial Bank regulated credit.

Thus, there was a dual control on the monetary system of the country. The Hilton Young Commission was told to give its opinion in this regard in 1925. This commission strongly recommended for the formation of separate central bank in the country. The commission gave its recommendation for the foundation of reserve bank of India for ending the system of dual control of the monetary system.

The Government of India welcomed the recommendation of this commission and presented ‘Gold Standard and Reserve Bank of India’ Act in the legislature in January, 1927. But there arose much conflict of opinion among the members over the issue of the ownership of the bank and appointment of the Board of Directors.

Consequently, this bill could not be passed and the matter remained under consideration. But once again, the Central Banking Enquiry Committee strongly recommended for the formation of the Reserve Bank of India. So, the government became active in this direction once again in 1929. Consequently, one more bill was put in the Indian Legislature on 8th September, 1933 which was passed on 22nd December, 1933.

There is a central bank at the apex in the banking system of every country. Reserve Bank of India is the central bank of India. It was founded on 1st April, 1935.

Again, it was passed by the council of states. Reserve Bank of India Act 1934 was passed on 16th March, 1934 after the approval of the Governor General. It started functioning properly on 1st April, 1935. The central office of the Reserve Bank of India was set up in Kolkata in the year of its foundation but it was permanently transferred to Mumbai in 1937.

Essay # 2. Establishment of the Reserve Bank of India:

The first bank in India, called The General Bank of India was established in the year 1786. The East India Company established The Bank of Bengal/Calcutta (1809), Bank of Bombay (1840) and Bank of Madras (1843). The next bank was Bank of Hindustan which was established in 1870. These three individual units (Bank of Calcutta, Bank of Bombay, and Bank of Madras) were called as Presidency Banks. Allahabad Bank which was established in 1865 was for the first time completely run by Indians.

Punjab National Bank Ltd. was set up in 1894 with head-quarters at Lahore. Between 1906 and 1913, Bank of India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank, and Bank of Mysore were set up. In 1921, all presidency banks were amalgamated to form the Imperial Bank of India which was run by European Shareholders. After that the Reserve Bank of India was established in April 1935.

Turning to efforts made in India to set up a banking institution with the elements of a central bank, we find that up to as late as 1920, the functions envisaged for the proposed bank were of a mixed type, reflecting the practices abroad.

It was proposed at that time to amalgamate the three Presidency Banks into one strong institution; the central banking functions envisaged for the new institution were not only those of note issue and banker to Government, as in the earlier proposals, but also maintenance of the gold standard, promoting gold circulation as well as measuring and dealing with requirements of trade for foreign remittances.

The amalgamation of the Presidency Banks took place in 1921, the new institution being called the Imperial Bank of India, but it was not entrusted with all the central banking functions; in particular, currency management remained with Government.

The Reserve Bank of India is India’s central banking institution, which controls the monetary policy of the Indian rupee. It was established on 1 April 1935 during the British Raj in accordance with the provisions of the Reserve Bank of India Act, 1934. The RBI plays an important part in the development strategy of the Government of India. It is a member bank of the Asian Clearing Union. The bank is also active in promoting financial inclusion policy and is a leading member of the Alliance for Financial Inclusion.

Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank notes of all denominations (except one rupee note and coin, which are issued by Ministry of finance). The Reserve Bank of India is the main monetary authority of the country and beside that the central bank acts as the bank of the national and state governments.

The central bank manages to reach the goals of the Foreign Exchange Management Act, 1999. The bank issues and exchanges or destroys currency notes and coins that are not fit for circulation. The RBI is also a banker to the government and performs merchant banking function for the central and the state governments.

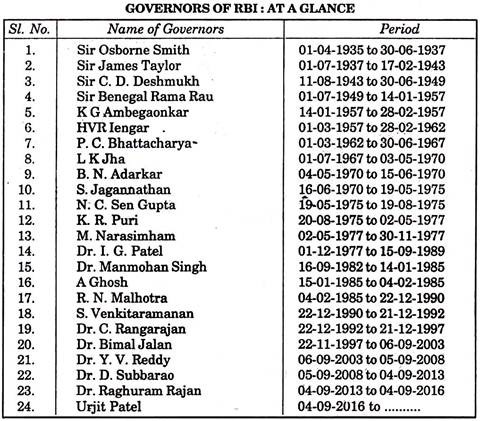

‘The Governor of the Reserve Bank of India is the chief executive of India’s central bank and the ex-officio chairperson of its Central Board of Directors. Indian Rupee currency notes, issued by the RBI, bear the governor’s signature. Since its establishment in 1935 by the British colonial government, the RBI has been headed by 23 governors.

The inaugural officeholder was the Britisher Sir Osborne Smith, while C. D. Deshmukh was the first Indian governor. The bank’s 15th governor, Man Mohan Singh, would go on to become India’s 13th prime minister. The position is currently held by Raghu ram Rajan, who took over from D. Subbarao on 4 September 2013.

Essay # 3. Nationalisation of Reserve Bank:

The controversy that it should be a bank of shareholders or it should be under the control of the state took birth at the time of its foundation only. The country was under British Rule at that time and they were the supporter of the Capitalist ideology. So, at the time of foundation, it was the bank of Private Shareholder. At that time its Authorised capital was Rs. 5 Crore divided into 5 lakhs shares each valued Rs. 100.

But after the independence, the public opinion was in the favour of the nationalisation of Reserve Bank and the condition in India was also favourable due to the nationalisation of the Central banks of many countries around the world. The Government of India passed the Reserve Bank of India (Transfer to Public Ownership) Act in September, 1948, according to which the Reserve Bank of India got nationalised on 1st January, 1949.

The government gave shareholders Rs. 118 and 10 annas (62 paise) as compensation for every share valued Rs. 100. Out of the compensation among Rs. 18 and 10 annas was given in cash and for the remaining Rs. 100 3% government bonds were given.

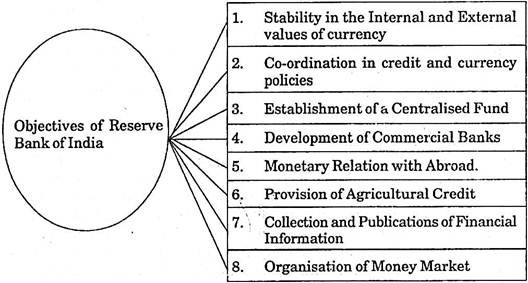

Essay # 4. Objectives of Reserve Bank of India:

The Reserve Bank of India was founded with the following objectives:

(1) Stability in the Internal and External Value of Currency:

Before the foundation of the Reserve Bank of India, the credit control and monetary control were in different hands. Due to it bringing stability in the internal and external value of money was not possible. So, it was felt that there was a need of a central arrangement for both these work. So, it was realised that a new central bank should be founded in the country.

(2) Co-Ordination in Credit and Currency Policies:

Before the foundation of Reserve Bank of India, the credit and monetary regulations were done by two different institutions. The Imperial Bank had the right of credit control while the government of India retained the authority of issuing and regulating money. Thus, there was a dual control on credit and money. It was not considered proper for the banking system of the country. Thus, there was the need of such an organisation which performed both these tasks.

(3) Establishment of a Centralised Fund:

Before the foundation of Reserve Bank of India there was a lack of a centralised fund of money in the country. Every bank in the country maintained their cash fund separately under its authority. As a result, there seemed a weakness in the banking system of the country and the banks could not win the total faith of people. To meet this shortcoming, there was a need of a central bank so that there could be the centralisation of cash fund in the country.

(4) Development of Commercial Bank:

For the proper development of the commercial banks, it was needed that there should be a central bank at the apex which could have equal regulation and control over all commercial banks. There was the need of a new central bank in the country to meet this need.

(5) Monetary Relation with Abroad:

It was needed to establish monetary relation with other countries for the economic development of the country. So, it was needed that there should be a central bank in the country.

(6) Provision of Agricultural Credit:

There was a need of thinking about a separate agricultural credit system in the country for the promotion of the agricultural credit system in the country for the promotion of the agricultural sector. But there was a lack of such institution before the foundation of Reserve Bank.

Thus, it was also an objective of the foundation of Reserve Bank of India that a solid policy should be formed for the management of agricultural credit by establishing coordination between the central and state government. At the same time, there may also be given proper advice to institutions providing agricultural credits.

(7) Collection and Publication of Financial Information:

It is the right of every citizen to obtain information regarding the financial condition of the country. For this, there was the need of such an organisation which could collect and publish information related to monetary and financial information. The foundation of Reserve Bank was considered important for this purpose.

(8) Organisation of Money Market:

The Indian Money Market was unorganised and faulty before the foundation of Reserve Bank. So, for the coordination of various organs there was the need of establishing a central bank.

Essay # 5. Management and Organisation of Reserve Bank:

The management and organisation of Reserve Bank of India can be clarified under following titles and sub-titles:

(1) Management:

The management of Reserve Bank is done by a Central Board of Directors having 20 members. Among these 20 members, there are a governor and four vice-governors. They are appointed by the Government of India for a period of five years.

Their salaries are determined by the Central Management Board by the advice of the government of India. Besides these, a total four directors, one from each of the local boards, Mumbai, Kolkata, Delhi and Chennai are nominated. Ten other directors are nominated by the government of India. A government officer is appointed by the government of India.

The tenure of the directors from the local board is 5 years while that of 10 other directors is 4 years. The government officer can be appointed for any period but, he doesn’t have the voting right the meeting of the board.

At least six meetings of the managing board of the Reserve Bank is mandatory within one year and a maximum of three month’s gap can be considered between two consecutive meetings. The calling of the meeting depends on the will of the Governor.

(2) Office of Reserve Bank:

The Central office of Reserve is in Mumbai. Beside these, four local head offices are in Mumbai, Kolkata, Chennai and Delhi which represent the Western, Eastern, Southern and Northern Zones respectively.

Besides these offices, the bank has opened its 22 regional offices at Ahmedabad, Bhubaneswar, Hyderabad, Kanpur, Nagpur, Jaipur, Jammu, Guwahati, Patna, Belapur, Srinagar, Shimla, Chandigarh, Dehradun, New Delhi, Lucknow, Gangtok, Agartala, Ranchi, Raipur, Kolkata, Panaji, Bangalore, Chennai, Kochi and Tiruvanantpuram. The places where it does not have its branches, State Bank of India acts as its representative.

(3) Department of Reserve Bank:

The organisation of Reserve Bank is through different departments.

They are:

(i) Issue Department:

The main function of this department is to manage and maintain the book and accounts of notes issued by Reserve Bank of India. There are 10 offices and 4 sub-offices for the supply of the paper notes. These offices are situated in different parts of the country.

(ii) Banking Department:

This Department of Reserve Bank was established with the foundation of Reserve Bank of India in 1935. The main function of this department is managing the government transactions and public finance. Besides this, keeping the cash reserves of the schedule bank safely and providing economic assistance on need are also done by this department.

(iii) Banking Operations Department:

The operation of the functioning of the banks in the country is done by this department of Reserve Bank. The Banking operations Department performs the tasks of checking the status particulars of banks, observing the banks, allowing the opening of new branch by any scheduled bank, providing license for new banks granting approval to the agreement of the merging of banks etc. Besides these, Control and regulation of the banking system under Reserve Bank Act, 1934 and Banking Regulation Act, 1949.

(iv) Banking Development Department:

This department was set up separately with the objective of encouraging the savings and banking habit in rural areas. The functions of this department include giving encouragement to the expansion of the banking system up to rural areas and giving training to the officials of scheduled banks.

(v) Agricultural Credit Department:

This department performs the function of studying the problems related to agricultural credit and solving these. At the same time, it gives suggestion and economic assistance to the central government, state government and other institutions related to agricultural credits.

(vi) Foreign Money Control Department:

The government of India passed Foreign Exchange Control Act in 1947. According to this act, this department controls the transactions related to foreign exchange.

(vii) Industrial and Export Department:

This department provides facility of obtaining loans to small and medium industries of the country. Besides it, investigations are done on export related problems. This department was set up in September 1957. This department also performs the function of giving important suggestion to finance corporation of states.

(viii) Non-Banking Companies Department:

This department mainly observes the functioning of non-banking companies and prepares regulation for these. This department was set up by Reserve Bank in March, 1966. The RBI Act as amended in January 1977 provides for among other things entry norms of non-banking companies.

(ix) Economic and Statistics Analysis Department:

This department performs the tasks of collecting data related to banking and financial data, their research and analysis. It also publishes these data in the interest of the nation. Hand Book of statistics on the Indian Economy, Report and Finance etc., are its important Publications.

The department of statistics was created in 1959, out of the previous department of research in statistics. The department was restricted in December 1981. It was designed as the Department of Statistics and Information Management.

(x) Legal Department:

This department was set up in 1951 for giving proper legal suggestion to various departments of Reserve Bank. This department not only gives legal suggestion regarding the banking issues to all departments. The main function of the department is to tender legal advices on various matters referred by the operational department of RBI.

Besides these ten departments, there are some other departments. Some examples are — Human Resource Development Department, Gold Management Department, Secretary Department, Urban Bank department, Monetary Policy Department, Department of Economics and Research etc.

Essay # 6. Legal Framework of Reserve Bank of India:

The legal frameworks of Reserve Bank are as follows:

Umbrella Acts:

Following acts come under it:

(i) Reserve Bank of India Act, 1934 for the regulation of functions of Reserve Bank.

(ii) Banking Companies Act, 1949 for the control over the financial sector.

Acts Governing Specific Functions:

1. Public Debt. Act, 1944/Governments Securities Act (Proposed) for govern on the Government Debt Market.

2. Securities Contract Regulation Act 1956 for the regulation of the government securities market.

3. Indian Coinage Act 1906 for the control of money and coins.

4. Foreign Exchange Regulation Act, 1973/Foreign Exchange Management Act, 1999 for the control on the trade and foreign exchange market.

5. Payment and Settlement System Act, 2007 which provides for regulation and supervision of payment system in India.

Acts Governing Banking Operations:

1. Companies Act, 1956 for the control of bank as companies.

2. Banking companies’ acquisition and transfer of Undertaking 1970/1980; related to nationalisation of banks.

3. Banking Secrecy Act.

4. Negotiable Instrument Act 1881.

5. Bankers’ Books Evidence Act.

Acts Governing Individual Institutions:

1. State Bank of India Act, 1954.

2. Industrial Development Bank (Transfer of Undertaking and Repeal) Act 2003.

3. The Industrial Finance Corporation (Transfer of Undertaking and Repeal) Act 1993

4. National Bank for Agricultural and Rural Development Act

5. National Housing Bank Act.

6. Deposit Insurance and Credit Guarantee Corporation Act.

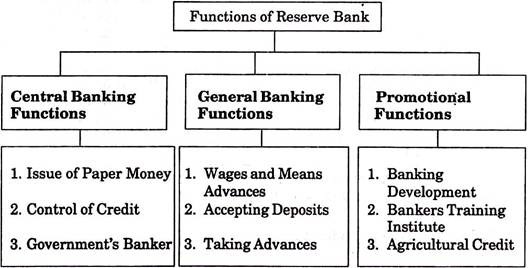

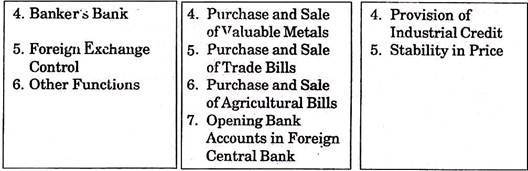

Essay # 7. Functions of Reserve Bank of India:

With the objective of studies the functions of Reserve Bank can be classified into three Parts:

A. Central Banking Functions:

Following are the Central Banking Functions of Reserve Bank:

(1) Issue of Paper Money:

All notes excluding the one rupee note are issued by Reserve Bank as it has the monopoly to do so. One rupee notes (now coins) are issued by the finance ministry of the Government of India. The system of issuing notes in India has been undergoing changes from time to time. In the initial days, there was a system of keeping Reserve Fund according to the Reserve Bank of India Act to win faith of people.

By 1956, the basis of issuing notes in India was Proportional Reserve System. The speciality of this system was that at least 40 percent of the values of the total notes issued had to be kept safely in the form of gold coins or foreign securities. At the time, the evaluation of gold had to be done at the rate of Rs. 21 13 annas and 10 paisa. The remaining 60 percent values of the issued notes are of the government of India and trade bills.

But during the Second Five Year Plans, there started appearing many difficulties in foreign exchanges which brought a reduction in the amount of foreign securities. Consequently, there was felt a need of bringing a change in the Act. So, an amendment in the Act was made in 1956 and in the place of Proportional Reserve System, the Minimum Reserve System was adopted.

Again in 1957, another amendment in Reserve Bank of India Act was made according to which the minimum limit of the paper note was fixed in the foreign securities of 400 crore rupees and gold or gold coins of Rs. 115 crore. But again in October, 1957 this limit was reduced from Rs. 115 crore to Rs. 85 crore in the form of foreign securities. It means, the total amount of minimum limit was fixed at Rs. 200 crore. At present also, notes are issued in India according to his system only, but the value of gold is changed from time to time.

The Reserve Bank of India issues Paper notes through a different department. The status—a particular of this department is kept separately from the banking department.

Reserve Bank reserves the sole right of changing the design of notes from time to time. Using this right, Reserve Bank has introduced bank note in the Mahatma Gandhi Series in the denomination of Rs. 5, Rs. 10, Rs. 20, Rs. 50, Rs. 100, Rs. 500, Rs. 1000 (Since 2000) Since 1996 the Rs. 1000, Rs. 500, Rs. 100, Rs. 50, Rs. 20, Rs. 10 and Rs. 5 note in use at present are 177 mm × 73 mm, 167 mm × 73 mm, 157 mm × 73 mm, 147 mm × 63 mm, 137 mm × 63 mm and 117 mm × 63 respectively.

The five rupee coins in use weigh 6 gm and its diameter is 23, while the old coin of Rs. 5 was 9 gm in weight and 23 mm in diameter. At present both kinds of coins are in use in market. The new coins of Rs. 2 are 5.62 gm in weight and 27 mm in diameter while the old coin of Rs. 2 was 6 gm in weight and 26 mm in diameter. Rs. 1 coin issued by the finance ministry of the government of India is 4.85 gm in weight and 22 mm in diameter. The Reserve Bank of India has issued new coins of Rs. 10 in April 2009. These coins weight 8 gm and their diameter is 28 mm.

The back side of paper notes issued by Reserve Bank contains price/value printed in 15 languages as a panel. These languages are Assamese, Bengali, Gujarati, Kannada, Kashmiri, Konkani, Malayalam, Marathi, Nepali, Oriya, Punjabi, Sanskrit, Tamil, Telegu and Urdu respectively.

The following symbol is US dollar ($), British Pound (£), Japanese Yen (¥) and European Euro (ϵ), a recognizable symbol has been determined for Indian rupee also. The decision to accept the symbol resembling the Devnagri letter and Roman letter ‘R’ was taken in the meeting of central ministry on 15th July, 2010. This symbol of rupee has been designed by D. Uday Kumar, a post-graduate in industrial designing from IIT Mumbai. The first series of coins with this new symbol was issued on 8th July, 2011.

(2) Control of Credit:

An important function of Reserve bank is to control credit to maintain stability in prices. Control of credit refers to controlling the policy of granting loans to the scheduled Banks. All other demand credit from Reserve Bank as it is the Central Bank of the country. According to the Reserve Bank of India Act, RBI has wide authority of controlling credit. Thus, for credit control, Reserve Bank has been adopting qualitative measures along with general ones.

(3) Government’s Banker and Advisor:

Reserve Bank of India acts as the banker, agent and advisor of the central and state governments.

As the banker of the government Reserve Banks accepts cash deposit and also performs the task of payment and transfer of funds according to the treasury rules as per the instruction of the Government for its general banking function and Reserve Bank also does not give any interest on deposit amount of the government.

As its role of an agent, Reserve Bank of India takes loans from time to time. Such loans are called Public Debts. Reserve Bank also performs the task of deciding the process of obtaining Public Debts and making complete arrangements of paying the sum along with the interest on the specified date. As the advisor, Reserve Bank of India gives advice to the government in its monetary, financial and economic functions and paves the way for making the policies of the government successful.

(4) Bankers’ Bank:

Due to being the apex bank of the country, Reserve Bank also function as controller, maker and lender for other banks. So, it is also called bank of banks. According to the Reserve Bank of India Act, 1934 every scheduled bank has to keep a certain part of its deposit With Reserve Bank. Many amendments were made in this regard.

(5) Foreign Exchange Control:

Reserve Bank performs the task of selling and purchasing foreign exchange under the section 10 of its act at the rate fixed by the government to maintain the stability of the exchange rate of rupees. However, now the exchange rate of rupees is determined in the market on the basis of demand and supply but it is the task of Reserve Bank to maintain stability in it as far as possible.

(6) Other Functions:

Besides these, the Central Banking functions, Reserve Bank performs certain other functions some of which are as given ahead:

(i) Accepting deposits without interest from the government of India state government and private individual.

(ii) Arranging clearing house for member countries as it is the central bank.

(iii) Collecting data related to money credit, finance, banking, agriculture etc. and publishing these. The monthly bulletin of Reserve Bank acts as an economic mirror.

(iv) It also performs the task of transferring funds.

B. General Banking Functions:

The main general banking functions of Reserve Bank are as follows:

(1) Ways and Means Advance:

Reserve Bank grants ways and means loans to the government for short term. The maximum period of such loans is 90 days. The government certainly says such loans within this period. Accepted securities, gold, silver, bills and promissory notes are taken as collateral for such loans.

(2) Accepting Deposits:

Reserve Bank accepts deposits from the government of India, state government and other institution without any interest. It does not accept deposits from private individuals.

(3) Taking Advances:

If needed, Reserve Bank can take advances up to a certain limit from any scheduled bank of the country or foreign central bank for a maximum period of 30 days.

(4) Purchase and Sale of Valuable Metals:

Reserve Bank performs the task of purchasing and selling valuable metals like gold, silver and gold coins etc.

(5) Purchase and Sale of Trade Bills:

Reserve Bank performs the task of purchase, sale and discounting of trade bills and promissory notes. But these trade bills and promissory should have maturity of maximum of 90 days.

(6) Purchase and Sale of Agricultural Bills:

Reserve bank also does the purchase, sale and discounting of agricultural bills written in India. But these bills should have the maturity of a maximum of 15 months.

(7) Opening Bank Accounts in Foreign Central Banks:

For Performing its task properly Reserve Bank can open its accounts in foreign central banks and can establish its agent banks in foreign.

C. Promotional Functions:

The role of Reserve Bank on the economic front is praiseworthy. It has simplified the complicated path of the economic development.

Its promotional field is as follows:

(1) Banking Development:

Reserve Bank has played important role in ensuring that the benefits of banking facilities is praiseworthy. The branch of banks spread in non-banking fields due to the branch expansion policy of Reserve Bank has got a good success in providing banking facilities in rural areas. The nationalisation of banks took place in the country in two phases in 1969 and 1980. Reserve Bank has been doing this programme in a planned way since 1969.

(2) Bankers’ Training Institute:

Training employees is essential for the successful operation of banking institutions. Feeling this need, Reserve Bank established ‘Bankers’ Training College’ in Mumbai in September 1954. The arrangement for the training of bank officials was made in this college. Later similar training institutions were set up in Pune and Chennai. Training Centers to train clerks were opened in Mumbai, Kolkata, Delhi and Chennai. Now many banks themselves are operating their training centers.

(3) Agricultural Credit:

India is a country with prominence of agriculture. Thus, for the development of agriculture, the arrangement of agricultural credit is important. Reserve Bank has a separate department for the agricultural credit from the beginning.

Reserve bank has been doing the work of conveying finance to farmers through various institutions for the development of agriculture from the initial days only. The guidelines of Reserve Bank were provided to commercial banks from time to time for promoting agricultural credit. Regional Rural Banks were set up in 1975 as next stage of this campaign.

After, the establishment of National Bank for Agricultural and Rural Development (NABARD) in July, 1982, the agricultural work of Reserve Bank was assigned to it. This bank provides credit for rural crafts and other productive work along with agriculture and related work. But Reserve Bank is still having its Agricultural Credit Department in operation as a separate department.

(4) Provision of Industrial Credit:

Reserve Bank does not grant a direct loan to any industry for the promotion of industrial sector. But it has given much co-operation to institutions granting long term credits to industries. Industrial Finance Corporation, Industrial Credit and Investment Corporation of India etc. have a good contribution to Reserve Bank in their foundation and success. Till 16th February, 1976, Industrial Development Bank of India worked as an associate organization of Reserve Bank, but now it is working as a Separate Corporation.

(5) Stability in Price:

Both inflation and deflation are bad for the development of any country. Reserve Bank strives for stability in price by controlling both of these.

Essay # 8. Prohibitions for the Reserve Bank:

Following functions are prohibited for Reserve Bank according to section 18 of Reserve Bank of India Act, 1934:

(i) Reserve Bank of India cannot takes part in any trade commerce and industries, nor can it give any direct economic assistance to such activities.

(ii) It can’t purchase any fixed asset excluding its office and premises.

(iii) Reserve Bank can’t grant loans for a period beyond the specified period.

(iv) It can’t accept deposit from people for interest.

(v) It can’t purchase the shares of any company, nor can it give loan on shares as collateral.

(vi) It can’t grant loan to any party without proper collateral.

Essay # 9. Credit Control Policy of Reserve Bank of India:

Credit control is most important function of Reserve Bank of India. Credit control in the economy is required for the smooth functioning of the economy. By using credit control methods RBI tries to maintain monetary stability.

There are two types of methods:

(a) Quantitative control to regulate the volume of total credit; and

(b) Qualitative Control to regulate the flow of credit (Credit control measures of reserve bank of India, 2009).

In Quantitative control method the central bank controls the quantity of credit given by commercial banks by using the following weapons:

(a) Bank Rate:

It is the rate at which bills are discounted and rediscounted by the banks with the central bank. During inflation, the bank rate is increased and during deflation, bank rate is decreased;

(b) Open Market Operation:

Direct buying and selling of government securities by the central bank in the open market is called as open market operations. During inflation the securities are sold in the market by the Central Bank. During the deflation period, the central bank buys the bills from the market and pays cash to commercial banks;

(c) Variable Reserve Ratio:

Every commercial bank has to keep a minimum cash reserve with the Reserve Bank of India depending on the deposits of the commercial bank. During inflation this ratio is increased and during deflation the ratio is decreased.

Under the provisions of the RBI Act, the Scheduled banks were required to maintain a minimum amount of cash reserve with the Reserve Bank. The reserve is made out of demand and time liabilities at certain percentage fixed by the RBI. The cash Reserve Ratio is required to be maintained in cash with RBI, in addition to the percentage to be maintained under the Statutory Liquidity Ratio. The cash Reserve Ratio cannot exceed 15 percent of the net demand and time Liabilities.

Under Section 24 of the Banking Regulation Act 1949, RBI is empowered to stipulate the liquid assets every banking company is required to hold against their demand and time liabilities in addition to cash reserve requirement. Accordingly the banks both scheduled and non-scheduled have to maintain liquid assets in cash, gold or unencumbered approved securities amounting to not less than 25 percent of their net demand and time liabilities in India;

(d) Deployment of Credit:

The RBI has taken various measures to deploy credit in different of the economy. The certain percentage of bank credit has been fixed for various sectors like agriculture, export, etc.

As the custodian of cash reserves of the commercial banks the RBI plays an important role in the control of credit created by the banks. For this the RBI is vested with wide powers under RBI Act and Banking Regulation Act.

Qualitative Control to regulate the flow of credit are:

1. Fixation of Margin Requirements on Secured Loans:

The margin money is required to be brought in by the borrower from his own sources. This much percentage of money will not be lent by banks. The RBI lowers the margin to expand the credit and raises margin to contract or control the credit for stock market operations. This system was introduced in 1956. The RBI made use of the weapon of regulation of margin requirements to check bank advances against food grains, i.e., cereals and pulses, selected oil seeds indigenously grown and oil there of vanaspati and all imported oil seeds and vegetable oils, raw cotton, jute, sugar, gur and khan sari, etc.;

2. Control through Directives:

The Reserve Bank of India (Amendment) Act and the Banking Companies Act has empowered the RBI to issue directives to a particular bank or to the banks;

3. Rationing of Credit:

This method is used to control the scheduled banks borrowings from the RBI. The RBI shows differential treatment in giving financial help to its member banks according to the purpose for which the credit is used;

4. Credit Authorisation Scheme:

Under this Scheme, the commercial banks have to obtain the RBI’s prior approval for sanctioning any fresh credit of Rs. 1 crore or more to any single party in the private sector and for sanctioning any fresh credit of Rs. 5 crore or more to any single concern in the public sector;

5. Moral Suasion:

Moral suasion is a means of strengthening mutual confidence an understanding between the monetary authority and the banks as well as financial institute and, therefore, is an essential instrument of monetary regulation;

6. Direct Action:

When the moral suasion proves ineffective the RBI may have to use direct action on banks. The RBI is empowered to take certain penal actions against banks which do not follow the line of policy dictated by it,

7. Rationing of Credit:

Under this method there is a maximum limit to loans and advances that can be made, which the commercial banks cannot exceed;

8. Publicity:

RBI uses media for the publicity of its views on the current market condition and its directions that will be required to be implemented by the commercial banks to control the unrest.

Essay # 10. Evaluation of the Working of the Reserve Bank:

According to the Reserve Bank of India Act, 1934, Reserve Bank of India was founded in 1935 is working as the Central Bank of the country under the ownership of the government since January, 1949. Many challenges came before it since beginning, but it tackled these challenges successfully. However, it has got failures or limited success in certain fields.

The brief details of its success and failure are given below:

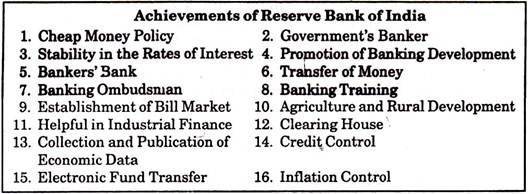

The important achievements of Reserve Bank are as follows:

1. Cheap Money Policy:

The monetary policy of Reserve Bank has an important place in the economic development of the country. Reserve Bank has been adopting cheap money policy since its foundation so that loans on cheap interest rate would be available for industries, trade and-agriculture. From 31st March 2004 to till date the Bank rate of Reserve Bank is 6 percent.

2. Government’s Banker:

As government’s banker Reserve bank has made important contribution with the Central and State Governments Reserve Bank has made work mentioning management of public debts for governments.

3. Stability in Rates of Interest:

Reserve Bank has made attempts for bringing stability in the interest rates considering the trade and industrial needs of the country. For this there has been expansion and contraction of credit. However, there has been change in the interest rates in the money market from time to time but it remains under the control due to interference of Reserve Bank.

4. Promotion of Banking Development:

However, the history of banking in India is very old but the systematic banking management came after the foundation of Reserve Bank. This raised people’s faith in banks. With the authority of Banking Regulation Act, it observes the banking system of the country and mends their short coming.

5. Banker’s Bank:

Reserve Bank gives economic assistance to other banks of the country. When scheduled banks can’t get loan from anywhere, they get it from Reserve Bank. So, it is called the bank of banks.

6. Transfer of Money:

Reserve Bank has provided the scheduled banks cheap and easy facility of sending money from one place to the other.

7. Banking Ombudsman:

Banking Ombudsman has been appointed by the Reserve Bank in different states. They listen to the Customers’ complaint and settle these at the earliest.

8. Banking Training:

There is a need of banking training of officials and staff for better banking facilities to customers. Considering this need separate training centres have been set up since 1954. Today, such training centres are in operation in different parts of the country.

9. Establishment of Bill Market:

Reserve Bank implemented Bill Market scheme in 1952 to organise the bill market. There has also been some success in this regard.

10. Agriculture and Rural Development:

Since, its establishment Reserve Bank has been working properly for the agricultural and rural Development through a separate department. It has emphasised on development by granting loans to co-operative banks, Regional Rural Banks, NABARD etc.

11. Helpful in Industrial Finance:

Reserve Bank has played a praiseworthy role in the establishment of institution like Industrial Development Bank of India: (IDBI), Industrial Finance Corporation of India: (IFCI), Small Industries Development Bank of India: SIDBI, Unit Trust of India: UTI for granting medium and long term credits for the industrial development of the country.

12. Clearing House:

Reserve Bank has set up clearing houses throughout the country. The development of business takes place due to increasing the use of cheques.

13. Collecting and Publication of Economic Data:

Reserve Bank has got much popularity in collecting and publishing small and big data related to trade, industries, monetary credit, banking and other sectors of economy. Its weekly and annual publication works as economic mirror.

14. Credit Control:

Credit Control is a big achievement of Reserve Bank. By adopting the proper policy of credit, it has done the proper function of controlling and regulating credit.

15. Electronic Fund Transfer:

Reserve Bank started Electronic Fund Transfer [EFT] scheme in 1996. Through this scheme, fund is transferred easily in the least time. This scheme is being expanded gradually.

16. Inflation Control:

The phase of inflation and deflation keeps coming in the economy. If these are not watched properly, these can spoil the economy. Reserve Bank has got partial success in this work. The failure of this field is due to money market.

Failures of the Reserve Bank:

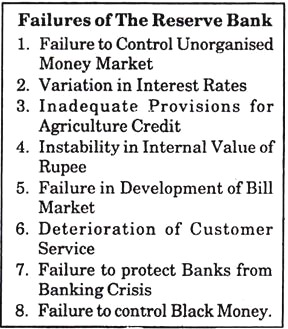

Reserve Bank has performed important functions from the beginning to strengthen the country economically. It has achieved many successes. Despite this, Reserve Bank has been unsuccessful in many respects.

The main failures of Reserve Bank are as follow:

(1) Failure to Control Unorganised Money Market:

The native bankers are the other organ of money market. Reserve Bank has been unsuccessfully in controlling this unorganized money market. This poses disturbance in the healthy banking system.

(2) Variation in Interest Rates:

The difference in interest rates is found due to lack of proper co-ordination of Reserve Bank with money market. Native bankers, money-lenders and landlords give loan to people on high interest rates without caring for the Bank Rate has no control over it.

(3) Inadequate Provision for Agricultural Credit:

It is a matter of satisfaction that Reserve Bank has taken good steps from time to time for the development of agricultural sector, but it has not got sufficient success in it. Even today, farmers have to take loans at high interest rates. India is a predominating agriculture base country. But the old saying that Indian farmers take birth in loan and grow and die in loan is true in today’s respect too.

(4) Instability in Internal Value of Rupee:

Reserve Bank has failed in stability the internal values of rupee. Over the last many years, the pressure of inflation has been increasing due to which there has been excessive rise in price. There is also instability in value of rupee with respect of dollar.

(5) Failure in Development of Bill Market:

Reserve Bank had prudently set up Bill Market in 1952. But it could not develop well in India. Even today, there is a lack of discountable bills in the money market.

(6) Deterioration in Customer Service:

Banks were nationalised in the first phase in 1969. After this, there came much deterioration in customer services. Particularly, Indian Banks have not been able to give proper services as compared to Foreign Banks.

(7) Failure to Protect Banks from Banking Crisis:

Reserve Bank is the Central Bank of the country. So, it is called Banker’s Bank. So, it is a duty of Reserve Bank to protect the commercial banks from the situation of failure by granting them economic assistance at the time of crisis. But Palai Central Bank and Laxmi Bank could not be saved from failure in 1960. However, owing to proper care of Reserve Bank no other bank has failed after that.

(8) Failure to Control Black Money:

Reserve Bank does not have any solid plan to check black money. The critics say that the credit contraction policy of Reserve Bank has prompted black money. The traders are able to get loans with the help of black money.

Conclusion:

The function of Reserve Bank can’t be overlooked despite many failures. It has played important roles in creating a proper atmosphere for the banking management in the country, promoting trade and industries, providing maximum support to the government at many fronts. But Reserve Bank should find out and correct its shortcomings.