After reading this essay you will learn about the institutions set up for rural development in India.

Essay on Panchayati Raj Institutions:

The successful implementation of rural development programmes requires not only decentralisation of administrative Machinery and Mechanisms for Co-ordination at the local level but also institutions for participation and involvement of local people. From this point of view; the Panchayati Raj institutions play the catalytic role.

The ‘Panchayat’ or the institution of village councils is as old as India’s history and is a part of her tradition. The ancient Panchayats serving as units of local government, discharged most of the functions that affected the life of the village community. There have been a number of indicative citations describing succinctly the forms, functions, features and forces that constructed the strong structure of Panchayats.

The erstwhile British Government had caused to supersede the Panchayat institutions by diverting their powers and functions concerning administration, execution and justice, and thereby centralised the administrative set-up to serve its colonial interests. Some of the British rulers like Lord Ripon introduce certain reforms in 1982 and advocated for the revival of the village Institutions.

The Royal Commission on Decentralization, of 1909 also favoured the promotion of these institutions, seeking people’s participation. The Montague-Chelmsford Reforms of 1919 had given same impetus for reviving the Panchayat bodies. But all these efforts were half-hearted and haphazard making no virtual impact.

Gandhiji the father of the Nation was also advocated for the revival of village Panchayat and to entrust full powers for the Independent functions. The Directive Principles of State Policy in the Indian Constitution in Article 40 (Part IV) lays down “The State shall take steps to organise village Panchayats and to endow them with such powers and authority as may be necessary to enable them to function as units of self-government.”

In the process of planned economic development the Government of India introduced the Community Development Programme in 1952. The Government was somewhat doubtful about the achievements of the programme and did not like to rest on the laurels collected by its own officers.

Therefore, the Planning Commission appointed a Study Team under the Chairmanship of Balwantrai Mehta on December 1956. The objective of the study team was to review the working of community development and examining the question of reorganization of district administration in the light of new developments.

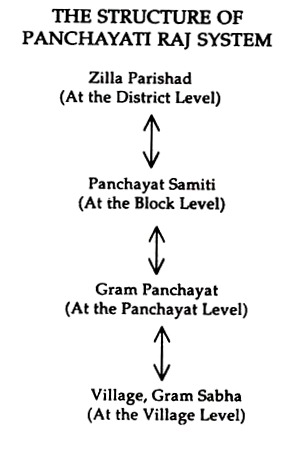

The Study Team suggested a three tier organization consisting of Village Panchayat at the grass root level, Panchayat Samiti at the Block level and Zilla Parishad at the District level. The team advocated the launching of this system simultaneously in the district.

According to the study team the democratic decentralization or Panchayati Raj alone can lead to effective rural development. The National Development Council endorsed the recommendations of the committee. However, the Institutions of Panchayat was officially launched on 2nd October 1959.

The Sino-Indian war of 1962, the death of Nehru on 1964, the Indo-Pak hostile on 1965 followed by the death of Lai Bahadur Shastri worsens the financial condition of the Institutions. In most of the States Panchayat election were either forgotten or postponed. In 1977 the Government of India appointed a Committee under the Chairmanship of Mr. Ashok Mehta to study the Panchayati Raj System.

The Committee favoured two-tier system of Panchayati Raj in the place of three- tier one as recommended by the Balwantrai Mehta Committee. The Ashok Mehta Committee report had not introduced properly due to the change of Central Government in 1980.

In 1985, the Planning Commission set up a committee to review the existing administrative arrangements for rural development and poverty alleviation programme (CAARD) under the Chairmanship of Prof. G.V.K. Rao. The Committee among other things suggested activation of Panchayati Raj Institutions.

In 1986, the Government of India set up a committee under the Chairmanship of L.M. Singhvi to prepare concept paper on the revitalization of the Panchayati Raj Institutions. The committee recommended that the local self- government should be constitutionally recognized, protected and preserved by the inclusion of a new chapter in the constitution.

Besides a sub-committee of the consultative committee of Parliament under the Chairmanship of Mr. P.K. Thungon recommended for constitutional status to the Panchayati Raj System in India. Due to change in Government at Centre and dissolution of Parliament resulted the delay in enactment of Panchayati Raj Institutions. However, Constitution (73rd) Amendment Act of 1992 became operative on 24th April 1993.

The main features of the Act are:

(i) Formation of Gram Sabhas.

(ii) Uniform three-tier system at village, block and district levels with exemption for intermediate level in States with population less than two millions.

(iii) Direct election to all seats for all members at all levels.

(iv) Twenty-one years as the minimum age for membership as well as Chairperson.

(v) Reservation for Scheduled Castes and Scheduled Tribes in proportion to their population both for membership as well as Chairperson.

(vi) Reservation of not less than one-third of the seats for women.

(vii) Five-year term.

(viii) Devolution of powers and responsibilities by the State in the preparation and implementation of development plans.

(ix) Financial arrangements through tax, grant-in-aid; levy, fees etc.

1. Gram Sabha (at Village Level):

At the village level there exists Gram Sabha. Each Gram Sabha consists of all persons registered by virtue of the Representation of the People Act 1950. The persons representing the Gram Sabha or ward areas may preside over the meeting.

The members present at the meeting of the shall form the quorum for such meeting and the proceeding of the meeting of the Sabha shall be recorded and authenticated by its president. The Gram Sabha recommends the meeting proceedings to the Gram Panchayat.

2. Gram Panchayat (Panchayat Level):

One Gram Panchayat divided into wards. The peoples so elected represent one ward. There is a Sarapanch, a Naib- Sarpanch or Up-Sarapanch, the elected representatives of the wards. Among the represent at least one member to represent Scheduled Castes and one member to Scheduled Tribes. Of the total representatives one third reserved for the women.

The Functions of village Panchayat are broadly divided into two categories, which include obligatory and discretionary. They broadly include Sanitation, Conservancy, Water supply, Construction and maintenance of roads, bridges etc. Promotion of agriculture, cottage industries and cooperative institutions, women and child development. Besides their important role is to implement rural development programmes.

3. Panchayat Samiti (Block Level):

The intermediate tier in the Panchayati Raj System is the Panchayat Samiti, which normally coterminous with Block.

Every Panchayat Samiti consists of:

(i) The Chairman and the Vice-Chairman.

(ii) One member elected directly.

(iii) Sarapanches of the Gram panchayats situated within the block.

(iv) Every member of the House of the People and of the legislative assembly representing constituencies, which comprise wholly or partly the area of the Samiti.

(v) Every member of the council of State who is registered as an elector within the area of the Samiti.

Seats shail be reserved for the Scheduled Castes and the Scheduled Tribes depending upon the total population. At least one-third of the total seats to be represented by the women.

The Samiti is mainly entrusted with the developmental activities and is made directly responsible for implementing the rural development programmes. Besides, the preparation of development plans has also been assigned to them. The institution is also promoting economic activities and Social Welfare activities.

4. Zilla Parishad (at the District Level):

The Third and highest tier of Panchayati Raj at the district level is known as Zilla Parishad.

The Zilla Parishad consists of:

(a) One member elected directly on the basis of adult suffrage from every constituency with due representation of Scheduled Castes, Scheduled Tribes and women.

(b) Chairman of each Samiti situated within the district.

(c) Every member of the House of the people and of the State legislative assembly representing constituencies, which comprise wholly or partly the area of the Parishad.

(d) Members of the Council of States who are registered as electors within the area of the Parishad.

(e) The Parishad headed by a Chairman/President elected from the members.

(f) The second functionary of the Parishad is the Vice- Chairman/Vice-President to be elected by the members.

The functions of Zilla Parishad include distribution of funds, Preparation of Plans, Projects, Schemes for rural development, Provision and maintenance of schools, Primary health centres, veterinary aid etc. The Parishad act as a connecting bridge between higher planning machinery like the Centre and State with the lower machinery like Panchayat Samiti at the block and Gram Panchayats at the grass root level.

Essay on Financial Institutions for Rural Development in India:

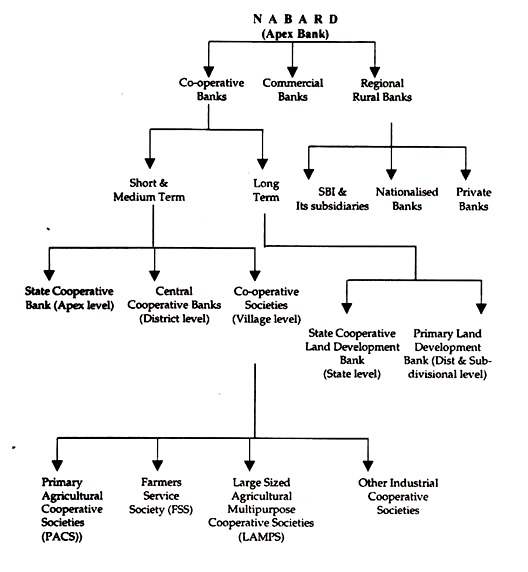

In the rural areas, there is at present a wider spectrum of financial agencies directly or indirectly involved in Rural Development. These agencies mainly comprise of Co-operative banks, Commercial banks and Regional Rural Banks.

All these institutions are again linked with apex institution like National Bank for Agriculture and Rural Development (NABARD) for refinancing and borrowing purposes. There is thus a multi- agency approach to rural financing engaged in rural development activities.

1. Cooperatives:

The cooperative banking system was introduced in India in the year 1904 as a Credit movement to assist the farmers for higher agricultural production. In course of time, the Cooperative Credit institutions became inevitable and important institution for Rural Development.

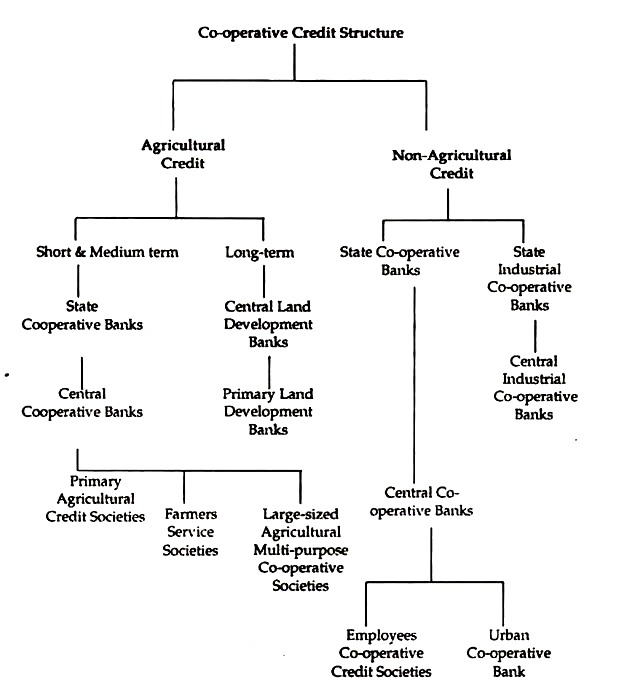

The cooperative credit structure is broadly classified into two types. They are short-term and long-term credit cooperatives. The short-term cooperative credit structure is of three-tier system. This system is federal in nature and pyramidical in type. At the apex of the pyramid, there is the State Co-operative bank. There are Central Co-operative banks (CCBs) at the district or intermediate level.

At the bottom, there is the Primary Agricultural Co-operative Credit Societies (PACs). They operate mostly at the village level. In recent years the Farmers Service Societies (FSS) and Large-sized Agricultural Multipurpose Co-operative Societies (LAMPS) have been added to the existing base level institutions.

However, in the entire Co-operative Credit Structure, the Primary Cooperative Credit Societies occupy a strategic position on account of their direct links with the farmers and weaker section people at the grass root level. The long-term Credit Co-operative Structure is of two-tier system. There is Central Land Development Bank (CLDB) at the top and Primary Land Development Banks (PLDBs) at the base level.

The State Co-operative Bank is the apex bank in the short- term Co-operative Credit Structure. The area of operation of the bank is extended to the entire State. The management of the bank is vested in the board of Directors.

The directors are the President/Chairman of the Central, Cooperative banks and Government Nominees like, the Registrar Co-operative Societies, the director of agriculture and Food Production and the director of Textiles. The Board appoints the Chief Executive Officer/The Managing Director/The General Manager for the day-to-day administration of the bank.

The Working Capital of the State Co-operative banks consists of share capital, reserve funds, deposits from members, direct State contribution and borrowings.

The major part of the resources of SCBs mobilised through various sources is generally utilised for loans and advances to CCBs and PACs. Most of the loans advanced by SCBs is for seasonal agricultural operations. Loans are also advanced for Marketing of crops, industrial purposes, consumption purposes etc.

The apex bank provides the link between the RBI/NABARD and the Money market on the one hand, and the entire Co-operative Credit Structure on the other. The SCBs, therefore occupies a key position in the entire structure of Short-term and Medium-term Co-operative Credit. The SCBs also issue guidelines to CCBs & PACs relating to advance of loans to special rural development programmes.

The position of Central Co-operative banks (CCBs) is of crucial importance in the Co-operative Credit Structure. They form an important link between the State Co-operative bank, at the apex and the PACs at the base.

The management of the CCB is vested with a board of Directors consisting of its members from different affiliated societies and the nominated members of the State Government. The CCBs obtain their funds through the share capital, deposits, membership fees, reserve funds, and borrowings from apex bank or refinance from the RBI/NABARD.

The CCBs advance short-term loans to primary agricultural Co-operative Credit Societies for meeting current farm expenses and medium-term loans for land reclamation, building of cattle sheds, purchase of cattle and pump sets and construction and repairing of wells for irrigation purposes etc.

These loans are granted on proper security such as landed assets, house mortgage, agricultural produce, gold or ornaments, fixed deposits, Life Insurance Policies, Government Promissory notes executed by the borrowing societies. They also advance loans to rural Development Programmes as per government norms and directives.

The last tier of the Co-operative banking structure is Primary Agricultural Co-operative Societies (PACs). These societies have direct linkage with the farmers and they are purely operating in the rural areas. The village credit society is the best agency to inculcate the habit of thrift, self-help and mutual help among its members. It is engaged in securing for its members services of various kinds.

It has to keep the concepts of mutuality and ethical dealings in mind and ensure sufficient social cohesion. The efficiency of the co-operative banking structure depends primarily upon the efficiency of the grass root level co-operative societies. “As a matter of fact; the PACs are the foundation on which the entire co-operative structure is built upon.”

The Primary Agricultural Credit Societies cover different types of Credit Societies, through the common feature of all these different societies is that most of their members are agriculturists.

The group includes:

(1) Large-size societies that include rural banks, agricultural banks and credit unions

(2) Service co-operatives and

(3) Other small size societies.

More clearly, at present there exists Primary Agricultural Cooperative Credit Societies (PACs), Farmers Service Societies (FSS) and Large-sized Agricultural Multi-purpose Co-operative societies (LAMPs) at the village level. They form the Primary Cooperatives in most of the States.

A Co-operative Society can be formed by at least 10 members after due permission and registration by the registrar of Co-operative Societies. In the management of Society, its general body, consisting of all its members, is the supreme authority. The general body elects a managing committee or executive committee consisting of President or Chairman Secretary and other eight to nine members.

The Secretary generally is the paid employee of the Society; whereas all other members including the President or Chairman is honorary The PACs obtain their funds in the form of deposits, membership fees, and borrowings from higher co-operative institutions. Normally, the members are eligible to borrow from the society.

There is no scope of borrowing by the non-members. The societies have undertaken distribution of fertilizer and have arrangements to hire or supply agricultural implements including plant protection equipment’s.

Some societies have been entrusted with the distribution of essential consumer goods under public distribution system. However, the PACs have mainly remained as credit dispensing agencies for the agriculturists in the rural areas. They play a very insignificant role in non-credit activities.

In order to overcome this problem Farmers Service Societies were established as a base level institution on the recommendation of National Commission on Agriculture in the year 1971. The important objective of FSS is to provide a package of inputs and consumer services along with Technical advice and supporting services like, storage, transportation, processing and marketing at a single contact point.

Aboard of directors manages the activities of the FSS. There are eleven members in the board. One fulltime paid director manages the day-to-day activities of FSS. Of the remaining 10 directors, five are the farmer members of the FSS; of whom three are small and marginal farmers and two are farmers of other categories.

The remaining five directors are; a representative of the financing institution a Block Development Officer, an Assistant Director of Agriculture, an Assistant Director of Veterinary Services and an Assistant Registrar of Co-operative Societies.

The Funds of the FSS mobilised through the acceptance of deposits from its members. Beside the sponsoring bank extend financial assistance. The State Government also contributes towards its share capital. The FSSs are meeting all the credit requirements of their members. The FSS advances short-term, medium-term and long-term loans.

All this is undertaken as per the guidelines of the financing bank. Besides, the FSS take up the business for supplying various agricultural inputs and services at reasonable prices. The institution also deals with the marketing of products for their members. They also undertake the construction of wells, minor irrigation projects, godowns etc. for their members.

The Ministry of Agriculture appointed a committee on cooperative structure in tribal areas in 1971 under the Chairmanship of Sri K.S.Bawa. Sri Bawa recommended the Organisation of Integrated Credit cum Marketing Co-operative Societies termed as Large-sized Agricultural Multi-purpose Cooperative Societies (LAMPs). This organisation generally operates in the tribal areas. This covers a block of ten villages. This is also expected to cover on an average 10 and 20 thousands population.

A board of directors manages the activities of the LAMPs. The board generally consists of eleven members. The Managing Director is the functional head of the organisation of the remaining 10 directors five are elected from among the tribal members. The other 5 directors belong to Financial Institutions, Block Development Officer, Co-operative Societies, Tribal department etc.

The Funds of the LAMPs are mobilised in the form of Share Capital, paid up capital, deposits and borrowings. The LAMPs provide short and medium-term agricultural loans, procures all major inputs and services and also buys produce of the tribal farmers. It also open consumer stores and act as retail that outlet of the State’s public distribution system. Sometimes, the long- term loans are also sanctioned to eligible borrowers of the locality.

The long-term cooperative credit institutions needs of the agriculturists have catered the long-term credit. They are Central/State Land Development bank operate at the State level and Primary Land Development Banks (PLDBs) at the district/sub-divisional level.

The Land Development banks, which are also known as land mortgage banks and agricultural development banks in some states made a beginning in the Nineteen hundred twenties. The long-term Co-operative Credit Structure, unlike the short-term structure is not uniform throughout the Country.

The structural patterns of these banks are of three types, like:

(i) Federal Type:

The usual federal type with the Central Land Development Bank (CLDB) at the top and the Primary Land Development Banks (PLDBs) at the base. This system prevails in the States like, Andhra Pradesh, Assam, Haryana, Kerala, Madhya Pradesh, Karnataka, Orissa, Punjab, Rajasthan, Tamil Nadu and West Bengal.

(ii) Unitary Type:

The CLDBs advancing loans direct to individuals operating through branches. The States not mentioned above adopted unitary type of long- term Credit Structure.

(iii) Mixed Type:

The CLDBs operating through branches as well as PLDBs. The membership of the CLDBs comprises of PLDBs, other co-operative banks and societies and individuals. The management of the bank is vested to a Board of Management elected as per provisions of the Act, Rules and Byelaws.

The State Government also nominates the Directors for Board of Directors or Board of Management. The financial resource of the bank consists of the share capital from members, reserves created out of profits, borrowing, deposits, sales of debentures and refinancing from RBI/NABARD. The bank provides long-term productive credit through the PLDBs.

The Primary Land Development Banks (PLDBs) generally grant long-term loans to farmers for farm development activities. The area of operation of PLDBs differs from State to State. In some States, it extends to whole of a district while in others it extends to a sub-division or a few talukas. The General body of members is the Supreme authority of management of a PLDB.

The general body elects the Board of Directors or Managing Committee. For day-to-day management, full time manager, secretary, accountant and other supporting staff are employed. In some of the States, the CLDBs have introduced Cadre Scheme, under which managers of PLDBs are recruited and trained by the CLDBs and posted to work in primaries affiliated to them.

The Funds of the bank is mobilised through share capital from members. The main part of the fund is mobilised through the borrowings from the apex bank, NABARD and from other agencies.

It also obtains finance in the form of deposits, grants and subsidies etc. from the State Governments. Generally these banks advance loans to undertake farm activities in long-term basis. Usually, loans are granted on the first mortgage of land. In course of time they extend loan for off-farm activities like, marketing, transportation, etc.

Besides, the Agricultural Credit Cooperatives. There is non- agricultural Cooperative operating in the rural areas. The weavers Cooperative Societies, Industrial Co-operative Societies working for the development of Village and cottage industries. Whereas Consumers Cooperative Societies working for the consumers/general public for smooth functioning of public distribution systems.

2. Commercial Banks:

In rural areas there are a wide spectrum of Commercial banks. The Commercial banks broadly classified into State Bank of India and its associated banks, Nationalised Banks and Private Commercial banks. In India there is a State Bank of India and its 7 associated banks, 19 Nationalised banks and a number of Private banks.

The SBI, Groups and Nationalised banks are directed to open branches in the rural areas and ensure adequate credit to the rural economic activities. They are to advance 40 per cent of their credit to the priority sector. The public sector banks also advance credit to the weaker sections of the society at 4 per cent rate of interest under Differential Rate of Interest (DRI) Scheme.

The banks also extend Credit to the sectors/beneficiaries under various rural development programmes. The commercial bank also advances indirect credit assistance through the PACs, RRBs, Electricity boards and other marketing agencies. The Commercial banks also take active part in the formulation of Credit plans; Action plans through their lead bank scheme.

3. Regional Rural Banks:

The Regional Rural Banks (RRBs) were established on 2nd October 1975. The important objective of the banks are to extend banking services to the rural areas and to deploy credit in favour of economically weaker sections of people in rural areas who are deprived of procuring adequate credit either from the cooperative banks and from the commercial banks.

The RRBs are also advance credits to the beneficiaries of rural development programmes. The credit advanced by RRBs are short-term, medium-term and long-term in nature. Besides, they are required to provide indirect finance to Co-operative Societies and the farmers Service Societies operating within its area of operation. The banks also provide consumption loans within the specified limits.

The management of the RRBs vests with the board of directors comprises of a members. The Chairman of the banks generally belongs to the sponsored Nationalised bank.

Three directors are nominated by the Central Government; two directors are nominated by the State Government the remaining five directors including the Chairman are nominated by the sponsoring bank. The Funds of the RRBs are mainly mobilised through share capital, contribution, deposits and borrowings. The funds so mobilised are generally channelised to meet the credit needs of the weaker sections.

4. NABARD:

The Apex bank for agriculture and Rural Development is National Bank for Agriculture and Rural Development (NABARD). The Bank established in July 1982 after the recommendation of the Committee to Review Arrangements for Institutional Credit for Agriculture and Rural Development (CRAFICARD) headed by Sri B. Sivaraman.

The Management of the NABARD is entrusted to a Board of Directors. The Board consists of 15 members, like; a Chairman, a Managing Director, 2 Experts in rural economics, 3 experts from Co-operative and Commercial banks, 3 Sitting Directors from the Board of RBI, 3 Directors from Government of India and 2 is nominated from amongst the State Government officials.

NABARD formulate developmental policy, planning and operational matters relating to credit for agriculture and rural development. It provides refinance facilities to the Co-operative banks, Commercial banks and Regional Rural Banks. It issues guideline and inspect co-operative banks and the RRBs.

The credit institutions operating at the grass root level also borrow Funds from NABARD. In India there exists the Multi-agency approach to rural financing. The basic and important philosophy of this approach is to ensure perfect coordination among all the Agencies operating in the rural areas for the common objective of meeting the credit needs of the rural economic activities along with the borrowers belong to weaker sections.